The Federal Reserve’s concluding meeting of 2025 commenced on Tuesday, December 9, with the central bank poised to reveal its last monetary policy decision of the year at 2:00 p.m. ET on Wednesday.

Summary

- The Fed is anticipated to announce a 0.25% rate reduction on Wednesday, marking its third cut of 2025.

- Historically, Bitcoin has shown a tendency to surge following rate reductions.

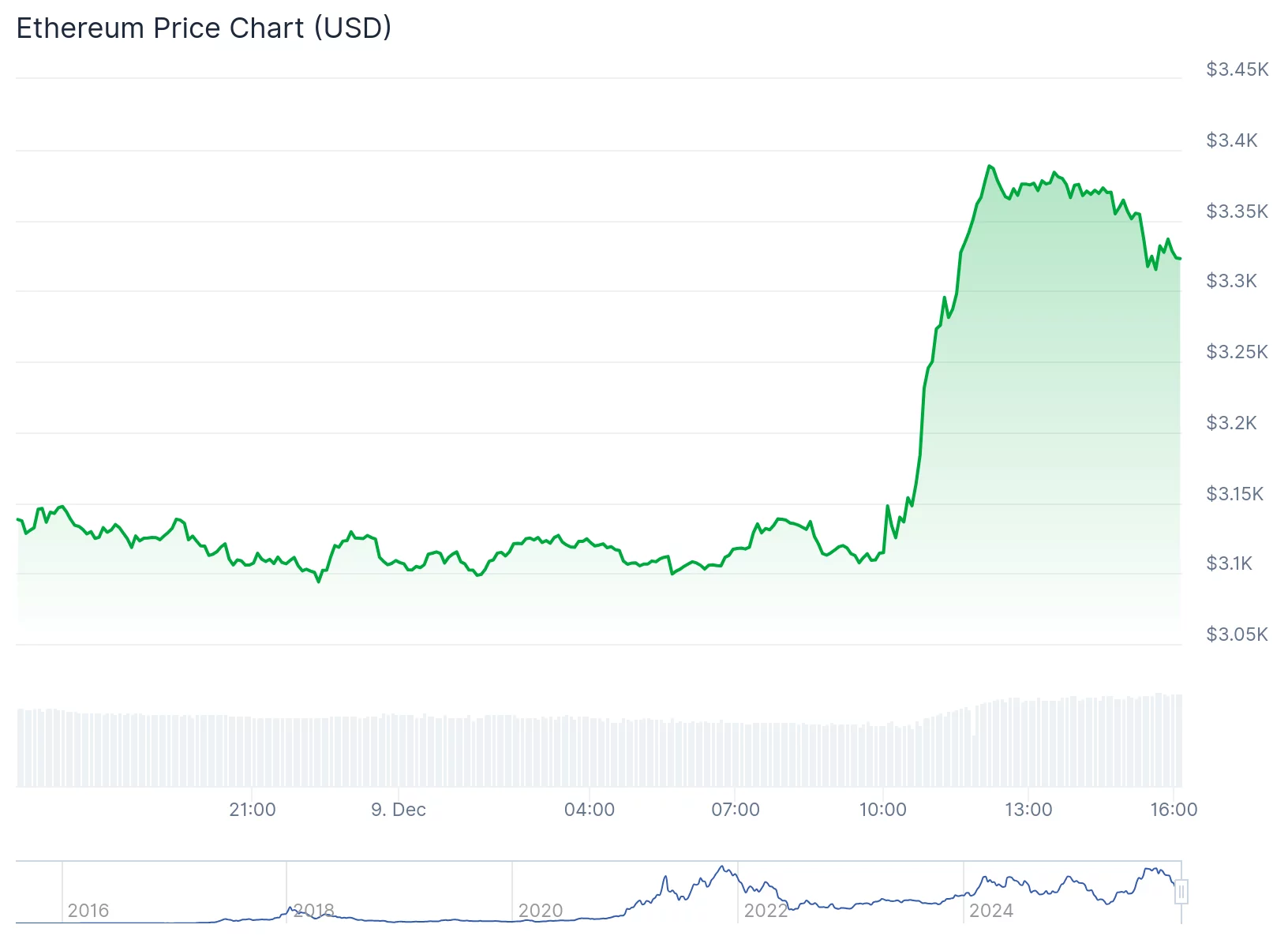

- Amidst market fluctuations, both Bitcoin and Ethereum displayed positive trends ahead of the announcement.

