Bitcoin strengthened as the Japanese yen declined following the anticipated interest rate increase by the Bank of Japan (BOJ).

The Japanese central bank elevated its short-term policy rate by 25 basis points to 0.75%, marking the highest point in nearly thirty years and continuing its shift from a period of ultra-loose monetary policy.

In its policy statement, the BOJ recognized that inflation has consistently exceeded its 2% target due to rising import prices and stronger domestic price trends. Nevertheless, policymakers noted that inflation-adjusted interest rates are still negative, indicating that monetary conditions remain favorable despite the increase.

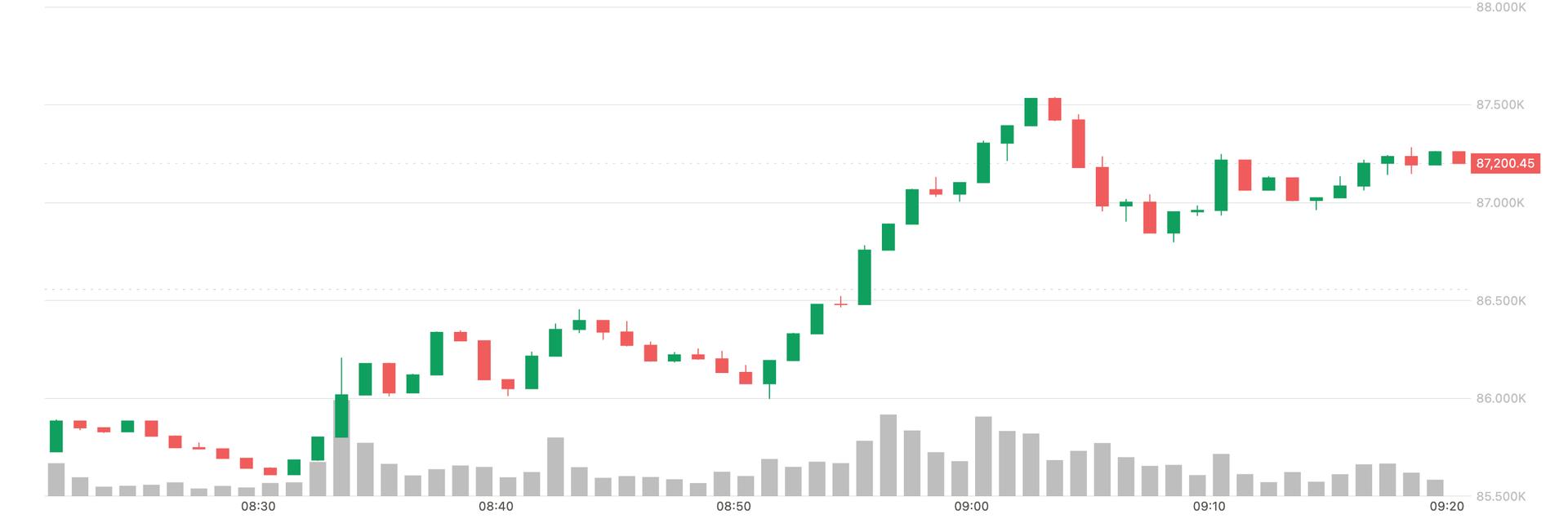

The Japanese yen fell to 156.03 per U.S. dollar from 155.67 post-announcement. Bitcoin, the top cryptocurrency by market cap, increased from $86,000 to $87,500 before slightly retreating to around $87,000 at the time of reporting, according to CoinDesk data.

The market response matched expectations, as the rate increase had been widely foreseen. Additionally, speculators had maintained long positions in the Japanese yen for weeks, mitigating any significant yen-buying reaction after the news.

Recently, some analysts voiced concerns that the rate hike could potentially bolster the yen, leading to a reversal of yen carry trades and a general risk-off sentiment.

For years, Japan’s ultra-low or negative interest rates made the yen a favored funding currency for carry trades. Investors would borrow cheaply in yen to invest in higher-yielding assets such as U.S. tech stocks, Treasury notes, and bonds from emerging markets, thereby enhancing global liquidity and risk tolerance. This strategy flourished as long as Japanese rates remained near zero, effectively turning the yen into a major facilitator of leverage and risk-taking across global financial markets.

Thus, the prospect of elevated rates in Japan alarmed risk asset supporters. However, these apprehensions were exaggerated, as CoinDesk highlighted, stating that even after the rate hike, Japanese rates would remain significantly lower than U.S. rates, ensuring no mass unwinding of carry trades.