Sure! Here’s a rewritten version of the content while preserving the HTML tags:

The long-awaited altcoin season remains out of reach as the Crypto Fear and Greed Index stays in the fear zone alongside ongoing Bitcoin Dominance.

Summary

- The Altcoin Season Index has significantly declined over recent months.

- Concurrently, the Fear and Greed Index has dipped into the fear zone.

- Anticipated rate cuts and a potential Santa Claus rally could benefit the crypto sector.

Altcoin Season Index remains low

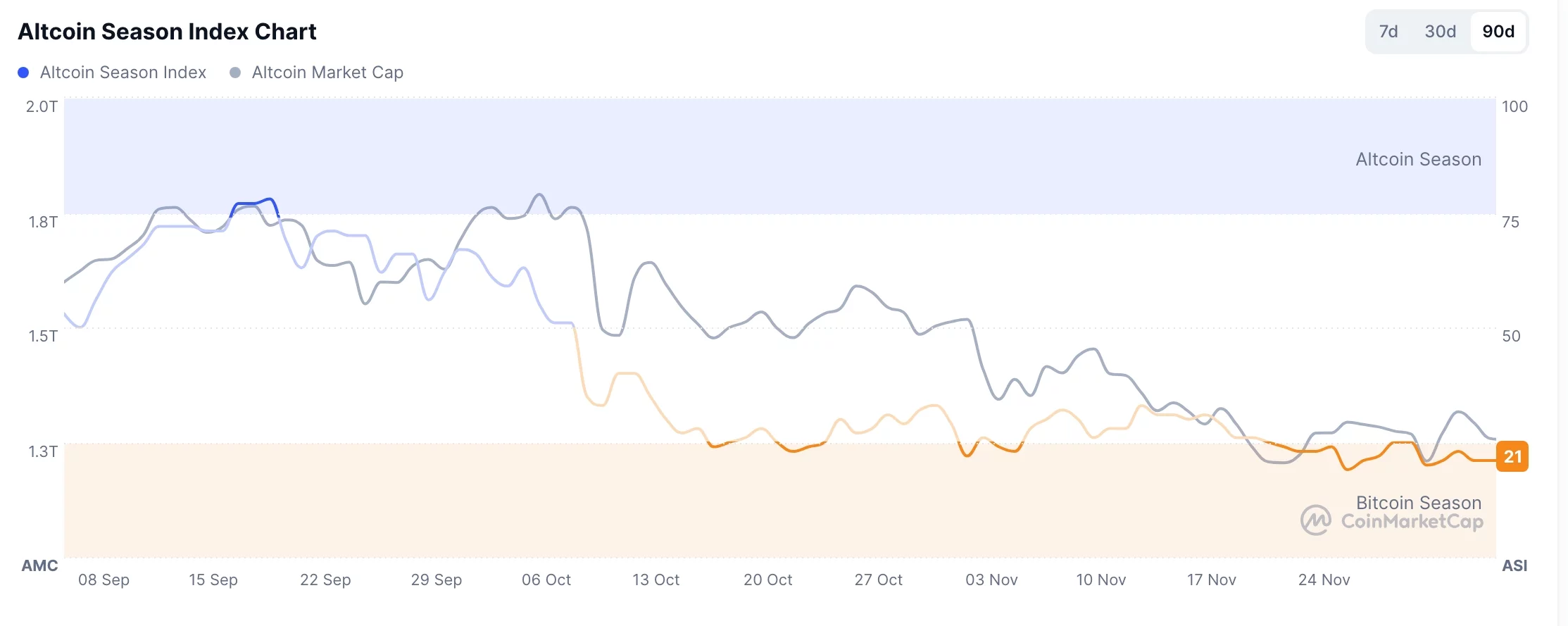

CMC data indicates that the closely monitored Altcoin Season Index has dropped to 21, a significant decline from its peak of 55 in July. This downturn coincides with continued underperformance of most altcoins against Bitcoin (BTC) during the current market downturn.

The biggest underperformers in the altcoin market over the last three months include tokens like Double Zero, Story, Celestia, Ethena, Pudgy Penguins, Cronos, Aptos, and Arbitrum, with all experiencing declines exceeding 60% during this time frame.

As altcoins continue to fall, the Bitcoin Dominance Index has increased, climbing from a January low of 37% to 58% today. In contrast, Ethereum (ETH) dominance has decreased from a year-to-date high of 20% to 11%.

