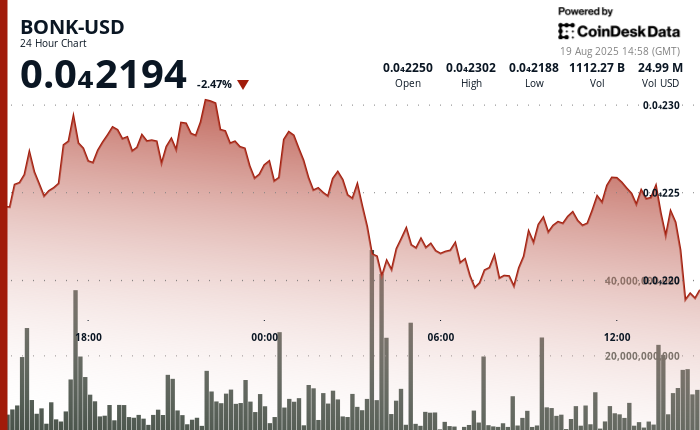

BONK, the Solana-based meme token, endured heightened volatility in the last 24 hours, falling 2.9% to $0.00002192. The action was defined by a ceiling at $0.00002308 that sellers repeatedly defended, while downside pressure built steadily, according to CoinDesk Research’s technical analysis data model.

Consolidation around $0.00002262 gave way to an advance toward $0.00002306 in the early U.S. afternoon on Monday, establishing the day’s key resistance point.

The sharpest bearish momentum unfolded during the early hours of Tuesday, when BONK slipped from $0.00002285 to $0.00002217 between 01:00 and 05:00 UTC. Volumes surged past 600 billion tokens at the 03:00 UTC interval, suggesting institutional-scale selling and possible retail capitulation.

BONK fell another 2% to $0.00002117 during the U.S. morning Tuesday with intraday declines accompanied by spikes in volume above 30 billion tokens. Brief rebounds, including a recovery attempt to $0.00002244 at 13:54 UTC, failed to sustain momentum, leaving BONK locked in a descending channel pattern.

Despite short-term weakness, longer-term data indicates selective accumulation. Sophisticated investors expanded holdings by over 300% in the past month, even as whale wallets trimmed positions by roughly 110 billion tokens. This divergence points to strategic positioning amid broader volatility, though technical indicators still suggest risk of a retest toward the $0.00002100 psychological support level.

Technical Analysis

- BONK capped at $0.00002308, serving as key resistance.

- Sharp decline from $0.00002285 to $0.00002217 between 01:00-05:00 UTC on Aug. 19.

- Trading volume exceeded 600 billion tokens during peak selling activity at 03:00 UTC.

- Repeated failures to reclaim $0.00002250 confirmed persistent selling pressure.

- Decline of 2% from $0.00002251 to $0.00002117 highlighted continued weakness.

- Brief recovery to $0.00002244 at 13:54 UTC reversed quickly, reinforcing descending channel trend.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.