Summary

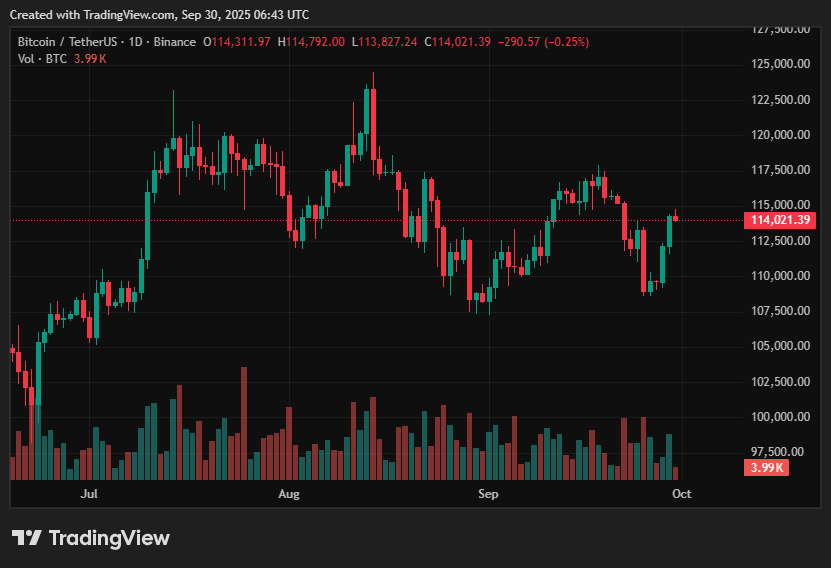

- Analysts observing Bitcoin price predictions note that BTC is currently trading in the low-to-mid $114k range following a rally at the end of September.

- Spot-ETF inflows have shown a mixed pattern: previous weekly withdrawals were substantial, but some US ETFs have experienced fresh daily inflows recently.

- Key short-term trading range identified: $108k-$116k; a breakout above this range may lead to prices between $118k-$120k (or potentially higher during an extended rally).

- A dip below $108k raises the chances of a decline to $105k or lower.

- Fundamental shifts in the market, including increased open interest in derivatives and the expansion of large institutional venues (such as IBIT), elevate both upward potential and the risk of increased volatility.

The focus on Bitcoin price predictions has intensified as the cryptocurrency has climbed back to the mid-$114k range after a challenging September. Recent market dynamics have shifted sentiment from a phase of consolidation to a more bullish outlook.

This shift is influenced by a mix of factors, including fluctuating spot-ETF flows that have alternately infused and drained liquidity, notable on-chain accumulation by key holders, and the development of derivatives positioning that can amplify price movements in either direction.

Crypto market experts are keeping a close watch to see if the late-September rally will foster a sustainable advance into Q4 or simply lead to more volatility.

Bitcoin price prediction: Current scenario

Currently, Bitcoin is trading in the low-to-mid $114k range, buoyed by a surge in volume and bids in late September; recent data indicates a price range between $114.4k and $114.6k.

Market players are navigating conflicting capital flows: some weekly data showed substantial withdrawals from pooled products earlier this month, yet intraday and product-level activities have exhibited inconsistency, with many US spot ETFs reporting new daily inflows.

Simultaneously, open interest in options and futures has significantly increased, and institutional venues like IBIT have rapidly expanded their footprint in derivatives markets, creating a structural shift that influences how liquidations and gamma squeezes may occur.

All of this occurs against the backdrop of typical technical levels: recent declines found support in the low-$109k range, and resistance is now coalescing in the $113k-$116k zone, where recent supply has concentrated.

Upside outlook

On the upside, a decisive break and sustained hold above the mid-$116k level would enhance the chart structure and potentially catalyze movement toward the $118k-$120k zone as leveraged short positions are liquidated and ETF demand drives net buying.

Numerous market analyses suggest that Q4 may be a critical timeframe for ongoing institutional allocation, which could significantly impact price ratings if flows remain positive; in such a scenario, several analysts project even more ambitious year-end price targets, reflecting a cautious bullish stance for BTC.

Moreover, considerable on-chain accumulation by long-term holders and institutional whales, coupled with diminishing exchange balances in recent data, bolster the case for notable price movements if buyer sentiment remains positive.

Downside risks

The bearish scenario for Bitcoin (BTC) is clear: failing to maintain the low-$108k support level could likely introduce fresh selling pressure at the mid-$100k mark, setting $105k as a reasonable near-term target during deeper declines. Potential near-term risks include occasional ETF outflows, miner or exchange sales, disputes over network updates, and macroeconomic surprises (such as central bank announcements or unforeseen risk-off events) that could abruptly shift sentiment.

Historical seasonality has generally been unfavorable in September, combined with the risk of rapid liquidations occurring when derivative positions cluster near critical levels, indicating that heightened intraday volatility could be anticipated even if the overall Bitcoin outlook remains positive.

Bitcoin price prediction based on current levels

Based on the current market structure and capital flows, the key near-term price range to monitor lies between $108k and $116k. If Bitcoin can maintain its position above this upper threshold, the likelihood of a continuation toward the $118k-$120k zone increases, with a more extended bull scenario potentially pushing prices into the mid-$120ks or higher as institutional participation ramps up.

Conversely, a clear breakdown below $108k would elevate the chances of a decline toward $105k and may reopen lower price targets if macroeconomic conditions worsen. Overall, the prevailing evidence suggests a cautiously optimistic outlook, contingent on ongoing ETF absorption and the avoidance of significant disorderly selling, while traders should brace for heightened volatility as market conditions evolve.

This creates an expectation of near-term fluctuations while still fostering a broader bullish outlook for higher price targets should supportive flows continue.

Disclosure: This article is for informational purposes only and does not constitute investment advice. All content and materials provided on this page are intended for educational use only.