Dogecoin has surged past significant resistance, displaying its highest trading volume in weeks. This movement hints at momentum fueled by retail investors, even as large holder activities dwindle to their lowest levels in several months.

News Background

- The latest developments for Dogecoin coincide with a steady, if modest, interest in ETFs.

- The recent launch of two U.S. spot Dogecoin ETFs—Grayscale’s GDOG and Bitwise’s BWOW—gathered $177,250 in net inflows on December 3, totaling $2.85 million since their inception, per SoSoValue data.

- Although these figures are not explosive, they suggest an early adoption trend among conventional investors as regulated DOGE products find traction. The overall memecoin market remains lackluster, yet ongoing ETF demand offers a slight supportive boost as DOGE works to regain critical technical levels.

Technical Analysis

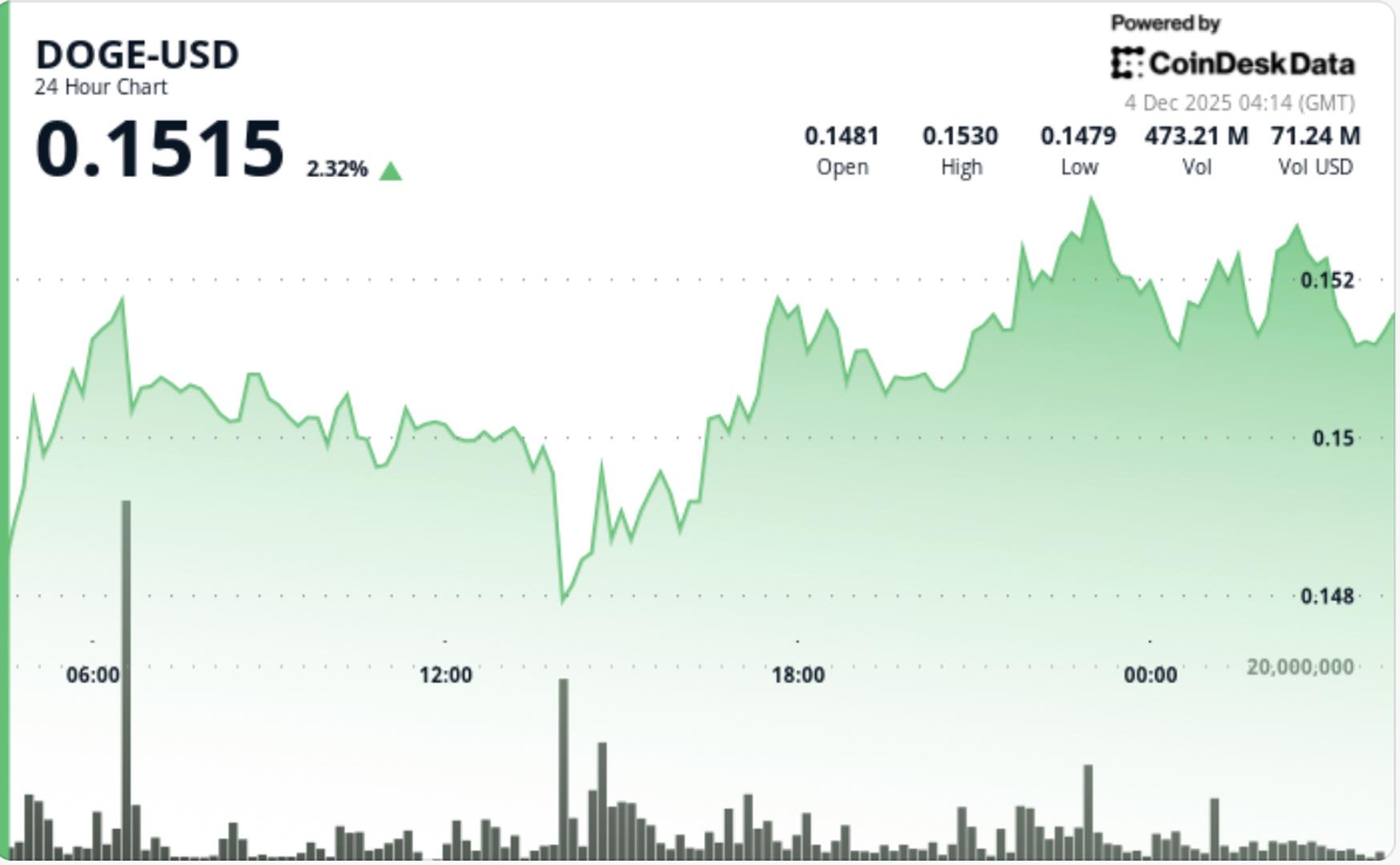

- DOGE’s framework has notably strengthened, confirmed by the establishment of an ascending channel marked by three higher lows at $0.1469, $0.1488, and $0.1512. This pattern showcases ongoing accumulation, with volumes increasing sharply during upward movements and decreasing during corrections—characteristics traders seek to differentiate genuine trend changes from mere fluctuations.

- The breakout beyond $0.1505 represents the first significant resistance clearance since late November. Tuesday’s volume increase—triple the daily average—validated the strength of this move.

- Despite the decline in whale participation, the chart indicates positive momentum: upward-sloping support, heightened activity on each breakout attempt, and clear reactions to intraday dips.

- Crucially, DOGE sustains structural strength above the $0.1470 support area. This region now serves as the technical pivot for continuation, defining the lower boundary of the ascending channel.

- On a broader timeframe, the $0.138 mark continues to act as a major structural floor, coinciding with the 0.382 Fibonacci retracement and the 200-week moving average—both levels that attract long-term investors.

- DOGE initiated with steady accumulation prior to breaking through resistance at $0.1505. The rally intensified around 14:00 GMT, reaching a volume peak of 874.7 million tokens. The price momentarily retreated to $0.1513 before buyers regained control, affirming the new support.

