El Salvador has restructured its Bitcoin treasury, shifting from a single wallet system to a more diversified approach.

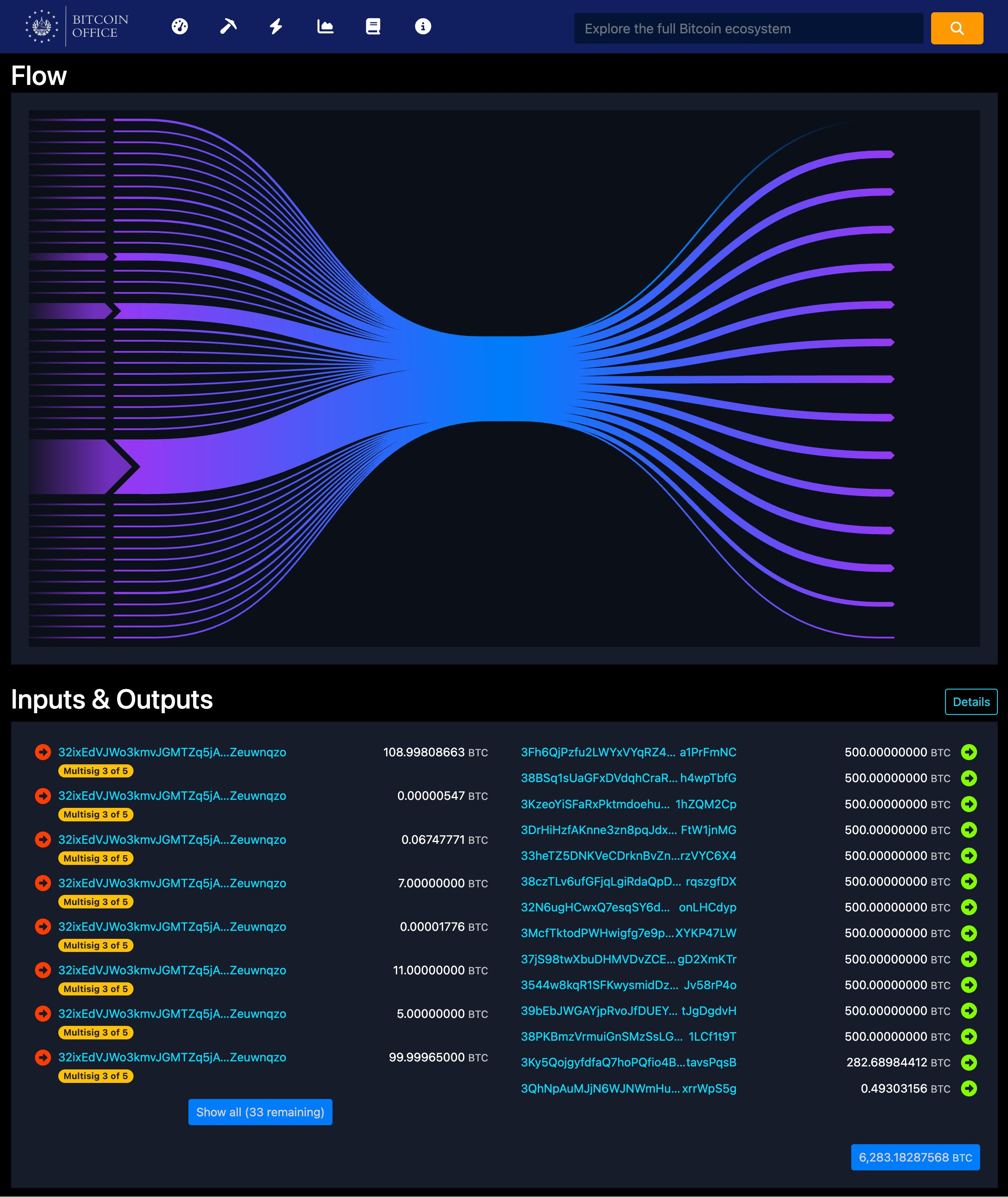

On August 30, the National Bitcoin Office announced it would distribute reserves across multiple addresses, with each address holding no more than 500 BTC.

Reasons Behind El Salvador’s Shift in Bitcoin Treasury Reserve Model

The Salvadoran government stated that this redistribution aligns with global best practices for managing digital assets. It also noted that the change addresses long-term concerns regarding quantum computing.

The government mentioned that quantum computers could potentially break the cryptography securing Bitcoin keys, raising significant questions about the long-term safety of digital wallets.

Previously, El Salvador used a single, continuously utilized address, which made its public key consistently visible, effectively giving potential attackers unlimited time to attempt a breach.

The new strategy mitigates this risk by dispersing holdings across multiple unused addresses, while still maintaining public accountability by publishing the address list.

According to the Bitcoin Office, distributing funds decreases exposure by limiting the amount held in each wallet. It also ensures that unused public keys remain undisclosed on the blockchain until transactions occur.

“Limiting funds in each address reduces exposure to quantum threats because an unused Bitcoin address with hashed public keys remains secure. Once funds are spent, the public keys are exposed and at risk. By distributing funds into smaller amounts, the potential impact of a quantum attack is lessened,” the government asserted.

Stacy Herbert, head of the National Bitcoin Office, described the change as both precautionary and strategic.

“El Salvador was the first to create a Strategic Bitcoin Reserve, and we are leading the way in establishing best practices for this era of true sovereignty and freedom money,” she stated.

Additionally, this decision has received positive feedback from industry experts.

Nick Neuman, co-founder of Bitcoin custody firm CasaHODL, described it as a commendable example of how large holders can preemptively address future risks.

“It’s great to see significant public BTC holders taking proactive measures against future quantum threats. El Salvador continues to serve as a good example of how nations should approach Bitcoin treasuries,” Neuman commented.

This development follows a recent assertion from the International Monetary Fund (IMF) that El Salvador has not significantly increased its Bitcoin reserves, indicating that most activity has involved internal transfers rather than new acquisitions.

Nevertheless, the Central American nation has continued to announce further Bitcoin purchases, raising its total holdings to 6,284 BTC (valued at over $681 million). As of the latest report, Mononaut, the anonymous founder of Mempool, indicated that these funds have been distributed across 14 new addresses.

Importantly, President Nayib Bukele recently suggested that the total could near $1 billion by the end of the year.