Recent reports indicate that XRP is nearing $2.78 as the markets approach the year’s end, with under 100 days remaining until 2026. The token experienced a decline of over 10% in the past week, following a stronger performance earlier this year.

Related Reading

Traders and analysts are monitoring a combination of on-chain signals and community discussions to gauge whether XRP can achieve higher price levels before the new year.

Community Predicted Targets

Social media has emerged as a dominant platform for price predictions. One long-term Bitcoin investor, known as Pumpius, who has been active since 2013, set a target of $25 for XRP before 2026, which would signify over ninefold increases from current prices.

#XRP to $25 before 2026 https://t.co/7GMFJ9psR9

— Pumpius (@pumpius) September 24, 2025

Other predictions have varied: Alex Cobb has suggested a $22 target by December, while some anticipate $10, and a few believe $5 could be a more attainable short-term goal.

A number of commenters even proposed targets exceeding $30, linking those expectations to anticipated ETF inflows. Opinions within the thread ranged from enthusiastic support to practical advice, such as focusing on smaller targets like breaking $4 first.

ETF Interest And Market Flows

Reports suggest that excitement around potential XRP ETFs is a key factor behind optimistic forecasts. Executives, including the CEO of Canary Capital, have indicated that these ETFs could facilitate billions in fresh inflows.

This perspective has reinvigorated bullish sentiments and fueled speculation about double-digit price ranges. However, market behavior has been inconsistent: XRP saw strong performance in January and again in July, but lost momentum thereafter, leaving traders cautious as they weigh ETF hopes against subsequent price dips.

Trading Behavior And On-Chain Signals

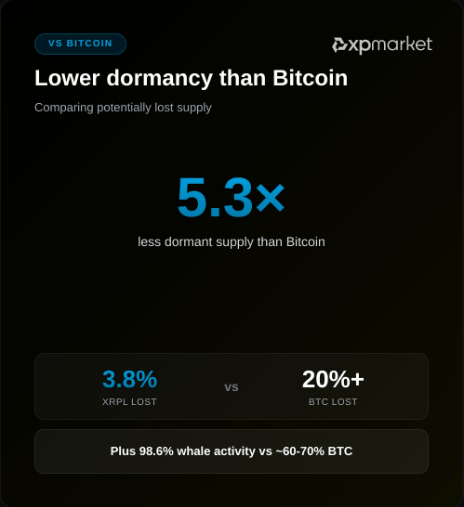

Recent chain data shows that XRP has a lower dormancy rate compared to Bitcoin and Ethereum. This suggests that XRP units exchange hands more frequently, typically indicating active use—such as payments, transfers, and liquidity trades.

Reports note that Bitcoin’s elevated dormancy is aligned with a stronger perception as a “store of value,” while Ethereum’s dormancy is linked to development and DeFi activity.

XRP’s frequent circulation aligns with Ripple’s long-term goal of establishing the token as a bridge asset for payments, rather than merely a coin held for investment purposes.

Related Reading

Dormancy Signals And Implications

If the trend of increased transactional use persists, it could strengthen XRP’s position as a utility-focused asset. However, higher circulation volume alone does not guarantee an increase in price.

Accumulation trends are also significant: assets that are hoarded often create scarcity narratives that support higher valuations.

Analysts and investors will likely oversee whether increased on-chain activity is accompanied by fresh buying pressure, particularly from institutional sources, before revising their long-term outlooks.

Featured image from Unsplash, chart from TradingView