AAVE experienced a rocky few sessions following rumors related to World Liberty Financial (WLFI). On August 23, the token dipped from $385 to $339 — a decline exceeding 8%. Nevertheless, the $339 level proved to be a robust support.

Despite the heightened volatility, data indicates that the movement was driven more by sentiment than structural factors, and AAVE remains poised for upward targets.

Exchange Reserves and Whale Accumulation Back Strength

In the last 30 days, AAVE exchange reserves decreased by 4.33%, falling to 5.4 million tokens. This signifies that approximately 244,400 AAVE tokens exited trading platforms. At the current price of $341, this translates to about $83.3 million in tokens leaving exchanges, indicating accumulation rather than sales.

Simultaneously, whale wallets increased their holdings by 13.49%. Their possession rose from 17,222 AAVE to 19,542 AAVE, an increase of 2,320 tokens. At present prices, these additional holdings are valued at nearly $790,000.

The trend of large wallets accumulating while exchange reserves decline typically indicates confidence among wealthy investors, potentially explaining why the AAVE price drop linked to WLFI was limited.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Spent Coins and Cost-Basis Heatmap Confirm Stability

Another important metric is the spent coins age band, which monitors whether older coins are being utilized, often revealing selling pressure. On August 23, the total spent coins were at 46,600 AAVE. By press time, it had decreased to 15,230 AAVE — a drop of around 67%.

The reduction in older coins being moved suggests that long-term holders did not rush to sell, even amid rumor-induced declines.

The cost-basis heatmap, illustrating where traders accumulated tokens, provides further insight.

At $339, around 143,470 AAVE are held, with an additional 135,820 AAVE situated near $337. These clusters signify strong demand zones, illustrating why $339 functioned as a pivotal point. Should another pullback occur, this area may provide support.

The largest accumulation band lies deeper at $272.90, where significant holdings create a final support line. Unless this level is breached, AAVE’s structure remains intact.

AAVE Price Action: Targets and Invalidation

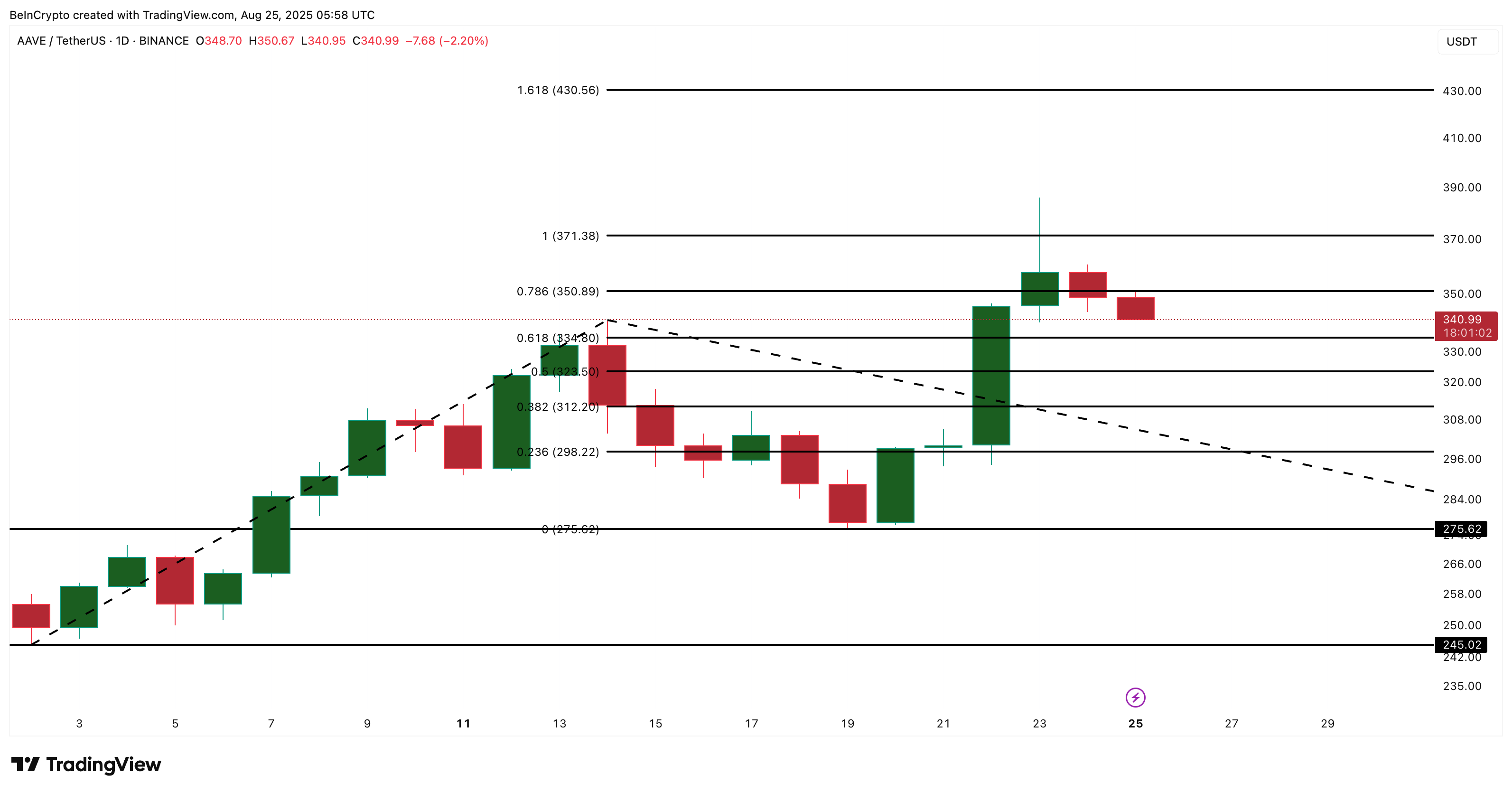

August has already proven to be a strong month for AAVE. Rising from $244 at the month’s outset to a peak of $385 on August 23, the token achieved an increase of nearly 58%. Despite the WLFI-related setback, it continues trading around $340, maintaining the uptrend.

The Fibonacci extension tool suggests $430 as the next bullish target, about 26% above current levels. A confirmed daily close above $371 would pave the way for this target. However, after the recent dip, $350 emerges as a significant resistance level for AAVE. The earlier cost basis heatmap identifies $352 as a crucial accumulation level, making it a key resistance zone.

Traders should also keep an eye on invalidation levels. A drop below $275 may breach the largest cost-basis cluster at $272.90, turning the short-term structure bearish. As for immediate support, $334 appears strong.

The post AAVE Price Shrugs Off WLFI Jitters as Key Indicators Still Point to $430 appeared first on BeInCrypto.