As Bitcoin (BTC) remains confined within the $110,000 to $115,000 range, data from cryptocurrency exchanges presents a mixed outlook on the premier digital currency. While traders on Binance are demonstrating a bullish perspective, those on various other platforms express some reluctance.

Bullish Sentiment Among Binance Traders

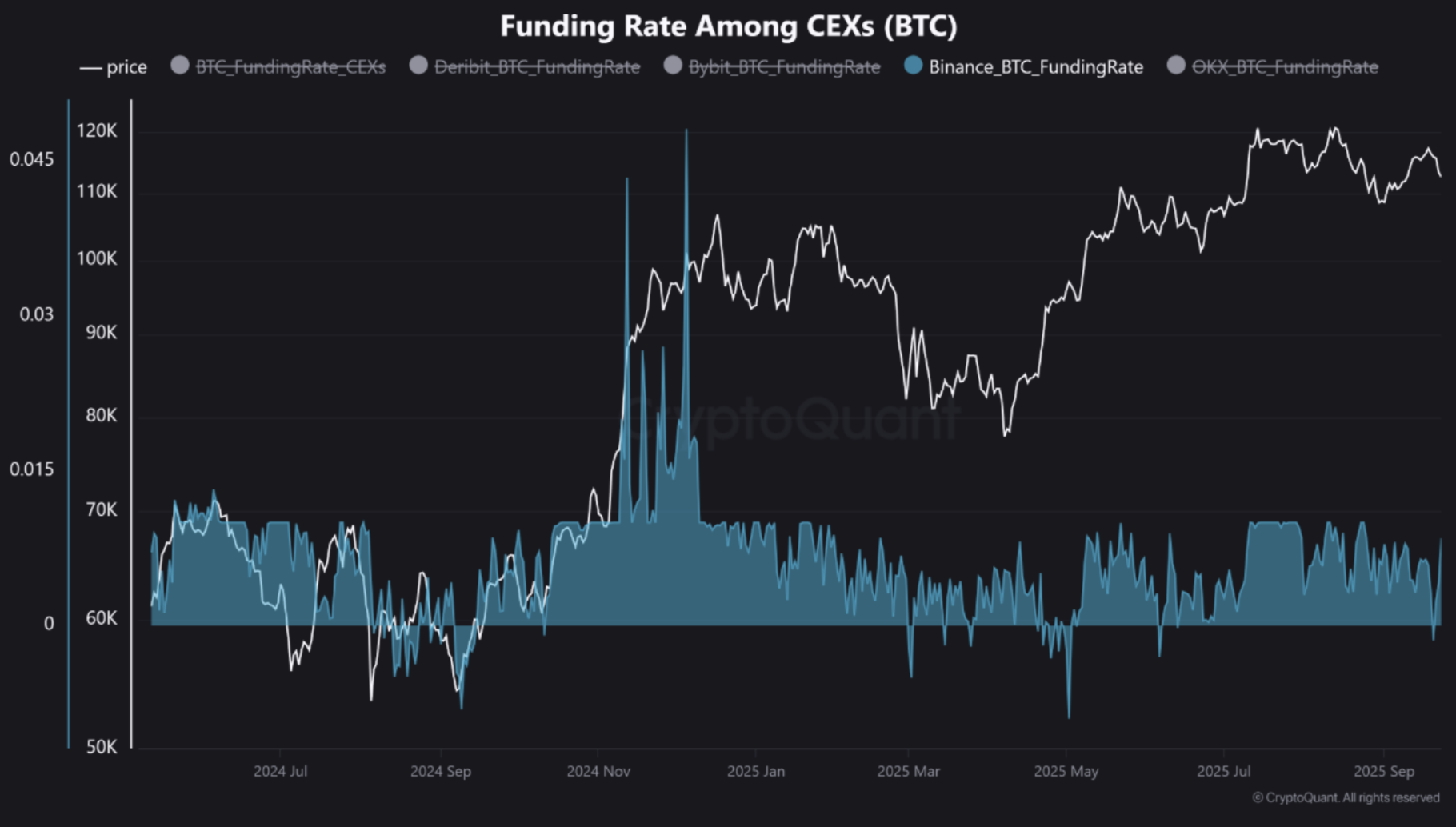

A post from CryptoQuant by contributor Crazzyblockk reveals that fresh derivatives data from Binance indicates changing market trends. Specifically, the recent BTC funding rate on Binance suggests that traders are adopting a bullish outlook.

Related Reading

In contrast, the BTC funding rate on other platforms such as OKX, Bybit, and Deribit shows that traders on these exchanges remain hesitant to make any directional investments.

As of September 23, the BTC perpetual funding rate on Binance rose to +0.0084%, indicating that long positions prevail and traders are prepared to pay a premium to uphold their bullish positions.

Notably, this increased funding rate is not a standalone occurrence; it reflects a positive shift over the past week, showcasing strengthening confidence among Binance traders.

In comparison, the BTC funding rate on OKX is currently at -0.0001%, while Bybit stands at 0.0015%. Deribit presents a funding rate of 0.0019%. As the analyst pointed out:

This represents not merely numerical differences, but contrasting narratives. While funding rates on OKX and Bybit have decreased over the past week, Binance’s rate has increased.