The primary reason for the persistent low Altcoin Season Index is Bitcoin’s correction, which saw a drop from its year-to-date high of $126,200 to the current value of $89,000. Typically, altcoins perform better in strong uptrends of Bitcoin.

Crypto Fear and Greed Index in the fear zone

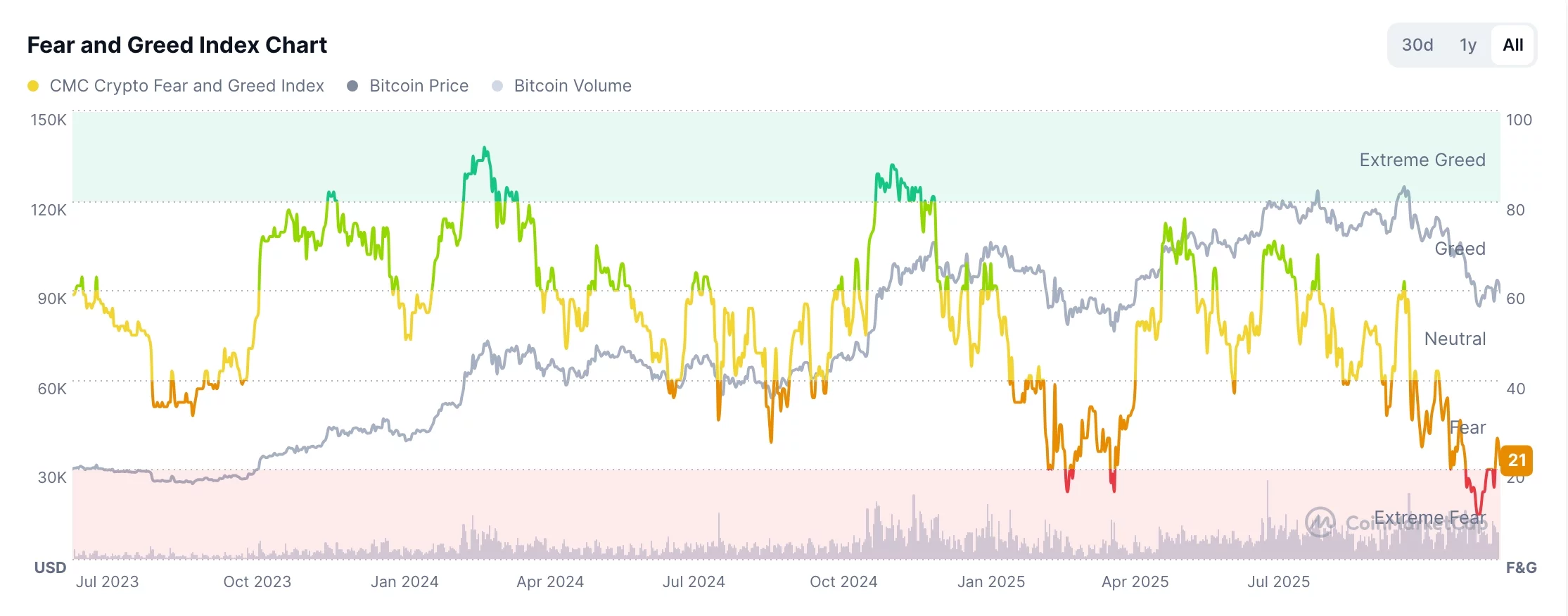

Simultaneously, there exists a prevailing fear within the crypto market, particularly following the substantial liquidation event on October 10, which erased over $20 billion from the market. Since that incident, investors have largely opted for deleveraging, leading to a reduction in futures open interest from $225 billion in October to around $122 billion currently. The funding rates across all tokens have also steadied while the Crypto Fear and Greed Index stands at 21.

Many investors remain wary of altcoins, with Kevin O’Leary suggesting that most of them are devoid of value and that Bitcoin and Ethereum are likely to be the long-term survivors. In fact, data shows that many meme coins, like Shiba Inu and Pepe, have experienced even steeper declines in the recent months.

Nevertheless, there are encouraging signs that could potentially uplift the crypto market. Typically, altcoin seasons tend to initiate when the Altcoin Season Index is deeply in the red. These events also often coincide with the Crypto Fear and Greed Index being in the fear zone.

In addition, the crypto market could receive a lift from the upcoming Federal Reserve interest rate decision, with expectations leaning towards a rate cut. Lastly, there’s a possibility that a Santa Claus rally could occur, boosting both stocks and cryptocurrencies.