At a blockchain event in Wyoming, Bowman argued that current restrictions on Fed employees and their spouses that were introduced in 2022, limit expertise and discourage talent from joining the central bank. She compared the situation to “learning a sport from someone who’s never played,” and believes that real-world experience is crucial as the Fed develops a supervisory framework for digital asset issuers. Her comments were made alongside the debut of the American Innovation Project, a new nonprofit backed by major crypto players to encourage bipartisan dialogue between policymakers and the digital asset industry.

Fed Staff to Needs Hands On Crypto Insight

Federal Reserve Vice Chair for Supervision Michelle Bowman suggested that staff at the US central bank should be allowed to hold small amounts of cryptocurrency in order to better understand the technology they regulate. At a blockchain event in Wyoming on Tuesday, Bowman argued that allowing de minimis investments in digital assets will actually help Fed staff gain some practical experience with how ownership and transfers function, which she said is critical as the institution moves toward creating a framework for supervising issuers of such assets.

Currently, most Fed employees and their spouses are prohibited from owning crypto or related products, including exchange-traded funds (ETFs) and shares in crypto companies. These restrictions were tightened in early 2022 after revelations that three senior officials engaged in questionable trading during 2020, while the Fed was implementing emergency measures to support the economy at the onset of the COVID-19 pandemic.

While Bowman acknowledged the importance of safeguarding against conflicts of interest, she said the current rules risk pushing away talent from joining the Fed and limit existing staff from acquiring the expertise necessary to engage with emerging technologies. She compared the situation to learning a sport from an instructor who has never actually practiced it, and even said she “wouldn’t trust someone to teach me to ski if they’d never put on skis.”

Bowman also pressed regulators more broadly to avoid what she called an “overly cautious mindset,” and warned that excessive skepticism toward blockchain and related innovations could leave the traditional banking system behind. She pointed out that many bankers see distributed ledger technology as a threat to established business models but explained that it has the potential to transform finance regardless of resistance from incumbents. Regulators, she argued, have to decide whether to embrace the change and shape a durable, reliable framework that preserves safety and soundness while reaping the benefits of efficiency and speed, or risk being bypassed altogether.

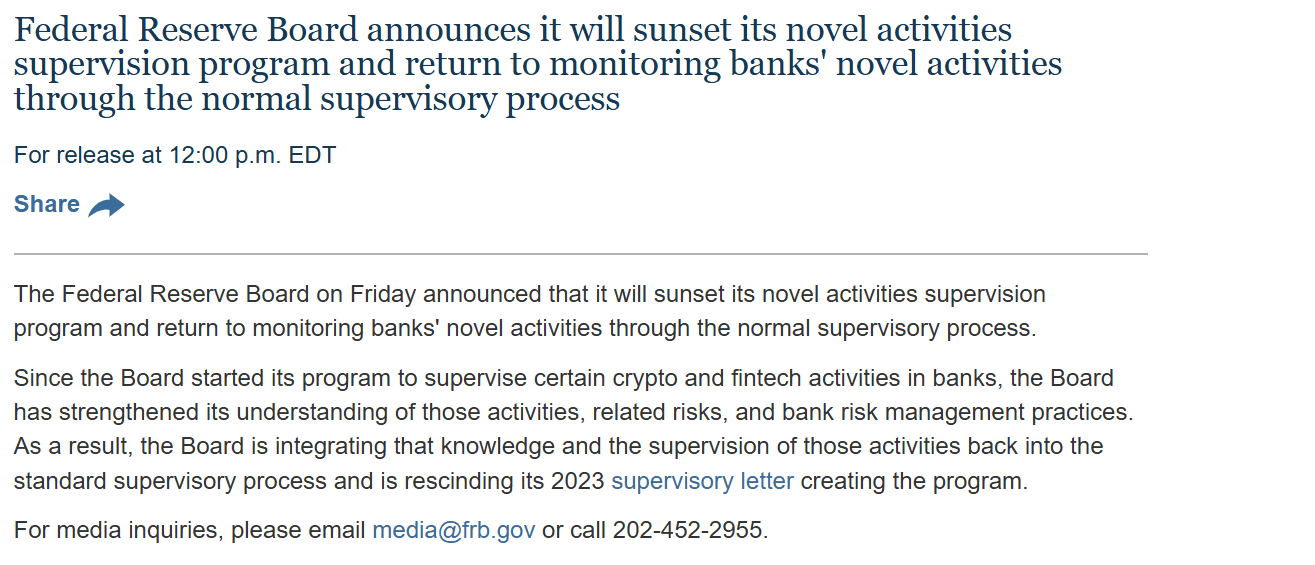

Announcement from the Fed

Her comments were made as the Trump administration is taking a much more favorable stance toward the crypto sector. Just last week, the Fed announced it will end a supervision program for blockchain-related bank activities that was put in place under President Biden. Earlier this month, Trump also signed an executive order directing regulators to investigate claims of debanking from the crypto industry and conservative groups.

American Innovation Project Debuts

Meanwhile, a new nonprofit organization emerged in Washington, DC, and its goal is to bridge the gap between US policymakers and the digital asset sector. The American Innovation Project (AIP), which launched on Tuesday, describes itself as a 501(c)(3) dedicated to fostering understanding of emerging technologies like blockchain and artificial intelligence.

It is led by Kristin Smith, president of the Solana Policy Institute, and the group’s board includes executives from major industry players including the Blockchain Association, Paradigm, Digital Currency Group, and Coinbase.

LinkedIn post from American Innovation Project

Smith explained that the initiative wants to create bipartisan dialogue and collaboration, and believes there is an urgent need for lawmakers to be equipped with the knowledge and tools to craft timely and effective regulation. The AIP’s creation follows a wave of pro-crypto lawmakers entering government after the 2024 elections, and it now joins a growing number of advocacy groups like the National Cryptocurrency Association, the Solana Policy Institute, and the DeFi Education Foundation.

The nonprofit’s funding sources include $1 million from Digital Currency Group, as well as contributions from Andreessen Horowitz, Kraken, Uniswap Labs, Stand With Crypto, and an undisclosed amount from the Cedar Innovation Foundation. This is a group with ties to the pro-crypto political action committee Fairshake.

The group’s launch coincides with the Wyoming Blockchain Symposium in Jackson Hole. AIP plans to host an “off-record” summit this week that is designed to build connections between the blockchain gathering and the Federal Reserve Bank of Kansas City’s Jackson Hole Economic Policy Symposium, which begins on the same day.

Among some of the more well known attendees at the Wyoming event were Senate Banking Committee Chair Tim Scott, and SEC Chair Paul Atkins, who suggested that the agency could shift its approach to digital assets under his leadership.