On Wednesday, Bitcoin was trading just above $121,000, maintaining gains after a decline from a recent high of over $126,000. Analyst Egrag Crypto believes that a minor market shift could spark a much larger rally, following a pattern he claims has been evident in previous cycles.

Related Reading

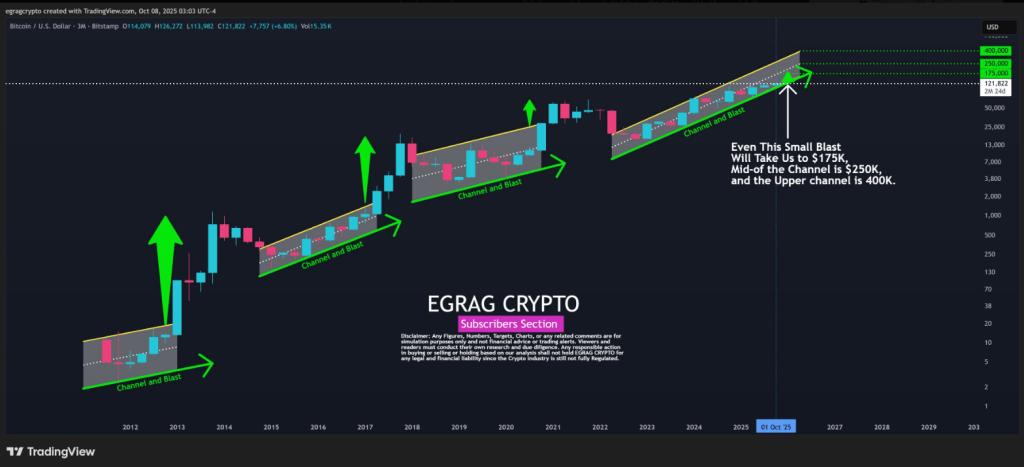

Historic Channel Breakouts

Egrag’s perspective is founded on a three-month analysis of price channels that he argues have preceded significant rallies. Reports indicate that similar channel breakouts were observed before the surge to around $1,163 in 2013, the climb past $19,000 in 2017, and the 2020–2021 rally that elevated prices above $69,000.

He notes that the current channel started to form in April 2022, suggesting that a small upward “blip” could elevate Bitcoin to $175,000. To achieve this target, it would require an approximately 43% increase from $122,620. Short-term fluctuations this week have varied between $115,000 and $125,000, with the current price around $121,900.

#BTC – $175K Is Just a Blip:

When examining the historical patterns of #BTC over a three-month period, a distinct channel formation is evident. In the last three cycles, breakouts at the end of these channels have been consistent. Although diminishing returns are noticeable, they are… pic.twitter.com/TabFoVlXBT

— EGRAG CRYPTO (@egragcrypto) October 8, 2025

Targets And Risks To Watch

Egrag outlined a spectrum of potential scenarios, positioning $175,000 as his main target. He also indicated a midpoint around $250,000 and a higher scenario near $400,000. These figures are ambitious and presented as part of a longer-term outlook rather than immediate guarantees.

The analyst drew parallels between his Bitcoin forecast and a previous gold projection, where he set a target of $3,500 for gold, which later approached $4,000—using this as a reference for his forecasting method.

In the meantime, on-chain data presents a mixed landscape. Blockchain analytics firm Glassnode reported that 97% of Bitcoin’s supply is currently realized in profit following the recent surge.

This high level of realized profits implies that many holders are above their acquisition price. Some analysts interpret this elevated profit level as an indication that markets may cool off to allow investors to secure gains.

Related Reading

Others highlight crowded positions and increasing leverage as potential indicators for heightened short-term volatility. There are concerns about what some refer to as a “Suckers Rally,” where a price spike entices late buyers before a decline follows.

Market Behavior And Investor Moves

Accumulation patterns have been noted in various wallets. Some investors are reallocating their gains instead of completely selling out, which, as reported, may signify a controlled capital rotation rather than a frantic sell-off.

Featured image from Pixabay, chart from TradingView