- Intraday movements displayed solid bid absorption at each successive higher low, while the upper boundary of the channel guided rallies toward the $0.1530 region. The session closed within the upper half of the day’s range, indicating bullish dominance.

• $0.1470 is now the significant support threshold; maintaining it upholds the breakout structure

• The immediate target for upside is set at $0.1530, with the $0.1580-$0.1600 range identified as the next resistance zone

• Volume confirmation remains crucial — a return to below average levels could impede continuation

• Retail-driven surges can escalate rapidly but might also diminish without institutional backing

• A breach of $0.1470 raises the risk of a deeper correction toward $0.1430, and potentially down to the macro support at $0.138

What Do Technicals Suggest For DOGE?

- Market structure indicates preliminary signs of a momentum shift, supported by a combination of indicators with mixed but improving signals. Analyst Ali Martinez noted a new “Buy” signal on Dogecoin’s weekly chart via the TD Sequential indicator—designed to pinpoint trend exhaustion and potential reversal points.

- Historically, TD Sequential “Buy” signals for DOGE have often preceded significant multi-week rallies, making the appearance of this new signal noteworthy as the coin tests the upper limits of its ascending channel.

- However, not all indicators align perfectly. TradingView’s Bull Bear Power tool—assessing the balance between bullish and bearish forces—has issued a sell signal, suggesting that sellers still retain influence during intraday fluctuations.

- Conversely, the MACD indicator, which monitors momentum via moving-average convergence and divergence, has turned bullish as the MACD line crossed above its signal line, typically interpreted as an emergence of upside momentum.

- In sum, the mixed indicator landscape suggests DOGE is in the early phases of a potential trend shift, where bullish momentum is beginning to surface but is not yet dominant.

- Traders are on the lookout for confirmation through sustained closures above resistance levels and increasing volume, both of which would validate the TD Sequential signal and counter short-term bearish indicators.