The crypto markets experienced a slight uptick following the US Federal Reserve‘s latest interest rate decision, with traders eager for more clarity moving forward. Recent reports indicate that the Fed has executed three consecutive interest rate reductions totaling 0.75% between September and December. This adjustment was largely anticipated, although the market’s reactions have been varied and somewhat volatile.

Related Reading

Fed Actions and Market Insights

Jeff Ko, the chief analyst at CoinEx, stated that much of the Fed’s activity had already been factored into the market, and the updated dot plot appeared slightly more hawkish than some participants wished for.

Ko highlighted a $40 billion initiative in short-term Treasury purchases as a technical maneuver to enhance liquidity and reduce short-term interest rates, rather than as a broad stimulus measure.

The markets reacted mildly positively, with US stocks gaining, which provided some support for Bitcoin after an early decline.

Santiment and Immediate Market Reaction

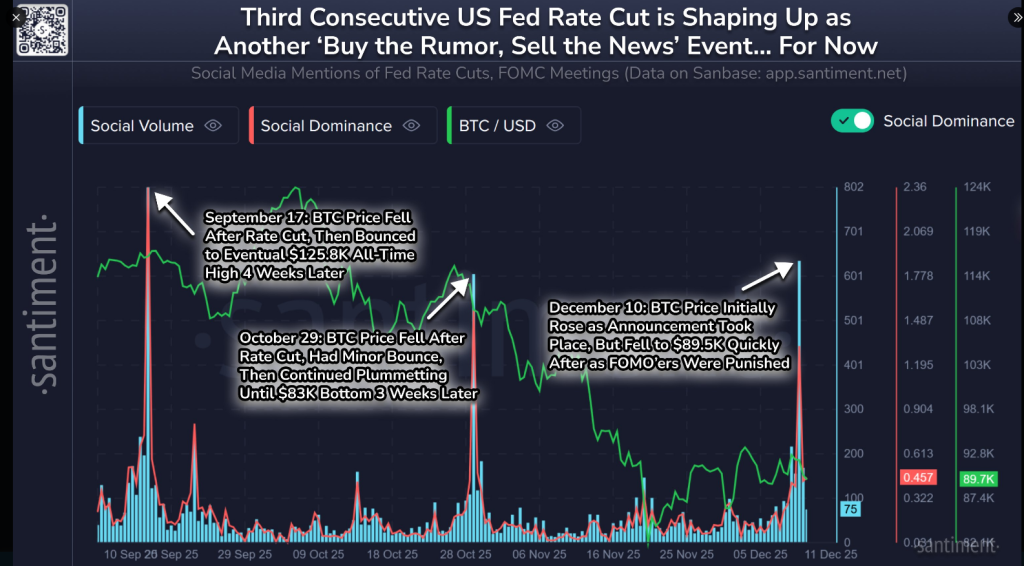

As reported by the on-chain analytics company Santiment, each interest rate cut triggered a classic “buy the rumor, sell the news” scenario, where initial enthusiasm was quickly followed by short selling.

🇺🇸 The US Fed has implemented three strategic cuts over the last three months, leading to a total interest rate decrease of 0.75%.

1⃣ September 17, 2025: Fed reduced the target range to 4.00%–4.25% (down from 4.25%+) during the 16–17 Sep meeting.

2⃣ October 29, 2025: Fed lowered the rate to… pic.twitter.com/X6DWypvq5t

— Santiment (@santimentfeed) December 11, 2025

While cuts are generally viewed as bullish for the crypto space in the long run, they have caused short-term pullbacks. Santiment notes that a slight wave of FUD or retail selling often signifies that the brief downturn post-cut is concluding, and a rebound could be on the horizon once stability returns.

Key Technical Levels for Traders

Bitcoin displayed significant volatility following the cuts, dipping below $90,000 before bouncing back to $93,500 on Coinbase and then stabilizing around $92,300 at the time of writing. Important resistance levels are identified between $97,000 and $108,000.

On the daily chart, BTC remains within a narrow rising channel embedded in a larger downtrend. Technical analysts observe that the MACD histogram is nearing a positive crossover — a sign that may indicate a potential resurgence in momentum.

ETF activity has been lackluster, with net inflows of only $219 million since late November, leading some investors to exercise caution.

Related Reading

Dollar Weakness and Market Signals

A depreciating dollar has been a consistent theme; the DXY index has dropped to 98.36 and shows bearish momentum on its MACD.

Nasdaq’s ascent above its 50-, 100-, and 200-day simple moving averages provided a brief lift to risk assets, supporting Bitcoin’s recovery attempts.

However, the correlation with equities remains inconsistent; declines in stocks often exert a greater negative impact on Bitcoin than gains provide a boost, resulting in an asymmetric risk landscape for traders.

Featured image from Impossible Images, chart from TradingView