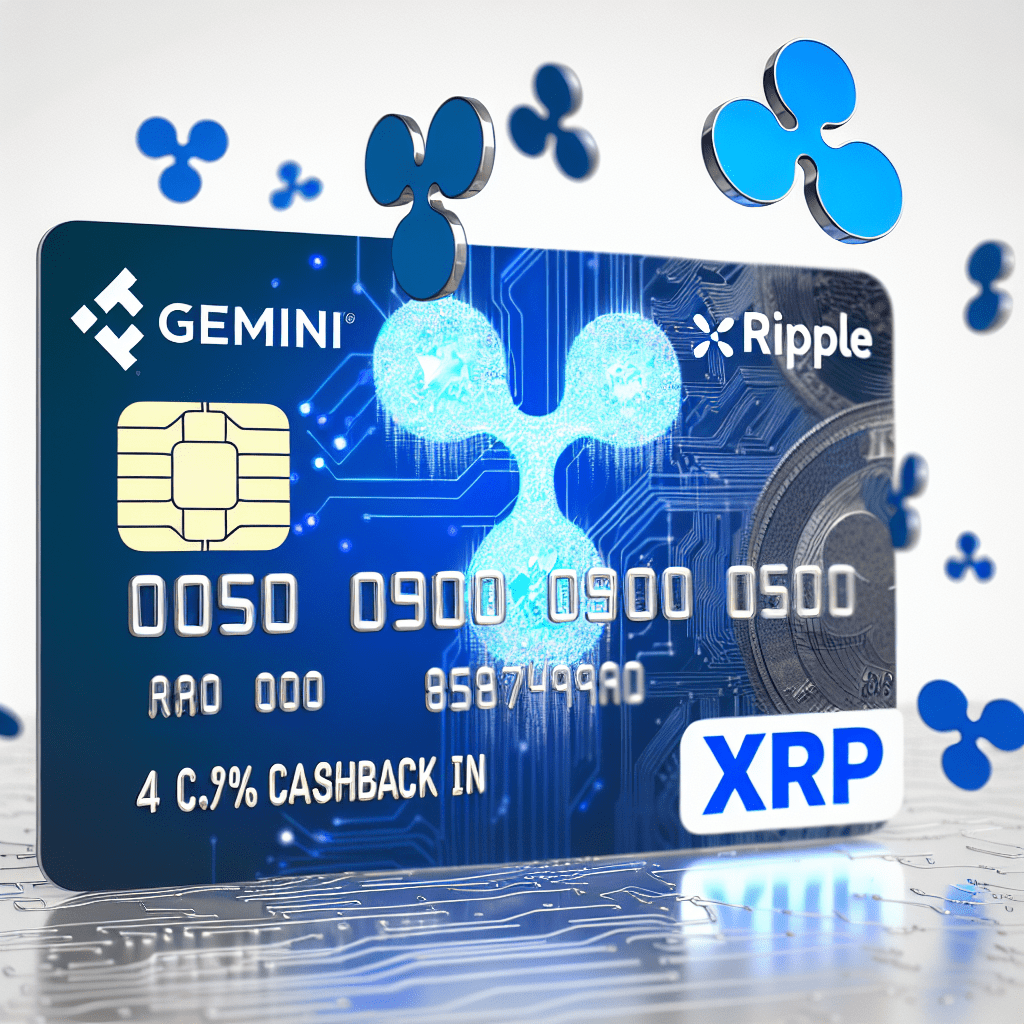

- The exchange has collaborated with Ripple to introduce a limited edition credit card.

- Users can earn up to 4% XRP cashback on everyday purchases.

- Ripple’s RLUSD stablecoin aims to facilitate crypto access.

As cryptocurrencies weave into our daily financial transactions, trading platform Gemini has joined forces with Ripple to launch an XRP-enabled credit card.

This exclusive metal card is designed to streamline transactions for the Ripple community, allowing cardholders to receive instant crypto rewards each time they make a purchase.

Unlike traditional reward systems that issue monthly cash or points, Gemini provides up to 4% cashback in XRP immediately after each transaction.

Introducing the Gemini Credit Card, XRP edition.

Tailored for enthusiasts, this exclusive metal card rewards up to 4% back in XRP instantly. No delays, just accumulation.

Available now 👀 pic.twitter.com/KU1bX7NvDS

— Gemini (@Gemini) August 25, 2025

Importantly, the limited-edition card is initially available to US users, with applications opening today.

Spending in a digital age

The Gemini XRP credit card transforms everyday purchases into seamless avenues for earning cryptocurrencies.

Picture earning XRP tokens every time you shop for groceries.

Pay bills in dollars and instantly receive crypto rewards in your account.

The rewards structure includes:

- 4% cashback in XRP on EV charging, ridesharing, and gas purchases.

- 3% XRP reward on dining and restaurants.

- 2% XRP back on grocery shopping.

- 1% back in XRP on all other daily expenses.

Introducing the @Gemini Credit Card XRP Edition

→ $RLUSD now available for US spot trading

→ Streamlined trading, no extra conversion fees

→ Quick and easy access to both crypto and stable values

→ Special-edition design tailored for the XRP community https://t.co/gdNJIPWMcq— Ripple (@Ripple) August 25, 2025

Crypto enthusiasts can capitalize on this setup to accumulate XRP tokens effortlessly.

The digital card converts routine expenditures like running errands, having lunch, and refueling into crypto investments.

RLUSD to streamline trading

The XRP credit card introduces a significant update within the Gemini ecosystem.

The crypto exchange has now integrated Ripple’s RLUSD stablecoin to facilitate US spot trading.

Users can access a stable token without incurring additional conversion fees.

This simplification enhances the movement of RLUSD, XRP, and other digital assets within the exchange.

The stablecoin adds value to Gemini’s trading platform by providing simple stable values and crypto-related rewards.

Gemini’s XRP gift card and stablecoin integration highlight the ongoing trend of making digital assets applicable for everyday transactions.

The importance of timing

This initiative follows Ripple’s achievement of regulatory clarity after concluding its lengthy dispute with the US SEC.

Additionally, new regulatory measures have been implemented in the United States to bolster the cryptocurrency industry.

Donald Trump signed the GENIUS law, providing the much-needed clarity for innovations in digital assets, particularly stablecoins.

The XRP credit card signifies the maturation of the cryptocurrency market.

What started as an experimental niche has transformed into a mainstream financial instrument, integrating traditional offerings with crypto benefits.

Recently, SBI Holdings entered into an agreement to distribute RLUSD in Japan.

XRP price perspective

Ripple’s native token has experienced a decline amidst a widespread market downturn.

It has dropped 2% in the last 24 hours, currently priced at $2.95.

While short-term trends are bearish, analysts predict a promising performance for XRP in the upcoming months, attributing it to its real-world utility in global payments.

Furthermore, the resolution of the Ripple vs. SEC case has enhanced XRP’s appeal among institutional investors.

Companies eager to adopt legitimate assets in the digital landscape are likely to consider XRP.

Analysts anticipate XRP’s price may reach $5 by 2025 and continue to rise in subsequent years.