The memecoin experiences a slight increase amidst heightened trading activity, while technical indicators suggest consolidation near critical support levels.

Background News

- On December 6, Dogecoin celebrated its 12th anniversary, marking twelve years since Billy Markus and Jackson Palmer launched the meme-token, which eventually grew into a significant crypto asset through ongoing community support.

- Despite this milestone, market reactions were subdued, driven primarily by technical patterns and on-chain activities.

- On-chain metrics revealed daily active addresses reached 67,511 on December 3 — the second-highest figure in three months — indicating renewed user engagement, though price movements remain stable.

Technical Insights

- DOGE has been consolidating in a narrow range between $0.1406 and $0.1450, creating a compression pattern likely to lead to a significant price movement.

The token rebounded from the $0.14 support on three occasions, reflecting strong buying interest at the lower end of this range. - Each rejection of a downward trend has coincided with diminishing selling volume, which is a positive indicator for potential upside movement.

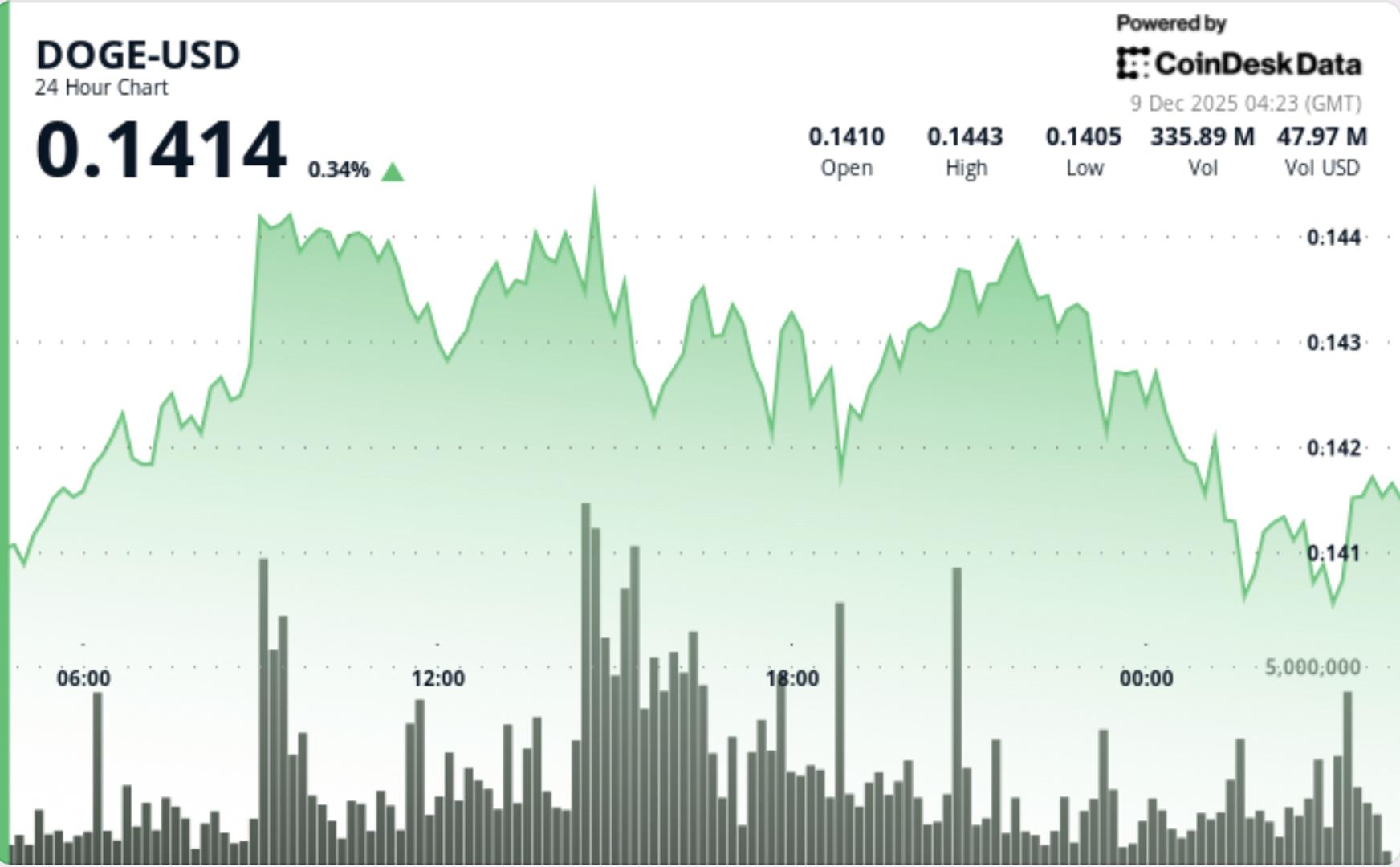

- Hourly charts indicated a significant volatility spike around 03:19–03:22 GMT, where the price dropped to $0.1405 before bouncing back up, strengthening an upward intraday support line.

- MACD curves are approaching a bullish crossover, while range contraction and higher lows suggest an early accumulation phase, not distribution.

Price Movement Overview

- DOGE saw a controlled rise from $0.1405 to $0.14155, reflecting a 0.81% increase.

Volume surged by 16.96% over weekly averages, with a noticeable 465.9M spike (+68% compared to the 24-hour SMA) at 01:00 GMT, indicating institutional interest at range lows. - The token maintained a stable pattern despite several tests of the $0.140–$0.141 range, while resistance at $0.145 was not challenged during the session.

Key Insights for Traders

- The consolidation phase is nearing a conclusion, with $0.16 identified as the crucial breakout level that would shift DOGE from sideways movement to a potential trend continuation.

- A failure to maintain the $0.14 support could push prices towards deeper on-chain support around $0.081, as indicated by UTXO distribution clusters.

- The combination of increasing active addresses and narrowing volatility suggests that a directional movement is imminent.

- Traders should monitor for volume increases above $0.145 or below $0.140 as likely indicators for the next price movement.