For those unfamiliar, funding rates serve as a real-time indicator of trader sentiment in the perpetual swaps market. A robust positive rate, like that seen on Binance, which diverges from the wider market, signals aggressive bullish speculation.

Is BTC Poised for a Breakout?

In another CryptoQuant piece, contributor XWIN Research Japan observed that Bitcoin’s implied volatility has reached its lowest point since 2023. Historically, this type of market lull has preceded explosive rallies, evidenced by a 325% surge that took BTC from $29,000 to $124,000.

Related Reading

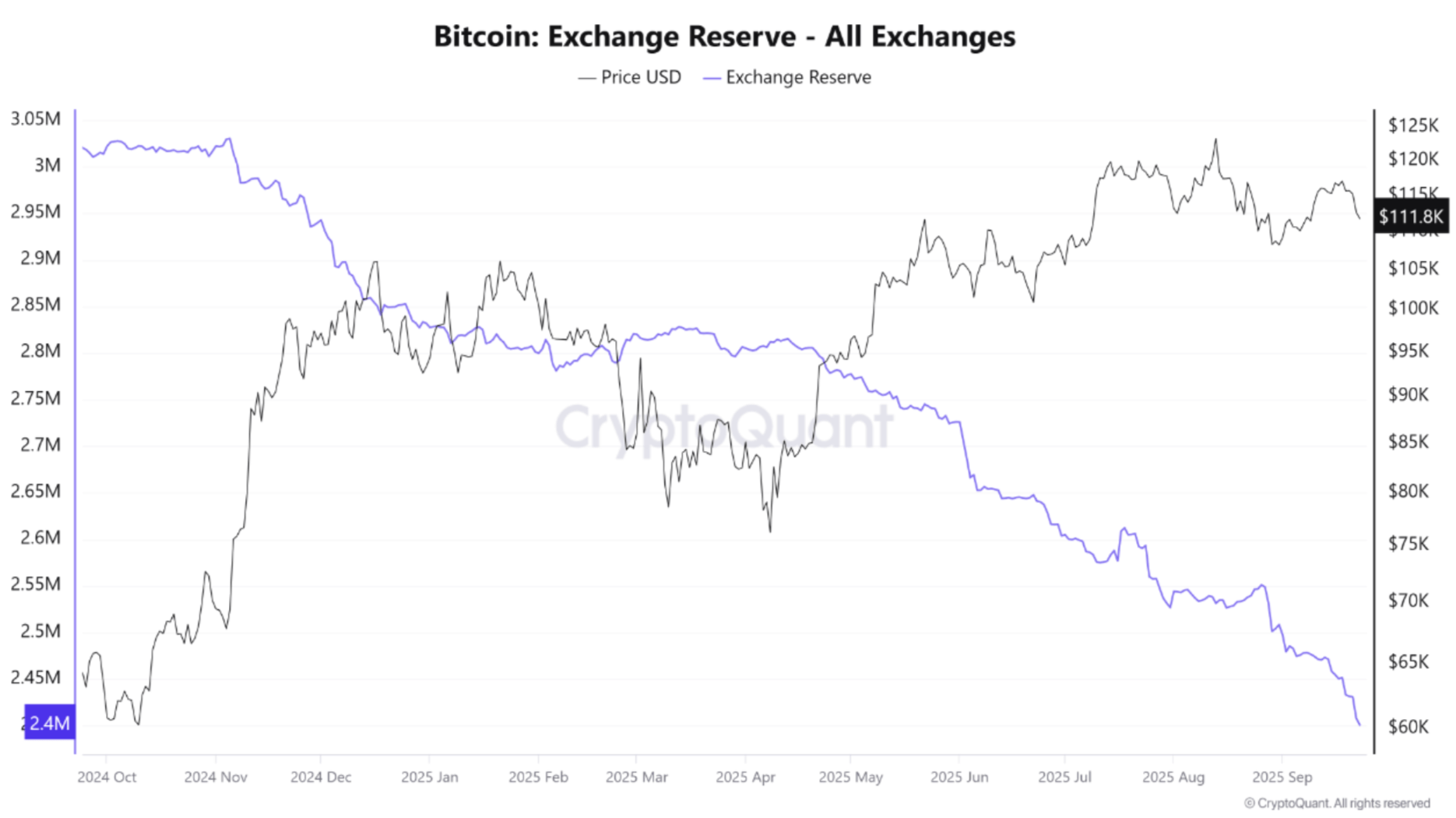

The analyst further noted that Bitcoin exchange reserves are rapidly depleting, reaching new multi-year lows. This trend has typically heralded supply squeezes, leading to a significant uptick in demand.

Despite this, the general sentiment towards BTC seems to be tepid at the moment. The Bitcoin Fear & Greed Index indicates that investors are apprehensive about entering the market, potentially creating a prime opportunity to acquire BTC at current prices.

Conversely, recent data from BTC wallets reveals that new wallets, those created within the last month, are beginning to acquire the leading digital asset. As of now, BTC is trading at $113,796, reflecting a 1% increase in the last 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com