Following a record-setting peak of $124,474 on Binance on August 13, Bitcoin (BTC) has fallen to around $113,000, with significant support expected near $110,000. Analysts caution that further declines could be imminent for the leading cryptocurrency.

Could Bitcoin Decline Further? Overcrowded Long Position Signals

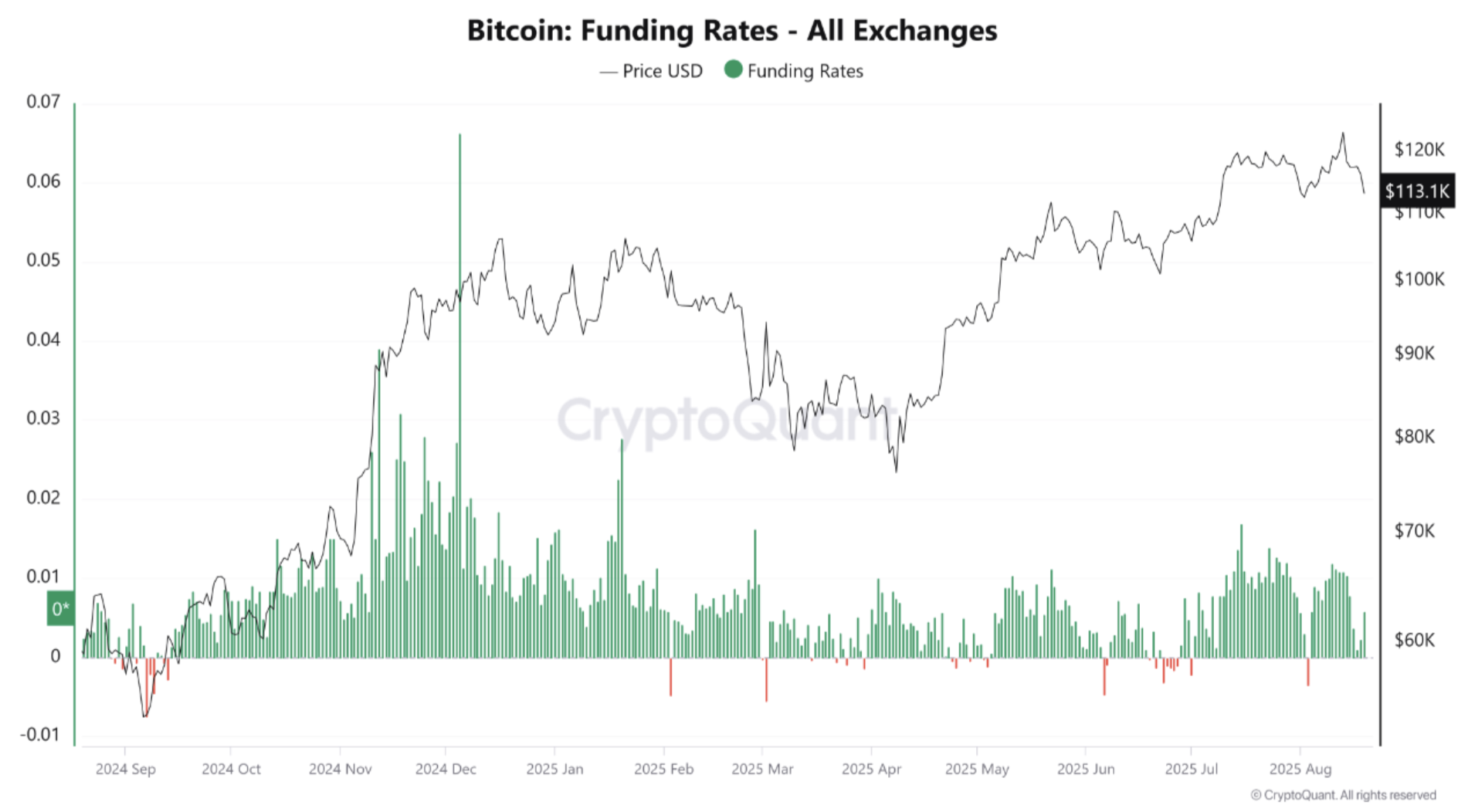

As highlighted in a CryptoQuant Quicktake piece by contributor XWIN Research Japan, Bitcoin open interest across all exchanges has exceeded $40 billion, approaching ATH levels. This increase indicates that both whales and short-term traders are entering leveraged positions in large numbers.

Related Reading

The chart below illustrates the recent surge in BTC open interest, currently around $40.6 billion. In comparison to the $15 billion recorded in August 2024, open interest has risen by over 150%.

The CryptoQuant contributor noted that even with this influx, the funding rate has remained positive, indicating a strong long bias. While this reflects market optimism, it also points to a crowded trading environment, where the majority of participants are betting on further appreciation of BTC.

Consequently, the risk of a long squeeze—where forced liquidations of long positions occur due to increased leverage—has heightened. XWIN Research Japan elaborated in their analysis:

A sudden price drop can instigate a chain reaction of forced selling, intensifying volatility. Essentially, Bitcoin’s short-term movements are currently influenced by speculative flows.

