Sure! Here’s a rewritten version of the content while keeping the HTML tags intact:

Dogecoin experienced a decline on Sunday after struggling to maintain short-term support, with high trading volumes indicating that sellers are regaining influence as the price shifts towards the lower boundary of its recent trading range.

Market overview

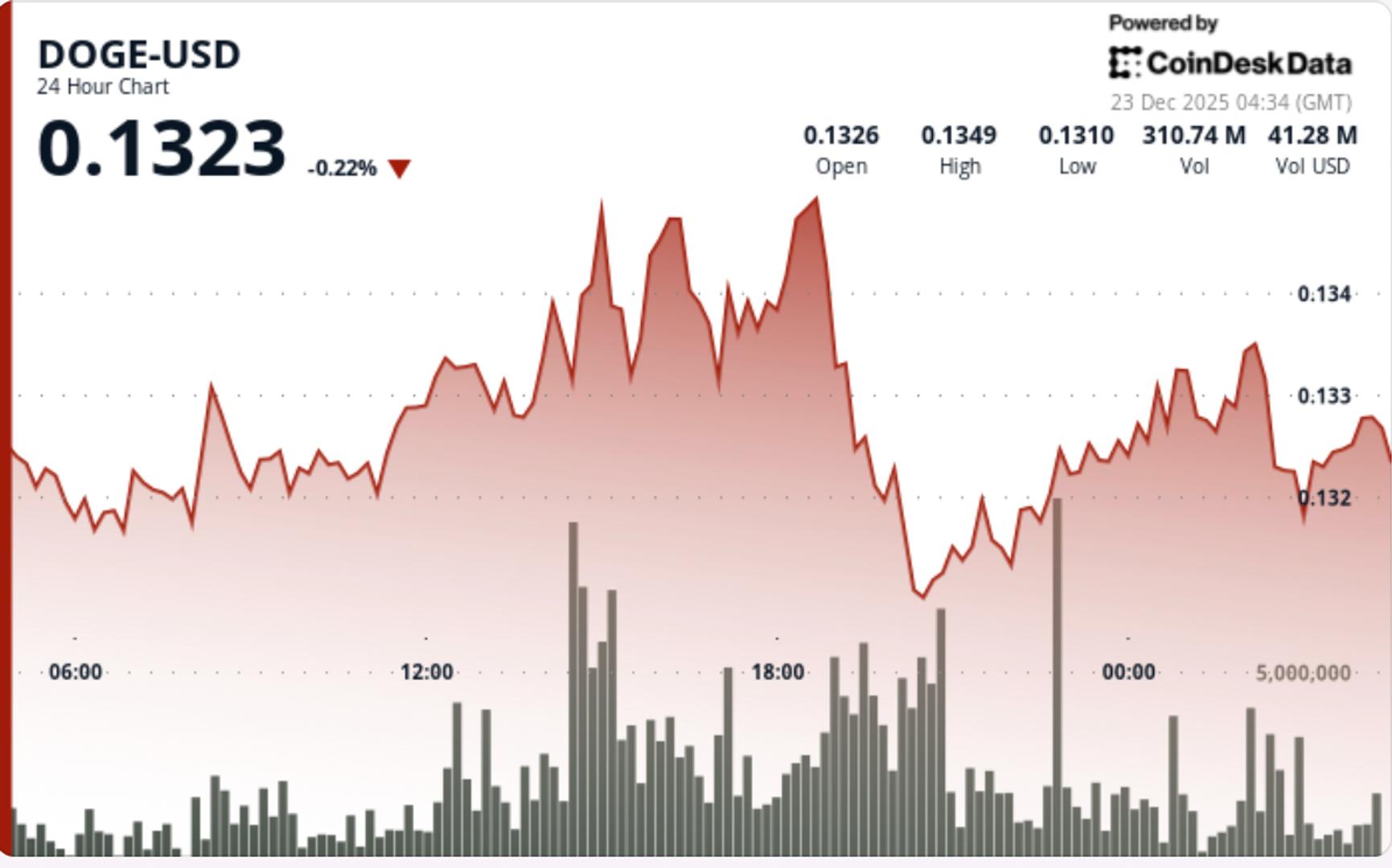

DOGE decreased approximately 1.8% in the last 24 hours, dropping from an intraday peak of around $0.1341 to a current value of about $0.1323. This decline followed an unsuccessful attempt to recover above $0.135, where renewed selling pressure emerged and limited upward momentum.

Trading volume notably increased during this pullback. It surged to around 721 million tokens at the peak of the session, about 150% higher than the 24-hour average, suggesting an active reshuffling rather than weak price movements in low liquidity.

Technical analysis

A significant technical development was the loss of support at around $0.1320, a level that had previously provided support during various pullbacks. After this level was breached, the price began to drift towards session lows with minimal buying follow-through.

On intraday charts, DOGE slipped beneath the lower boundary of a short-term upward channel, confirming a departure from the modest recovery pattern established late last week. The rejection around $0.1352 set a lower high, reinforcing a bearish outlook in the short term.

Price action summary

- DOGE was unable to maintain gains above $0.135, facing selling pressure at resistance

- Volume surged sharply during the pullback, indicating distribution activity

- Price fell below $0.1320, which had served as short-term support

- Late-session trading stabilized around $0.1323, although there was no significant rebound

Overall, the price movement indicated controlled selling rather than panic, yet momentum remains skewed to the downside.

What traders should watch

With $0.1320 now acting as resistance, focus shifts to whether DOGE can stabilize above the subsequent demand zone near $0.1280–$0.1290. This area corresponds with prior consolidation and may draw in dip-buyers if selling pressure subsides.

For DOGE to neutralize the current bearish trend, it would need to reclaim $0.1320 and then $0.1350. Until such levels are regained, any rallies are likely to encounter resistance from sellers looking to exit their positions.

Currently, DOGE finds itself in a precarious technical state, with price activity suggesting a trend of consolidation to lower levels rather than confirming a reversal.