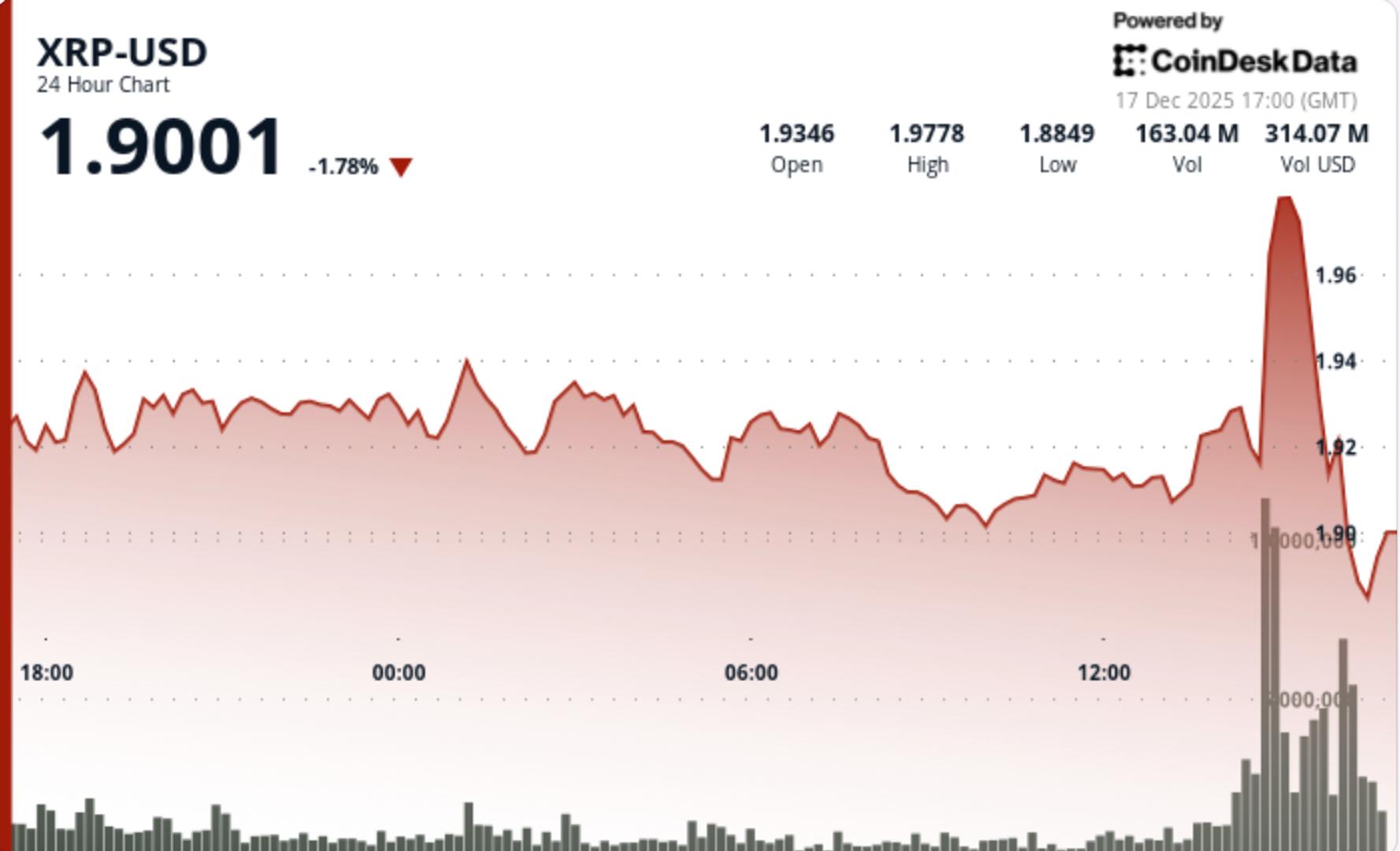

XRP experienced a notable decline on Wednesday, dropping below the $1.92 support level as substantial selling pressure combined with extreme volatility across various assets during U.S. trading hours.

This movement coincided with abrupt changes in bitcoin, U.S. stocks, and AI-related shares, increasing the vulnerability of altcoins as liquidity decreased and derivative positions were adjusted.

News Background

- Crypto markets underwent significant whipsaw movements in early U.S. trading, with bitcoin briefly rising from $87,000 to over $90,000 before falling back to around $87,000.

- This reversal was paired with substantial drops in AI-related stocks, including Nvidia, Broadcom, and Oracle, which fell 3%–6%, dragging the Nasdaq down by over 1%.

- Market sentiment soured after reports emerged that Blue Owl Capital withdrew from funding a $10 billion Oracle data-center project, which further pressured AI infrastructure-related risk assets.

- These sudden fluctuations led to over $190 million in liquidations within four hours in the crypto space, with $72 million in long positions and $121 million in short positions being liquidated, as per CoinGlass.

- XRP showed slight underperformance relative to the overall market, as derivative-driven flows affected mid-beta altcoins more severely amid the volatility spike.

Technical Analysis

- Support:Immediate: $1.90, serving as the primary defenseSecondary: $1.75–$1.64, providing a deeper liquidity area if $1.90 fails

- Resistance:Near-term: $1.94–$1.99, previously a support level, now a supply zonePsychological: $2.00, currently a firm rejection point

- Volume Structure:Rejection around $1.9885 recorded the day’s highest volumeIncreased activity indicates distribution rather than passive sellingNo signs of seller exhaustion as of now

- Trend Structure:Breakdown beneath key Fibonacci retracement alters structure to bearishLower highs formed prior to the rejection, indicating a decay in momentumConsolidation has resolved downward

- Momentum Check:Failed attempt to squeeze above $2.00 served as a bull trapPrice acceptance below $1.94 maintains a negative bias.

What Traders Are Watching

- Whether $1.90 holds — a clean break would swiftly target $1.75–$1.64.

- How the price reacts if it retests $1.94–$1.99 — rejection at this level would confirm ongoing trend.

- Whether macro volatility subsides or continues to drive cross-asset deleveraging.

- Derivative positioning following $190 million in liquidations — direction hinges on who reloads first.

- XRP’s performance relative to BTC if bitcoin stabilizes around $87,000.