Recent data indicates a divergence in the Funding Rate indicator for Bitcoin and Ethereum, with traders favoring long positions on BTC and short ones on ETH.

Divergent Funding Rates for Bitcoin & Ethereum

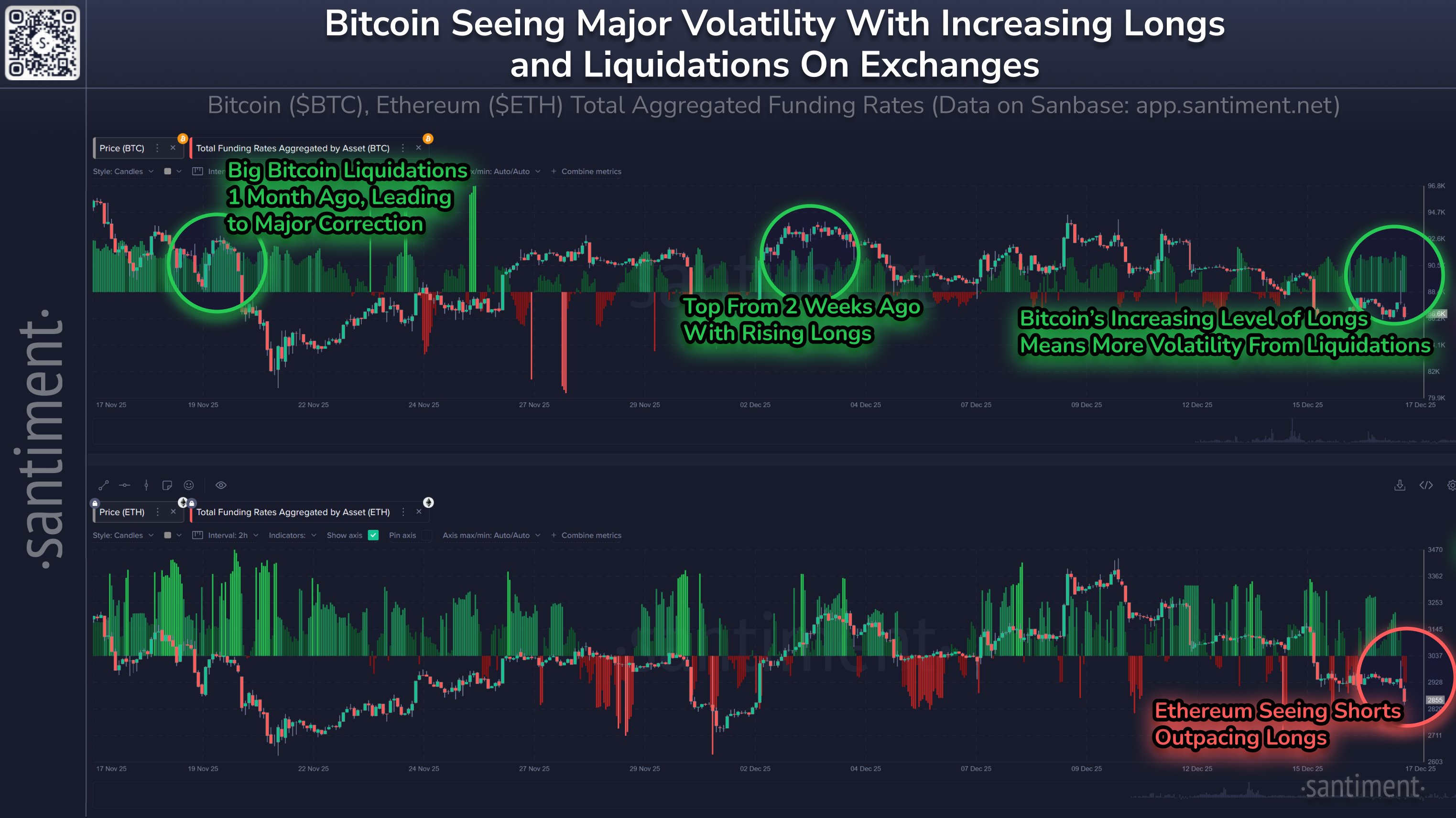

In a recent post on X, the on-chain analytics firm Santiment discussed the evolution of the Funding Rate for both Bitcoin and Ethereum amidst recent market fluctuations.

Related Reading

Bitcoin and several other cryptocurrencies experienced significant price changes in the last 24 hours. BTC’s price quickly surged to $90,300, only to drop back to around $86,000 just as rapidly, with further declines pulling it down to $85,300.

While BTC has rebounded to levels similar to those before the rapid surge, Ethereum’s situation differs. Following its spike to $3,000, ETH dropped to $2,830 and suffered another decline to roughly $2,790. Prior to the volatility, it was trading around $2,920.

The contrasting price movements may be contributing to the divergence seen in market sentiment in the derivatives market as reflected by the Funding Rate.

The Funding Rate measures the periodic fees that derivatives traders are incurring across all centralized exchanges. A positive value on this indicator indicates that long positions are paying short ones, while a negative value suggests that bearish positions are outnumbering bullish ones.

Here’s the chart shared by Santiment illustrating the changes in the Funding Rate for Bitcoin and Ethereum over the past month:

The chart reveals that Bitcoin’s Funding Rate has remained positive for several days, suggesting that a bullish sentiment is prevailing among traders. This outlook has been sustained even amidst price volatility.

Ethereum, meanwhile, also displayed a positive Funding Rate before the volatility hit, but the trend did not persist like it did for Bitcoin. Following its swift rise and subsequent drop, the indicator for Ethereum has turned negative, indicating that short positions have begun to outpace long ones.

While the weakening bullish sentiment around ETH might appear concerning, it may not be entirely negative. According to Santiment, highly leveraged long positions have historically been linked to sharp liquidation events and increased volatility. This trend has been observed during previous market peaks and corrections.

Thus, given the current negative Funding Rate for Ethereum, the risk of volatility could be reduced. Nevertheless, Bitcoin’s long-dominated market environment might still influence the cryptocurrency.

Related Reading

As Santiment notes, “all assets will continue to be influenced by Bitcoin, meaning Bitcoin’s funding rates must either stabilize or become negative to pave a clear path back to $100K and to facilitate an altcoin recovery.”

BTC Price

After a sharp drop on Wednesday, Bitcoin has rebounded to $87,100.

Image provided by Dall-E; data from Santiment.net; charts from TradingView.com