Key Highlights:

- Bitcoin plunged from $123,800 to $117,180 after Treasury’s remarks.

- Daily liquidations exceeded $963M as market reacted to policy uncertainty.

- Despite clarification, Bitcoin has yet to recover to its earlier all-time high.

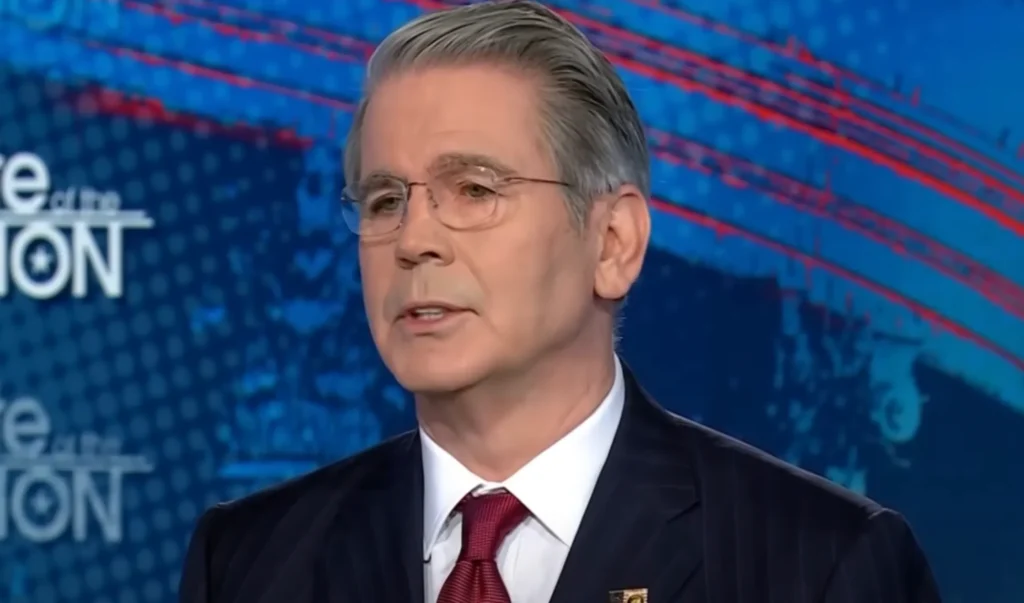

On the evening of August 14, 2025, Bitcoin’s price suddenly dropped from $123,800 to $117,180 after comments from US Treasury Secretary Scott Bessent. In an interview with Fox Business, Bessent stated:

“We’ve also started — to get into the 21st Century — a bitcoin strategic reserve. We’re not going to be buying that, but we are going to use confiscated assets and continue to build that up. We’re going to stop selling that.”

Initially, this declaration signaled a halt in government Bitcoin accumulation, fueling panic and a sharp correction. At the time of writing, Bitcoin remains just below $119,000, with the all-time high above $124,000 reached earlier that night.

When asked if initiatives like the Bitcoin reserve and gold revaluation were part of a sovereign fund plan, Bessent responded:

“These are all great, original ideas. But they require the infrastructure to be built for legalization and oversight. However, it is the right step in terms of securing a future for the next generation.”

Liquidation Wave and Market Sentiment

Triggered by Bessent’s statements, the daily volume of liquidations exceeded $963 million, mainly affecting leveraged positions in Bitcoin and other major cryptocurrencies. Market capitalization for Bitcoin fell from $2.48 trillion to $2.33 trillion, per TradingView.

The crypto community also linked this turbulence to the resignation of Bo Hines, the head of the Presidential Working Group on Crypto Assets, deepening concerns about sector leadership.

Treasury Walks Back Statement, Market Remains Shaken

After backlash, Bessent issued a follow-up statement clarifying that the US Treasury seeks “budget-neutral” options for reserve growth, not direct purchases from the Treasury. Community members joked that “someone whispered” to the minister about the fallout, while others saw the shifting stance as evasion of responsibility. As one commentator noted:

“It’s all out in the open now. The government doesn’t care about Bitcoin. They just want to line the pockets of insiders.”

Braiins CEO Eli Nagar expressed frustration, remarking the agency was still “looking for ways,” and describing it as an attempt to shirk responsibility.