Shares of American Bitcoin, associated with Trump, have increased by 20% this week as the company approaches the 4000 BTC milestone.

Summary

- Shares of American Bitcoin have decreased by 6%

- The Trump-associated company completed a significant Bitcoin purchase

- The treasury and mining firm now holds 3,865 BTC, with a market capitalization of $5.29 billion

Even with Bitcoin trading near its historical highs, treasury firms are continuing to accumulate Bitcoin. Nevertheless, on Tuesday, October 28, shares of Trump-linked American Bitcoin were down by 6% after a substantial rally the previous day.

The stock price of American Bitcoin stood at $5.57, a drop from the weekly peak of $6.29 seen the day before. This decline wiped out the previous day’s gains, which had been bolstered by the firm’s latest treasury accumulation.

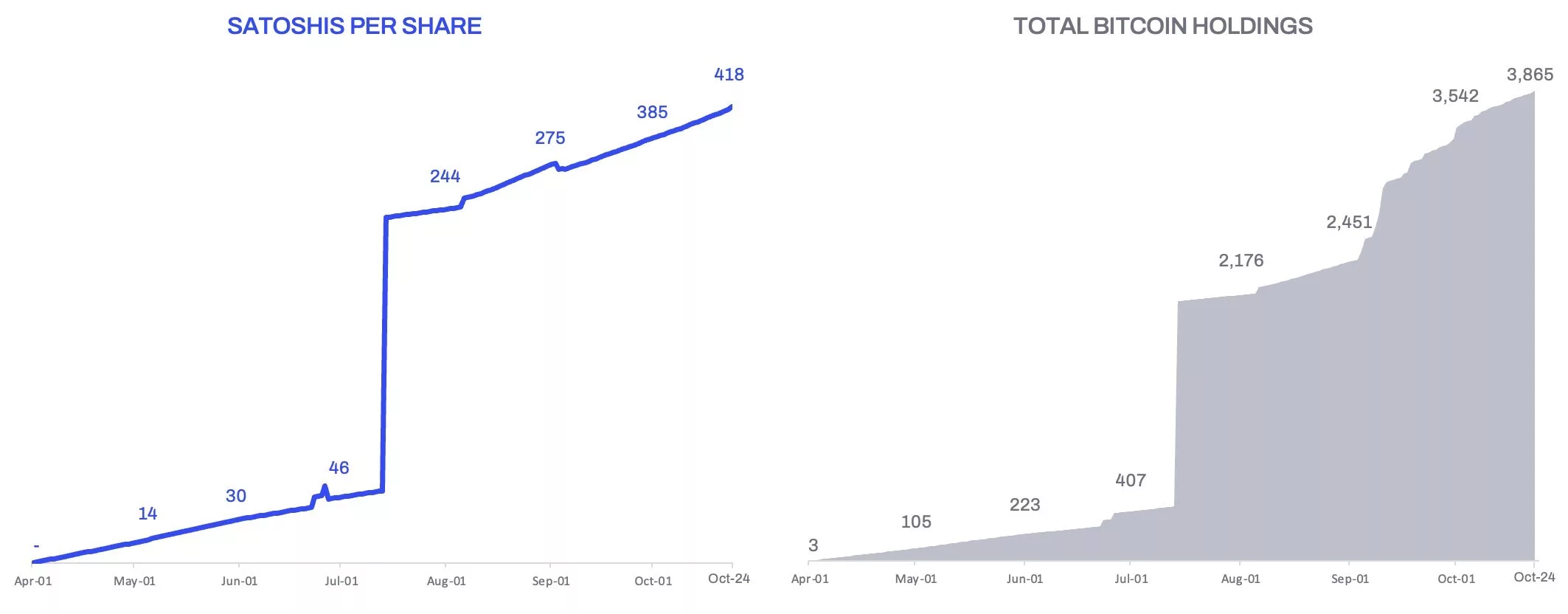

On Monday, October 27, American Bitcoin acquired 1,414 BTC, increasing its total Bitcoin (BTC) reserves to 3,865 BTC. Concurrently, the company began publishing the “satoshis per share” metric to evaluate its acquisition strategy’s effectiveness.

“We think one of the most crucial indicators of success for a Bitcoin accumulation platform is the amount of Bitcoin that supports each share,” remarked Eric Trump, Co-founder and Chief Strategy Officer of American Bitcoin.

American Bitcoin encounters market challenges

Despite the optimistic outlook surrounding the recent acquisition, some traders express concerns about ABTC’s valuation. Although its current Bitcoin reserves are valued at around $444 million, the company’s market capitalization is $5.10 billion. This high valuation creates ample opportunities for the firm to acquire Bitcoin via equity, yet it remains reliant on future performance.

American Bitcoin was formed through a partnership between publicly traded BTC mining firm Hut 8 and the Trump family. Notably, the company’s co-founders include Donald Trump Jr. and Eric Trump, who also serves as the Chief Strategy Officer.