XRP surged towards the $3 level in the last trading session, with trading volumes increasing over 6% compared to its weekly average.

News Background

• The increase in XRP coincides with a general stabilization in the cryptocurrency market, where altcoins are experiencing modest inflows following last week’s downturn.

• On-chain analytics indicated significant institutional movements, with approximately 155 million XRP transacted during recovery phases, significantly above the daily average of 63 million.

• Market discussions initially proposed that XRP was approaching new highs, although the actual all-time peak remains $3.84 from January 2018, highlighting that this is more of a recovery test than a price discovery phase.

Price Action Summary

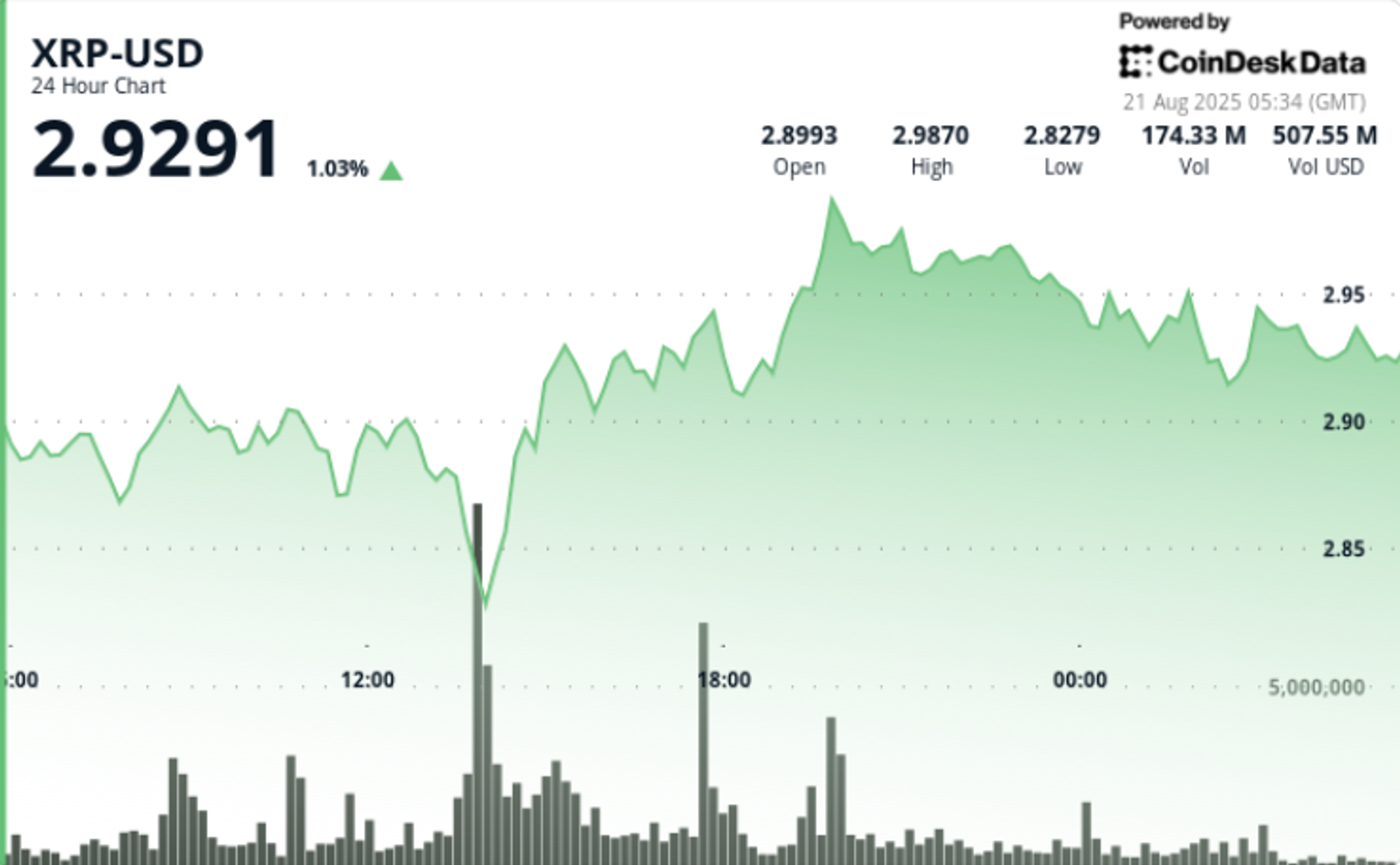

• XRP experienced a fluctuation of 5.1% between the levels of $2.84 and $2.99 during the 23-hour period from Aug. 20 13:00 to Aug. 21 12:00.

• The most pronounced movement occurred around 19:00 UTC on Aug. 20, when the asset jumped from $2.84 to $2.99 with a volume of 80.6 million.

• Following sessions showed some stabilization, with consistent rebounds within the $2.89–$2.93 range, verifying it as a temporary support level.

• A sharp price movement in the last hour (Aug. 21 11:03–12:02) observed an 8.6% variation: fluctuating from $2.916 to $2.901 on 960,000 units, before settling down.

Technical Analysis

• Support: The $2.89–$2.93 area has demonstrated repeated strong bounces with above-average volume participation.

• Resistance: The psychological barrier at $2.99–$3.00 is limiting upward momentum, with multiple rejections noted.

• Volume: 80.65 million during the uptrend compared to a 24-hour average of approximately 63 million.

• Pattern: The market is experiencing sideways consolidation following a bullish push, with momentum slightly declining.

What Traders Are Watching

• The key focus is on whether the $2.93 support will hold in the near term or give way for a retest of $2.82.

• A breakout above $3.00 may act as a catalyst for a continuation of the upward trend.

• The sustainability of volume is crucial—if flows decrease, the bullish momentum may weaken.