Quant’s native token, QNT, has positioned itself as one of today’s leading altcoins, with its price rising 6% amidst broader market challenges.

This increase has reignited bullish sentiment, as on-chain data suggests further potential for gains in upcoming sessions.

Sponsored

Sponsored

Quant Token Surges With Increasing Trader Confidence

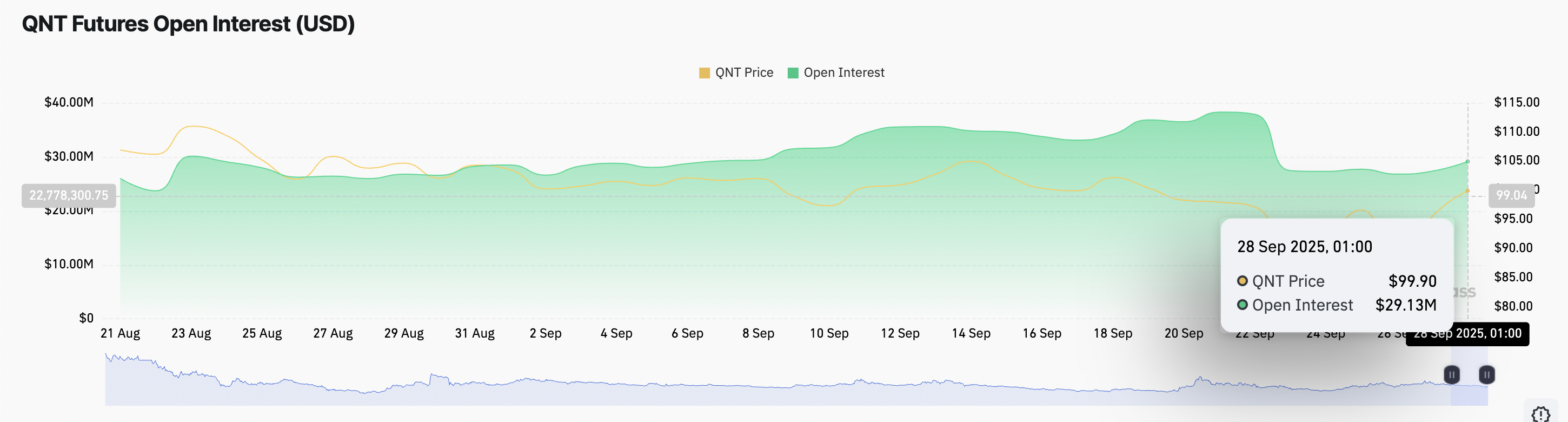

QNT’s daily gains have been paralleled by a rise in its futures open interest, indicating that traders are more inclined to establish new positions rather than close existing ones. Currently, this figure is $29.13 million, reflecting a 7% increase over the last 24 hours, according to Coinglass.

Interested in more token insights? Subscribe to Editor Harsh Notariya’s Daily Crypto Newsletter here.

Open interest represents the total number of unsettled futures contracts. It acts as a critical indicator of market activity and trader engagement; when it increases alongside price, it signifies new investments entering the market, bolstering the trend.

For QNT, this trend reflects rising confidence among traders that the current bullish trajectory is set to continue.

