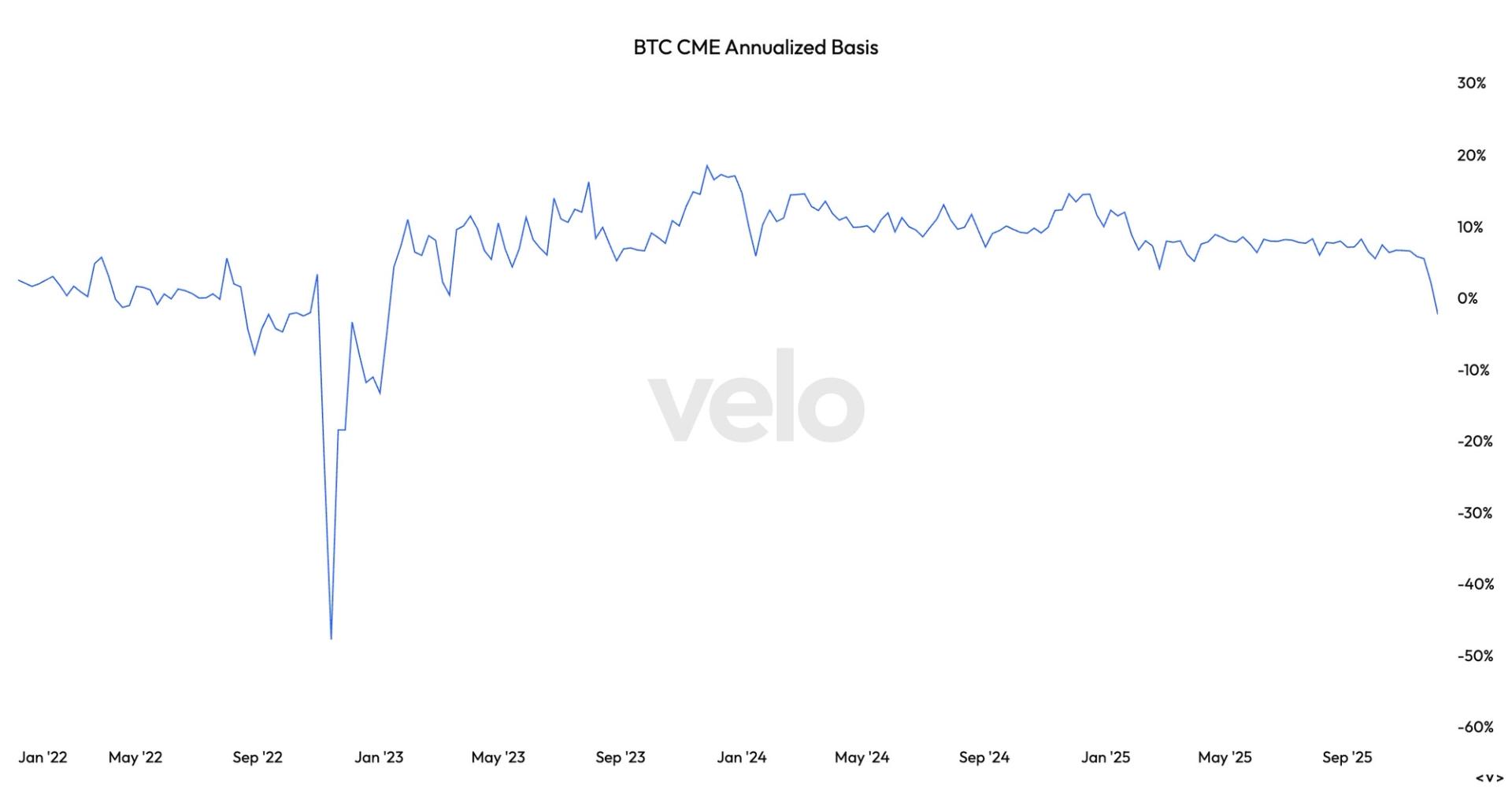

The annualized basis for CME bitcoin has dropped to -2.35%, marking its most significant backwardation since the dramatic dislocations following the FTX collapse in November 2022, when it briefly neared -50%, as reported by Velo data.

Backwardation refers to a situation in the futures market where contracts expiring sooner are priced higher than those expiring later. This indicates the market’s expectation of a lower bitcoin price in the future compared to the current or near-term price, resulting in a downward-sloping futures curve and suggesting that traders anticipate declining prices over time.

This pattern is typically rare for bitcoin, as its futures generally trade at a premium—known as contango—due to the cost of leverage and strong demand for future positions.

The transition into backwardation first became evident around November 19, just two days prior to bitcoin hitting a low near $80,000 on November 21. In this latest correction, a substantial amount of leverage has been removed from the marketplace, with traders closing long positions and institutions lowering their exposure.

Historically, backwardation has surfaced during periods of market stress or forced deleveraging, with past occurrences in November 2022, March 2023, August 2023, and now November 2025 aligning closely with significant or local market lows.

However, backwardation does not automatically indicate a bullish turnaround. As emphasized in previous CoinDesk research, bitcoin cannot be directly compared to physical commodities like oil, where backwardation reflects tight supply conditions. CME futures are cash-settled, frequently utilized by institutions engaged in basis trading, and can descend further into negative territory.

From this perspective, backwardation signifies cautious pricing for the future and diminished expectations rather than a robust demand for spot trading.

A significant amount of leverage has already dissipated, but conditions could deteriorate further if risk appetite continues to decline. Concurrently, this is the same structural pattern that has consistently indicated pivotal moments, once forced sellers are depleted. Bitcoin now enters a phase where both peril and potential opportunities have historically arisen.