Investors are expecting a 0.25% interest rate cut, which would be the third reduction of the year, with the CME Group indicating a 90% likelihood of the cut.

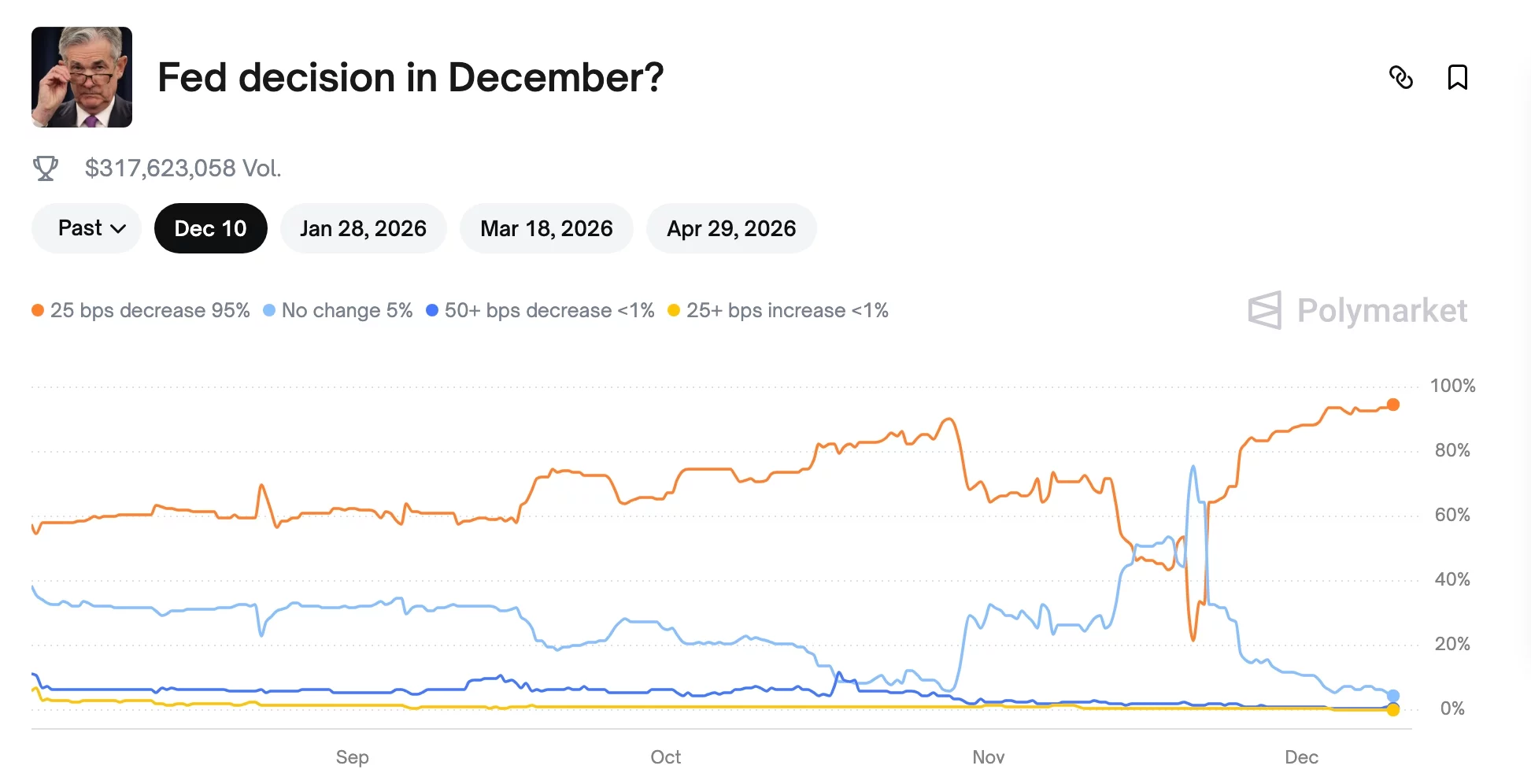

Bettors on Polymarket also show favor towards a 0.25% decrease, driven by persistent concerns regarding the labor market. See below.

Historically, Bitcoin tends to respond positively to rate cuts, as lower interest rates make non-yielding assets like cryptocurrencies more appealing, often leading to a weaker dollar.