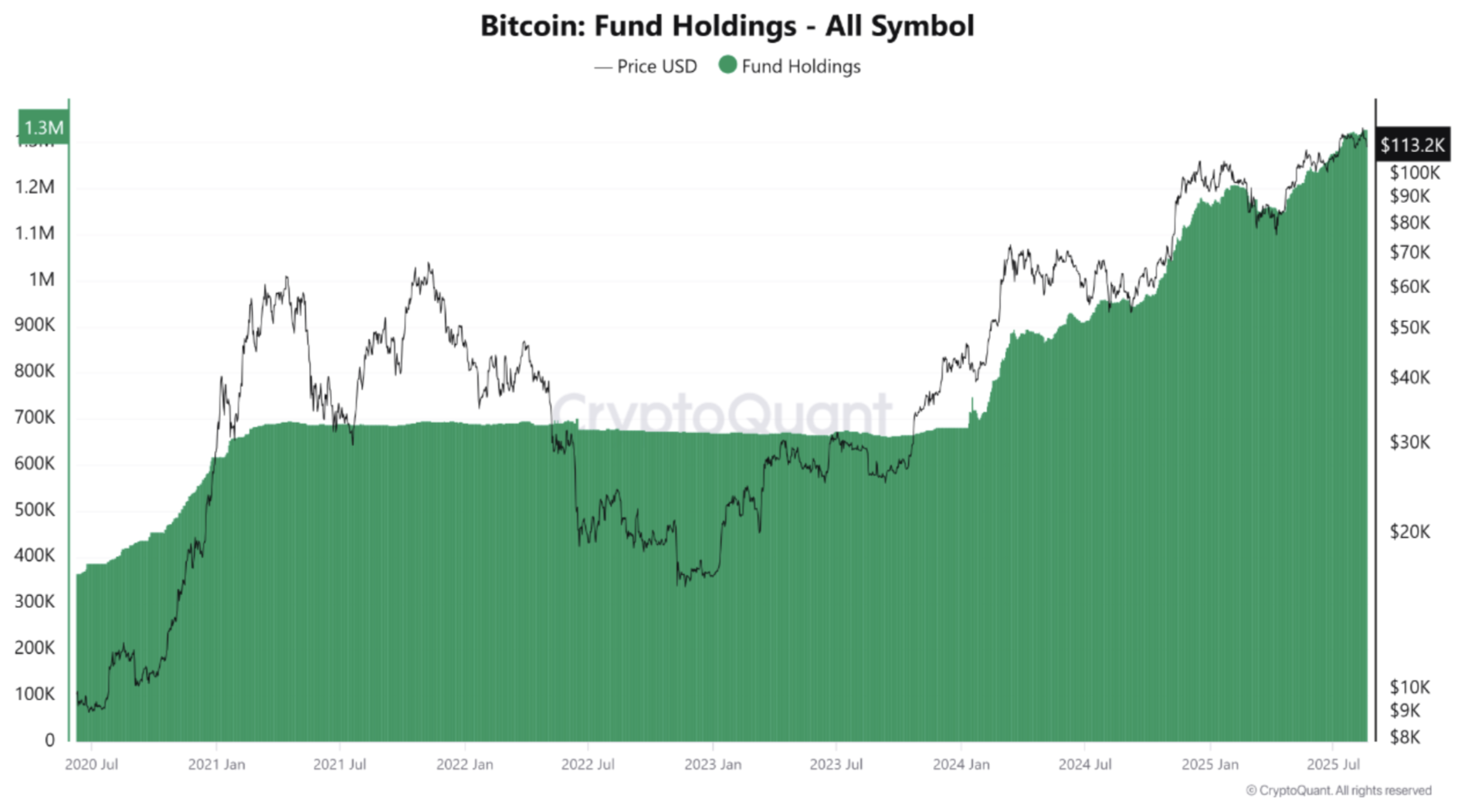

Increase in BTC Fund Holdings by Institutions

In spite of the market’s speculative excess driven by leverage, Bitcoin fund holdings by ETFs and institutional investors are on the rise, surpassing 1.3 million according to the latest data.

The acquisition of BTC by spot ETFs and corporate treasuries creates a structural demand that progressively lowers its supply. According to data from SoSoValue, US-based spot Bitcoin ETFs currently manage $146 billion in assets—accounting for 6.47% of BTC’s market capitalization.

Related Reading

However, this week has experienced more than $645 million in outflows from spot Bitcoin ETFs, following two successive weeks with inflows totaling nearly $800 million. Among these ETFs, BlackRock’s IBIT leads with $84.78 billion in net assets as of August 19.

Nonetheless, not all indicators are negative. For example, despite BTC dipping below $115,000, its spot trading volume surged beyond $6 billion, offering bulls a glimmer of hope for a potential recovery.

Additionally, technical analyst AO recently suggested that BTC might be reflecting gold’s path, with an ambitious target of $600,000 by early 2026. As of now, BTC is trading at $113,845, down 1.5% over the last 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com