Memecoin encounters resistance at $0.1409 while institutional investments surge to 480M tokens, highlighting a contrast between technical weaknesses and fundamental strengths.

News Background

- Dogecoin remains under the $0.14 level despite notable accumulation trends and increased network activity. On-chain metrics indicate that whales acquired 480 million DOGE from December 2–4, raising total large-holder balances from 28.0B to 28.48B.

- Concurrently, DOGE network engagement spiked to 71,589 active addresses — its highest level since September — suggesting enhanced chain activity despite stagnant price movements.

- The significant whale purchases and growing activity sharply contrast with the price action, which continues to struggle beneath a strong resistance zone due to breakeven sellers and technical overhead capping momentum.

Technical Analysis

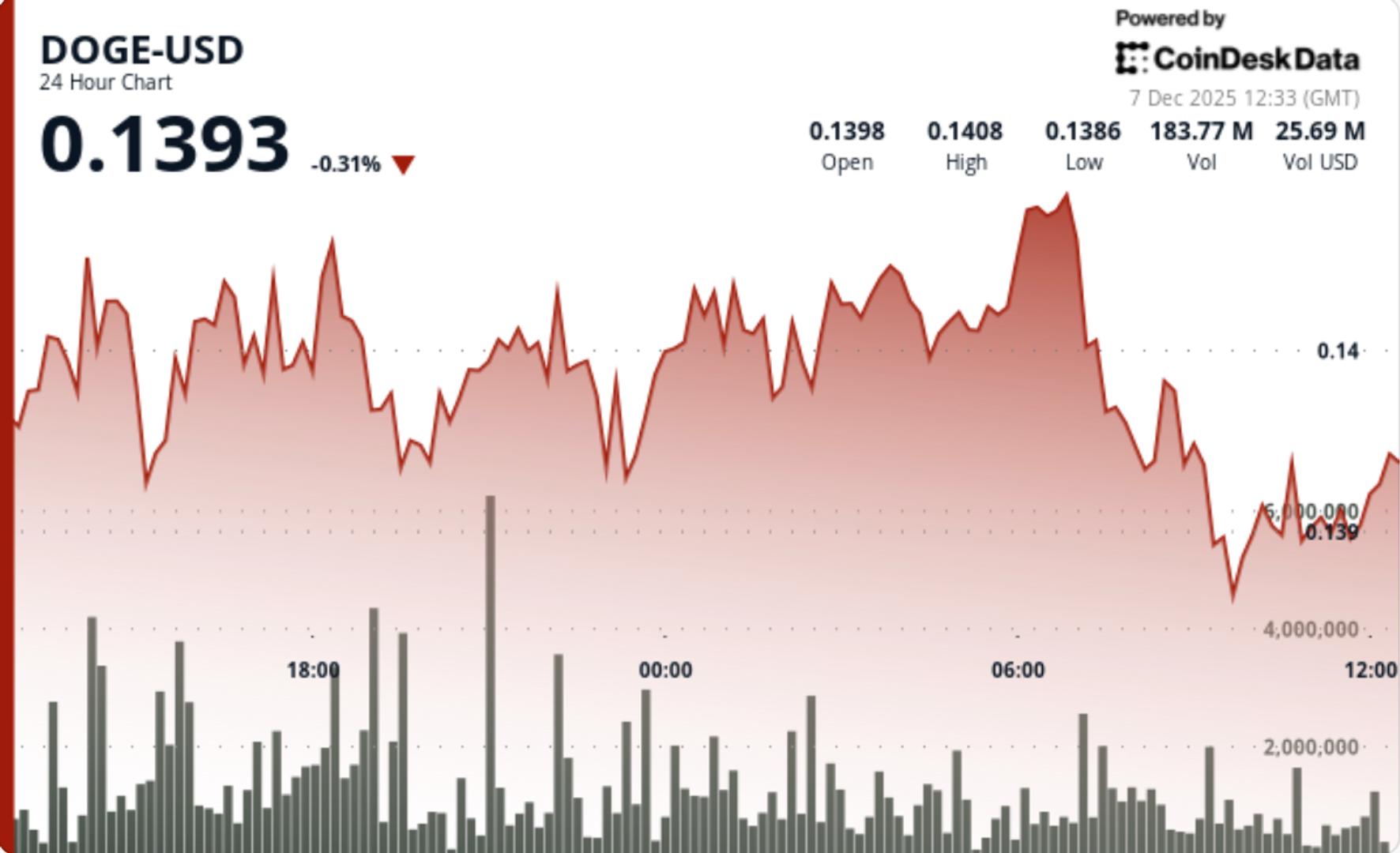

- DOGE’s effort to overcome the $0.1409 resistance faced a definitive failure when a 333M volume spike — 79% above average — led to an immediate rejection from this level. This highlights robust distribution pressure at this critical barrier.

- The price structure remains confined to a range, showing tight consolidation between $0.1393 and $0.1400. The volume contraction following the failed breakout emphasizes market uncertainty and a lack of buyer confidence.

- Short-term charts indicate a slight breakdown below the $0.140 support, driving DOGE to $0.1392 amidst elevated activity above 15M — a scenario that broadens the consolidation range and establishes new resistance at $0.1400.

- Despite whale accumulation, the technical landscape remains weak: the market sits below resistance, momentum declines, and shorter timeframes present no verified trend reversals.

Price Action Summary

- DOGE decreased by 1.2% from $0.1522 highs to $0.1395, after several unsuccessful attempts to reach $0.1409.

- The most notable activity occurred at 07:00 UTC when volume surged to 333M, coinciding with a sharp rejection from the resistance level.

- Subsequent weakness caused DOGE to drop to $0.1392, forming new intraday support at $0.1393 while consolidating around the $0.1395 midpoint.

What Traders Should Know

- DOGE is currently at a critical juncture between substantial underlying accumulation and weak short-term technical indicators.

- Whale buying is increasing, yet the overhead supply remains significant at $0.1400–$0.1409, where persistent sell pressure indicates active distribution.

- A breakthrough above $0.1409 could lead to a potential rise toward $0.142, but failing to maintain $0.1393 poses the risk of retesting $0.1380.

- The divergence between bullish fundamentals and range-bound technicals implies a likelihood of consolidation until volume increases or a significant catalyst appears.