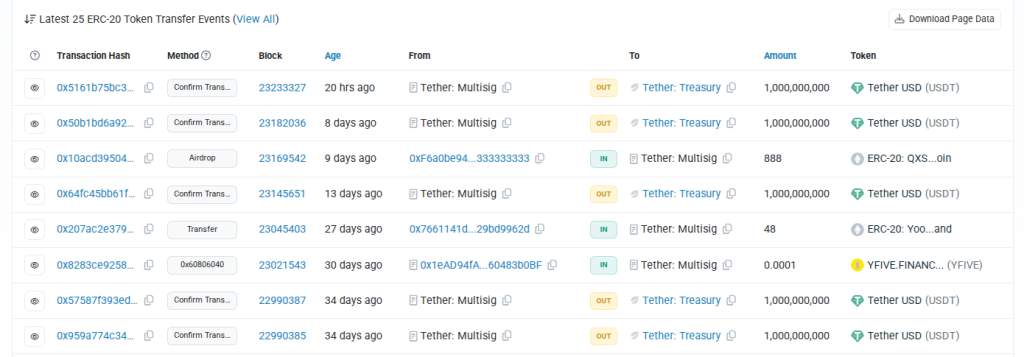

Tether issued 1 billion in USDT on Wednesday, a development that analysts believe has introduced new liquidity into an already optimistic crypto market.

Related Reading

Reports indicate that the total crypto market cap rebounded from a low of approximately $3.80 trillion to about $3.90 trillion that same day, with Bitcoin trading near $112,300 and Ether regaining levels close to $4,600.

This minting is significant as it typically symbolizes liquid funds that can be swiftly deployed to exchanges and trading desks.

Tether Minting Promotes Liquidity Movement

New USDT issuances are commonly used to facilitate purchases, and the latest billion-dollar issuance was flagged by on-chain trackers as a potential source of increased buying capacity.

According to Santiment and other tracking services, the number of addresses holding at least 1,000 BTC rose by 13 to approximately 2,085 since early August. Meanwhile, wallets holding at least 10,000 ETH saw an increase of 48, totaling roughly 1,271.

On August 26, US spot ether ETFs experienced about $450 million in net cash inflow, predominantly led by BlackRock’s ETHE, which accounted for approximately $320 million that day.

This brought total inflows into spot ether ETFs close to $13.30 billion, while US spot Bitcoin ETFs saw approximately $88 million, with BlackRock’s IBIT contributing around $45 million.

The recently minted USDT could be utilized by traders and desks to invest in Ether and other altcoins, aligning with the observable shift from Bitcoin to alternative assets and ETF-related demand.

Whale Accumulation Grows

Not only large holders indicated demand; trading volumes and price actions revealed altcoins gaining momentum, but the flow of stablecoins fundamentally supported this trend.

An increase in stablecoin supply reduces barriers for large purchases, allowing money to move to exchanges and be executed more swiftly than waiting for bank transfers.

This operational nuance clarifies why a billion-dollar mint attracts attention, even amid rising headline prices.

The immediate impact of the mint was to provide traders with additional readily accessible cash. However, liquidity injections can have dual consequences: they may escalate prices if buyers are assertive, while concentrated purchases followed by profit-taking can induce sharp fluctuations.

Related Reading

Implications of Tether Minting for Markets

Market participants are closely monitoring liquidity, whale wallets, and ETF movements concurrently, as the combination influences whether there will be a lasting capital shift into altcoins or if gains will prove fleeting.

Tether’s issuance of 1 billion USDT stands as a definitive signal of enhanced purchasing power during Wednesday’s market recovery.

This supply, along with significant inflows into Ether ETFs and indications of whale accumulation, establishes a scenario where demand for altcoins can accelerate rapidly.

Featured image from Meta, chart from TradingView