As Bitcoin (BTC) continues to hit new all-time highs (ATH), attention shifts to critical price points that could indicate the next resistance levels where a sell-off might occur. Recent on-chain data outlines the most significant price levels for BTC.

Potential Resistance Levels for Bitcoin

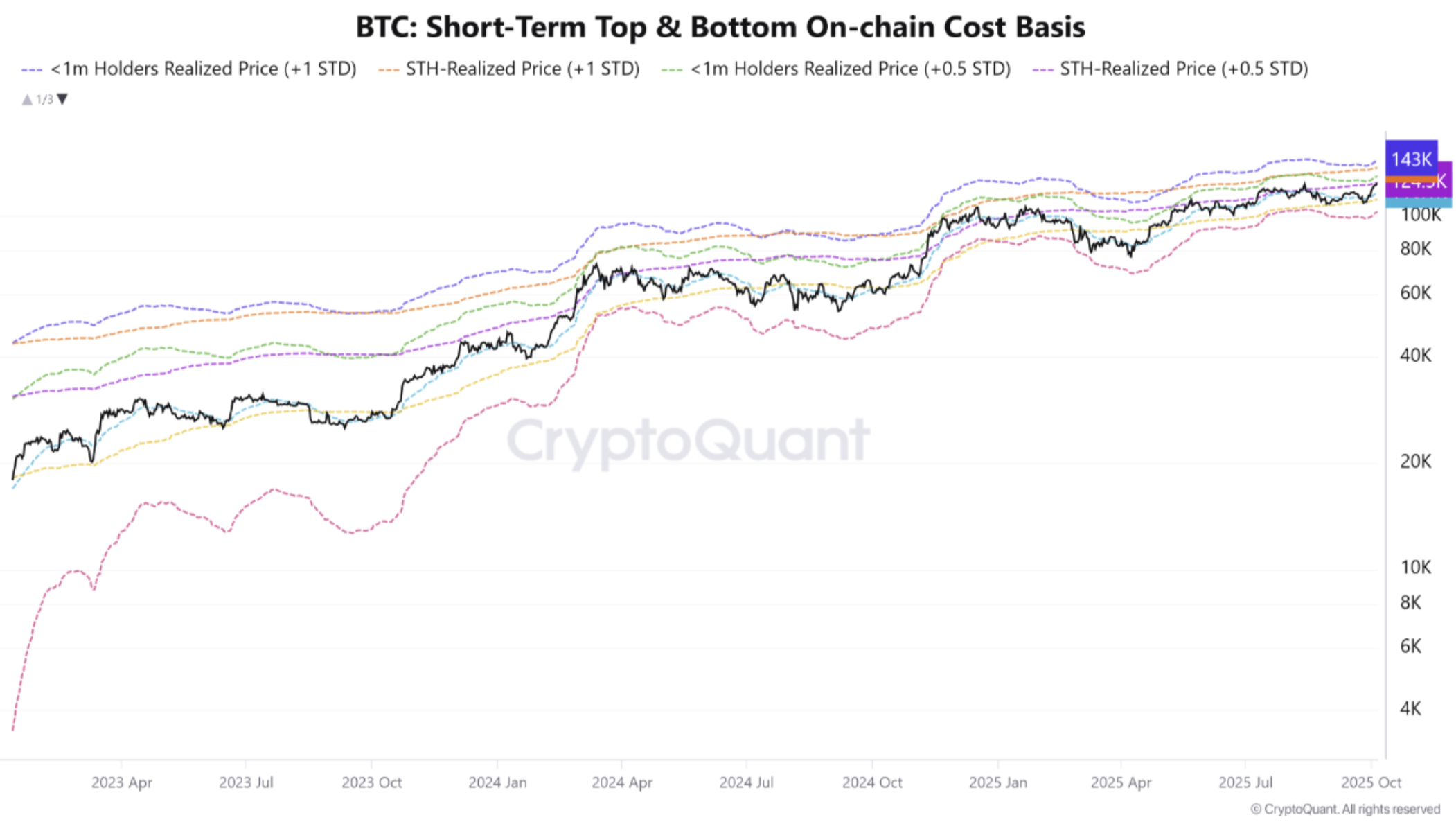

Per a CryptoQuant Quicktake post by contributor Crazzyblockk, the cost basis (Realized Price) of BTC Short-Term Holders (STH) gives insight into vital support and resistance areas.

Related Reading

Importantly, the STH Realized Price indicates the cumulative price at which recent investors purchased their BTC. This data helps analysts identify potential price points that could sway investors to either take profits or maintain their holdings.

Crazzyblockk pointed out several price levels that may serve as potential profit-taking areas. For example, the <1 month Holders Realized Price, +1 Standard Deviation, is currently at $143,170.

In simpler terms, $143,170 is the level where recent buyers (those holding BTC for less than a month) would, on average, be around one standard deviation above their purchase price—a zone likely to trigger selling and act as a short-term resistance.

Likewise, the <1 month Holders Realized Price, 0.5 Standard Deviation, now rests at $133,239. Additionally, the STH-Realized Price, +1 Standard Deviation, is currently at $131,310.

The analyst remarked that the current BTC spot price trades slightly above the “pivotal mid-point” level, which could shape the market’s next short-term direction.

Furthermore, the CryptoQuant contributor identified several key support levels that could act as re-accumulation zones for BTC investors, including $117,763, $111,963, and $103,239.

Another crypto analyst, Titan of Crypto, mentioned that although BTC has achieved a new ATH surpassing $125,000, it now needs to break above the ascending channel and target $130,000. A failure to do so may result in a price correction for the cryptocurrency.

What Are the Potential BTC Targets?

While some analysts worry that BTC might be nearing its peak for this market cycle, others maintain a more positive outlook. For instance, experienced crypto analyst Ali Martinez forecasts that BTC could reach $140,000 based on pricing bands.

Related Reading

In a similar vein, crypto analyst Alex Adler Jr. predicted that BTC could rise as high as $160,000 if two key criteria are fulfilled. Additionally, shrinking BTC reserves on crypto exchanges may accelerate the digital asset’s upward trajectory.

Ultimately, if Bitcoin follows the path set during the 2021 market cycle, it might aim for at least $136,000, with an extended target of $147,000. As of now, BTC is trading at $122,113, reflecting a 2.2% decline in the last 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com