However, recent reactions have been more mixed, with Bitcoin and other assets experiencing initial dips after cuts in 2025, indicating that investors are increasingly attuned to Fed communications, especially Jerome Powell’s tone, alongside broader liquidity conditions rather than just the rate changes.

Despite the volatility, both Bitcoin and Ethereum were showing upward trends at the last check, with analysts suggesting that additional cuts in late 2025 or early 2026 could induce rallies despite current market instability.

As of the last check on Tuesday around 4 p.m. EST, Bitcoin was up approximately 2.6% for the day, while Ethereum rose about 6%. Conversely, altcoins were trending downward as of midday Tuesday. See below.

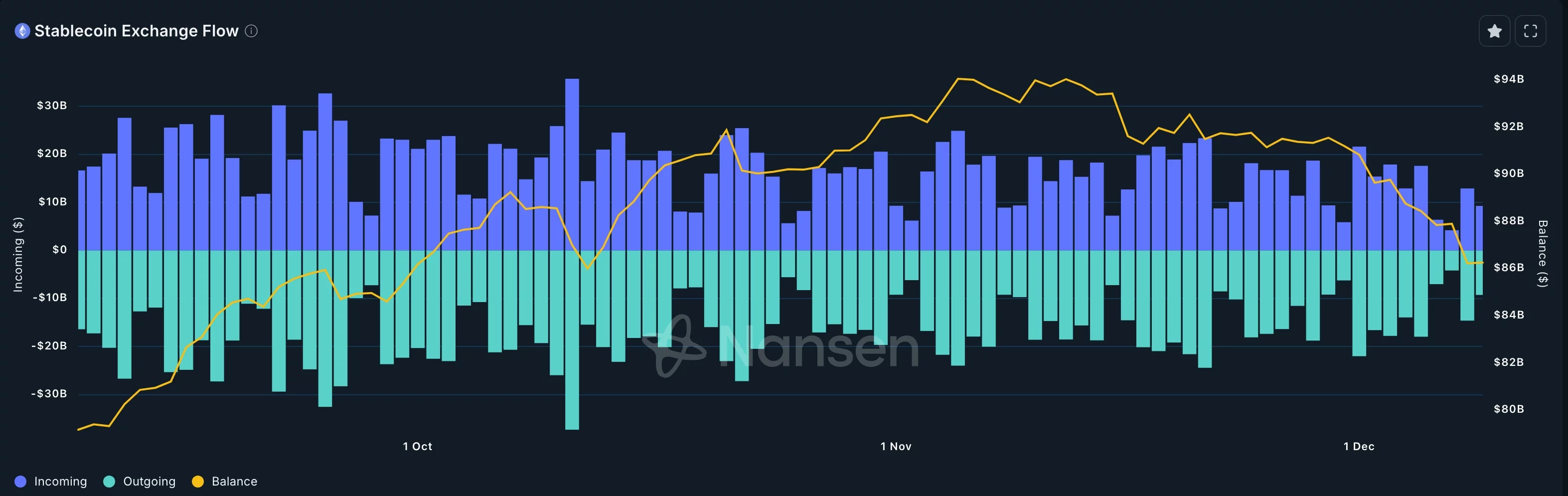

Stablecoin outflows

Data from Nansen indicates that the balance of stablecoins on exchanges has plummeted to $86 billion, its lowest point since October. Stablecoins have been on a downward trajectory since peaking at $94 billion on November 6 this year, a sign that investors are adopting a risk-off approach.

This ongoing trend with stablecoins coincides with the market’s deleveraging. Data from CoinGlass reveals that futures open interest declined by 0.3% in the past 24 hours to $130 billion.

A decreasing futures open interest and a stabilized funding rate suggest weak demand in the futures market, which has recently dominated crypto trading.

Federal Reserve interest rate decision ahead

There is a possibility that Bitcoin and other altcoins will experience declines following the rate cut for three primary reasons.

- Firstly, the interest rate cut may have already been factored in by market participants, leading to potential selling behavior.

- Secondly, the Fed could present a hawkish cut, implying that it intends to maintain rates for a while as it evaluates incoming data.

- Thirdly, a rate cut could spark inflation in the U.S., causing the Fed to potentially keep rates steady for an extended period or even increase them in 2026. This concern accounts for the rise in U.S. bond yields in recent weeks, with the 10-year yield climbing to 4.18%.

The ongoing drop in the crypto market supports our caution expressed on Monday that the rally was likely a dead-cat bounce, a scenario where an asset in decline temporarily rises before continuing its downward trajectory.