Sure! Here’s a rewritten version of your content while keeping the HTML tags intact:

The price of Bitcoin is nearing a significant resistance level at $118,000, coinciding with the point of control within the present trading range. A decisive break past this threshold could set off a series of short liquidations, potentially driving the price to unprecedented highs.

Summary

- $118K Resistance: Crucial point of control in the current trading range.

- Short Squeeze Risk: Liquidations concentrated between $118K and $119K.

- Bullish Setup: A breakout could push prices towards new all-time highs.

Bitcoin (BTC) continues to maintain a robust bullish trajectory, with recent momentum fueled by a bounce from the 0.618 Fibonacci retracement level. This bounce has successfully reclaimed the value area low, setting the stage toward the $118,000 resistance level.

The Federal Reserve’s initial rate cut of the year has sparked renewed optimism in risk assets, further bolstering Bitcoin’s potential upside. With growing derivative positions at this mark, a successful reclaim could lead to increased volatility and trigger a short-squeeze scenario.

Key Technical Indicators for Bitcoin Price

- $118,000 Resistance: Critical point of control since the testing of $100,000.

- Fibonacci Support: The bounce initiated from the 0.618 retracement confirms a bullish structure.

- Liquidation Cluster: Short liquidations layering between $118,000 and $119,000 heighten the chance of a cascade.

The recent rally from the 0.618 Fibonacci level underscores Bitcoin’s inherent strength. This retracement aligned with the reclaimed value area low, creating a technical basis for further upward movement. The price is currently testing the critical point of control at $118,000, which has attracted concentrated trading volume and interest.

From a structural standpoint, reclaiming the POC is vital for continuation. If bulls manage to close above this level, Bitcoin would re-enter a zone saturated with short positions, potentially providing the fuel needed for a rapid price acceleration.

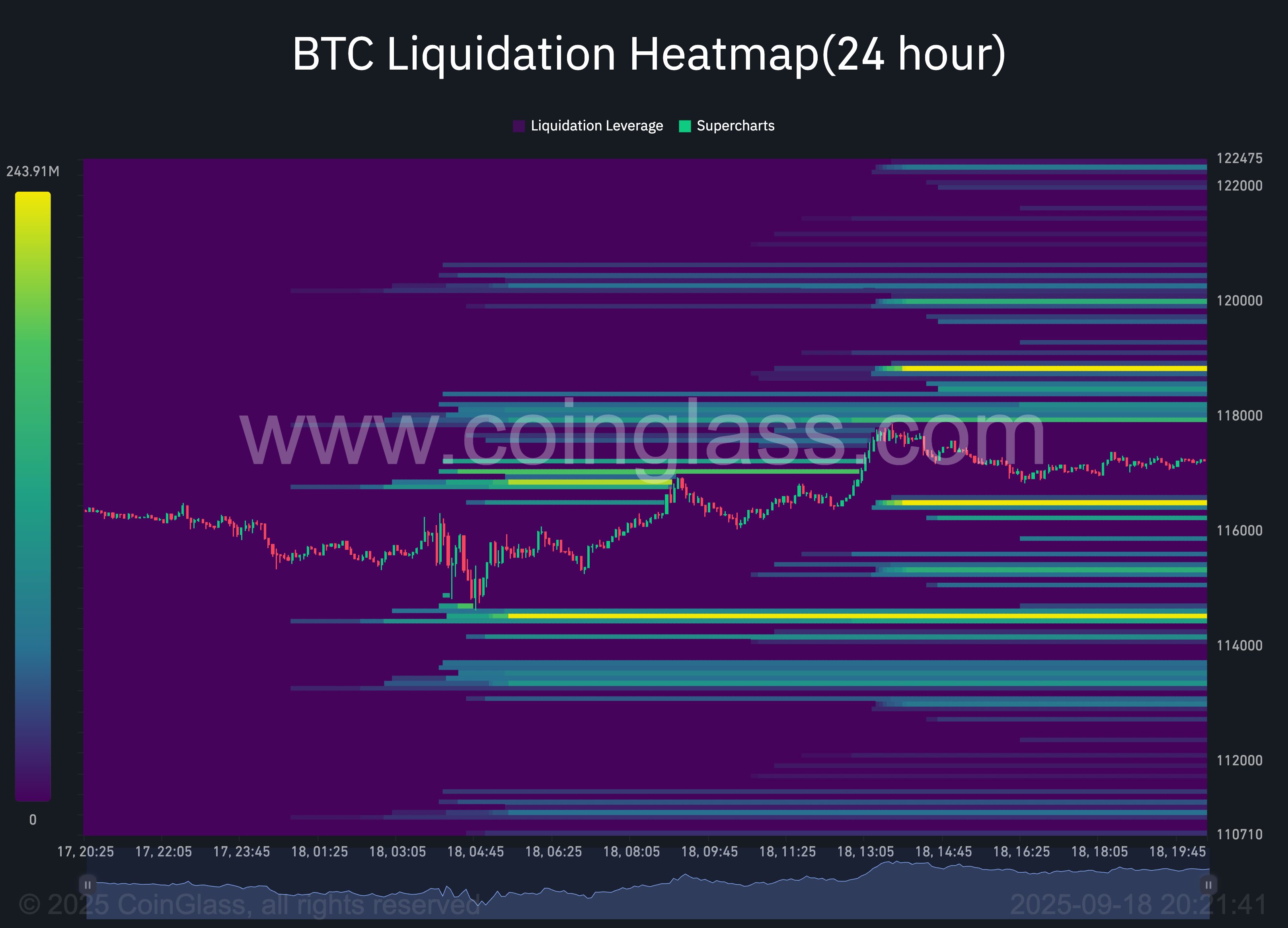

The derivatives markets further emphasize the importance of the $118,000 threshold. Liquidation heatmaps reveal a dense concentration of short liquidations starting at $118,000 and extending to $119,000. As more positions accumulate, the likelihood of a cascading liquidation increases should this resistance be surpassed.

A short squeeze in this area could drive Bitcoin beyond the current trading range, possibly reaching new all-time highs. These liquidation-driven surges often occur swiftly, as forced covering adds momentum to the ongoing bullish trend. Indicators of sell pressure also suggest the potential for a rapid accumulation phase as the price climbs higher.

Anticipating Future Price Movements

Bitcoin is set for a pivotal move as it nears the $118,000 mark. Remaining below this level may extend consolidation, but a confirmed breakout and closure above it would likely set off a liquidation cascade, accelerating the price into uncharted territory.