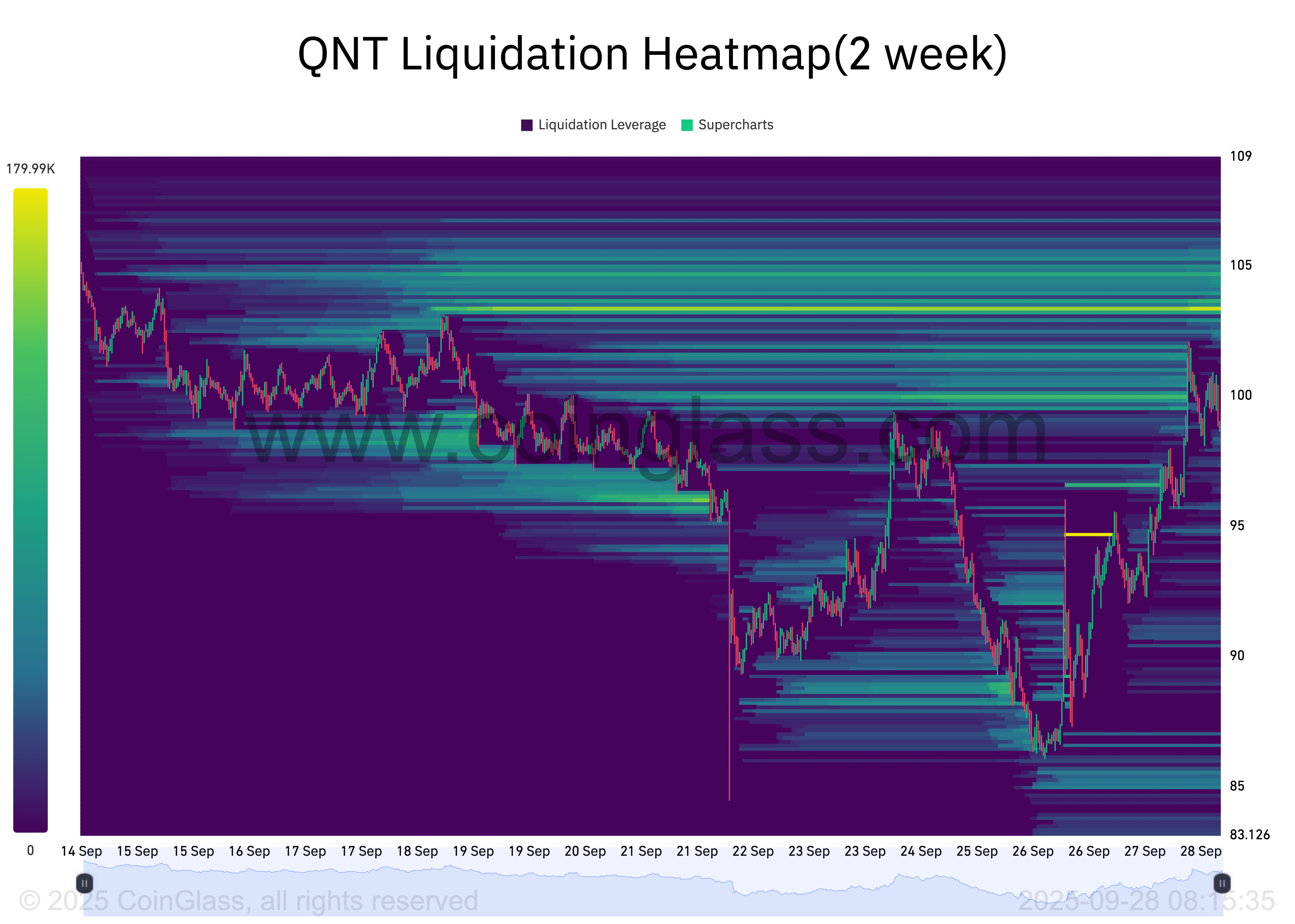

Moreover, QNT’s liquidation heatmap reveals a significant concentration of liquidity above current levels, hovering around $103.

Sponsored

Sponsored

Liquidation heatmaps are tools that enable traders to pinpoint price levels where substantial leveraged positions may be liquidated, showcasing areas of high liquidity often color-coded by intensity, with brighter zones indicating larger liquidation potential.

These zones are frequently described as “price magnets,” attracting both spot and derivatives activity as traders strive to capitalize on potential squeezes. This suggests that QNT could maintain its upward trajectory toward the liquidity cluster, assuming the market momentum persists.

QNT’s Uptrend Accelerates

On the daily chart, the Chaikin Money Flow (CMF) indicator for QNT is trending upwards, supporting the case for a lasting rally. As of now, this momentum indicator is at 0.02.

The CMF evaluates the flow of capital in and out of an asset through price and volume analysis. An increasing CMF indicates rising buy-side pressure, reinforcing the argument for ongoing bullish trends in QNT.

If demand stays robust, it could lead to a breakthrough of the resistance at $101.87, moving toward $107.68.

However, if momentum falters, QNT’s price may be susceptible to profit-taking, particularly if broader market weakness intensifies. In such a case, it might reverse course and decline to $85.37.