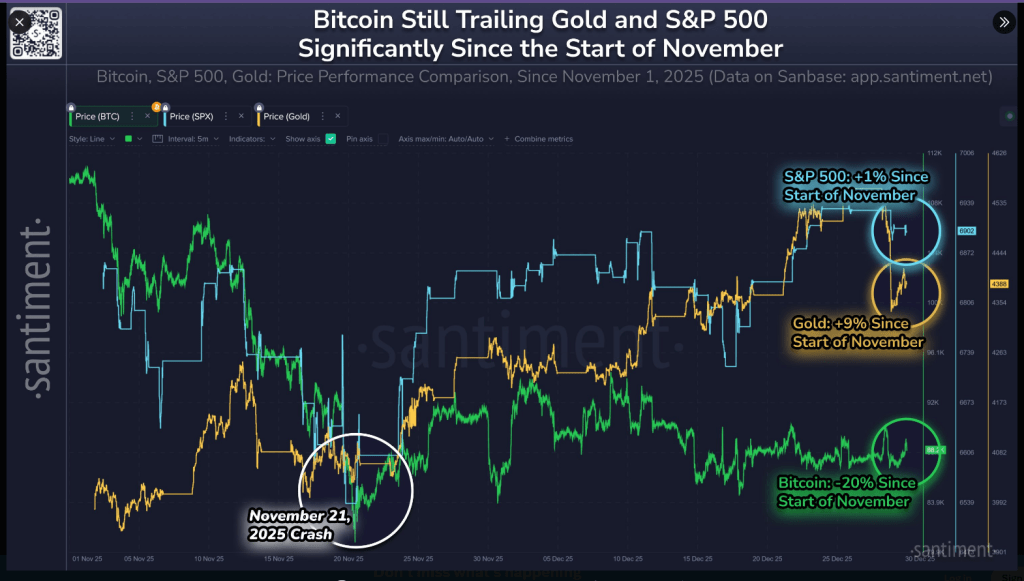

As stated by market intelligence firm Santiment, Bitcoin is lagging behind both gold and the S&P 500 following a significant pullback in November. Gold has increased by 9% since early November, the S&P 500 has advanced by 1%, while Bitcoin has declined roughly 20%, trading around $88,000 as of Wednesday. Reports indicate that this disparity has led to a quieter crypto market as other sectors experience modest recoveries.

Related Reading

Whale Accumulation Signals

Santiment’s analysis reveals a division in behavior among holders. Smaller wallets were active in purchasing during the latter half of 2025, whereas larger wallets mostly maintained their positions and sold following the spike to October’s all-time high.

Large holders are typically seen as influential in the market, and their cautious approach has applied pressure on prices. Historically, a reversal occurs when large holders start buying while retail investors pull back, but such a transition is not yet clearly evident.

📊 The correlation between Bitcoin & crypto compared to other major sectors is still lagging behind. Since the onset of November, price performance is as follows:

🥇 Gold: +9%

🏦 S&P 500: +1%

🪙 Bitcoin: -20%🤞 Looking towards 2026, there remains an opportunity for crypto to recuperate. pic.twitter.com/FW8JaQboTV

— Santiment (@santimentfeed) December 30, 2025

On-Chain Data Mixed

Reports highlight certain signs of stabilization. Long-term Bitcoin holders reduced their holdings from 14.8 million coins in mid-July to 14.3 million by December, then paused further sales. Active Bitcoin addresses saw a 5.51% increase in the past 24 hours, yet transactions plummeted nearly 30% during the same period.

This divergence suggests more individuals are observing the market while fewer are investing funds. The raw figures indicate interest, but do not demonstrate a clear return to widespread trading activity.

Market Voices Weigh In

Garrett Jin, a former operator of the BitForex exchange, noted that traders are reallocating their investments, suggesting that capital shifts from one market to another when new opportunities arise. The capital remains unchanged, and it is always prudent to sell high and buy low, Jin remarked in social media posts.

Another analyst, CyrilXBT, characterized the current conditions as late-cycle positioning before a potential rotation: as liquidity changes, gold might cool, Bitcoin could lead, and other tokens may follow.

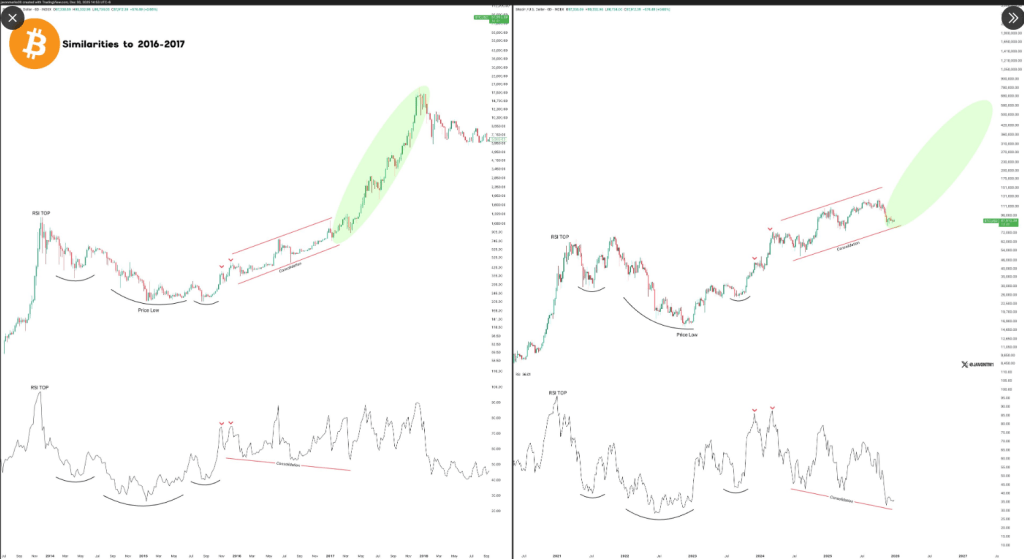

Bitcoin now bears resemblance to the 2016-2017 phase just prior to a parabolic surge.

These two scenarios stand out due to their stark similarities, and bullish signals are persisting and intensifying as well.$BTC is primed to take off 🚀… pic.twitter.com/H1hInYwix8

— JAVON⚡️MARKS (@JavonTM1) December 30, 2025

Price Calls And Technical Views

Technical analysts remain divided. Javon Marks has highlighted parabolic patterns in Bitcoin’s chart reminiscent of the 2016–2017 rally, predicting a rise toward $125K.

Data from CoinCodex indicates a more conservative expectation first: the platform predicts BTC could reach $91,500 by January 30, 2026, an increase of 3.68% from current prices.

Related Reading

CoinCodex reports a bearish sentiment and indicates the Fear & Greed Index at 23 (Extreme Fear). Additionally, Bitcoin witnessed 15 out of 30 days with positive returns and exhibited 2.11% volatility over the last month, with the latest update on December 31, 2025.

Short-term traders should monitor whether large wallets resume significant purchases and if transaction levels rise alongside increased active addresses. A resurgence in whale accumulation coupled with a halt in long-term holders reducing their positions would provide a stronger signal than either metric independently.

Currently, reports suggest stabilization rather than a confirmed market reversal, leaving potential for a recovery in 2026 if liquidity and sentiment shift positively.

Featured image from Unsplash, chart from TradingView