Weekly Bitcoin Price Analysis

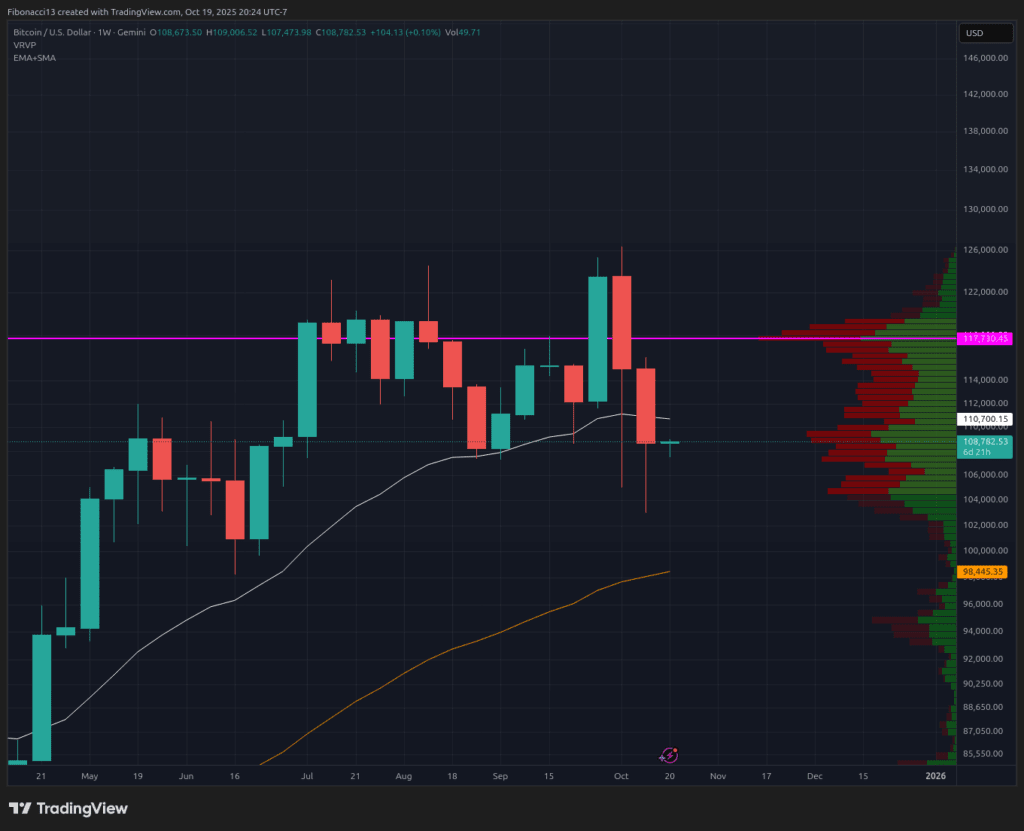

Last week, the bearish momentum intensified as bitcoin broke below the previous week’s low of approximately $105,000, touching around $103,000. Although we observed a bounce from the support area, it has proven less robust than what we saw last week. The bulls appear to be struggling, seemingly set to remain subdued for the immediate future. The closing price for the week settled at $108,717, considerably under the 21 EMA support level we hoped to maintain, reinforcing the prevailing bearish outlook.

Current Support and Resistance Levels

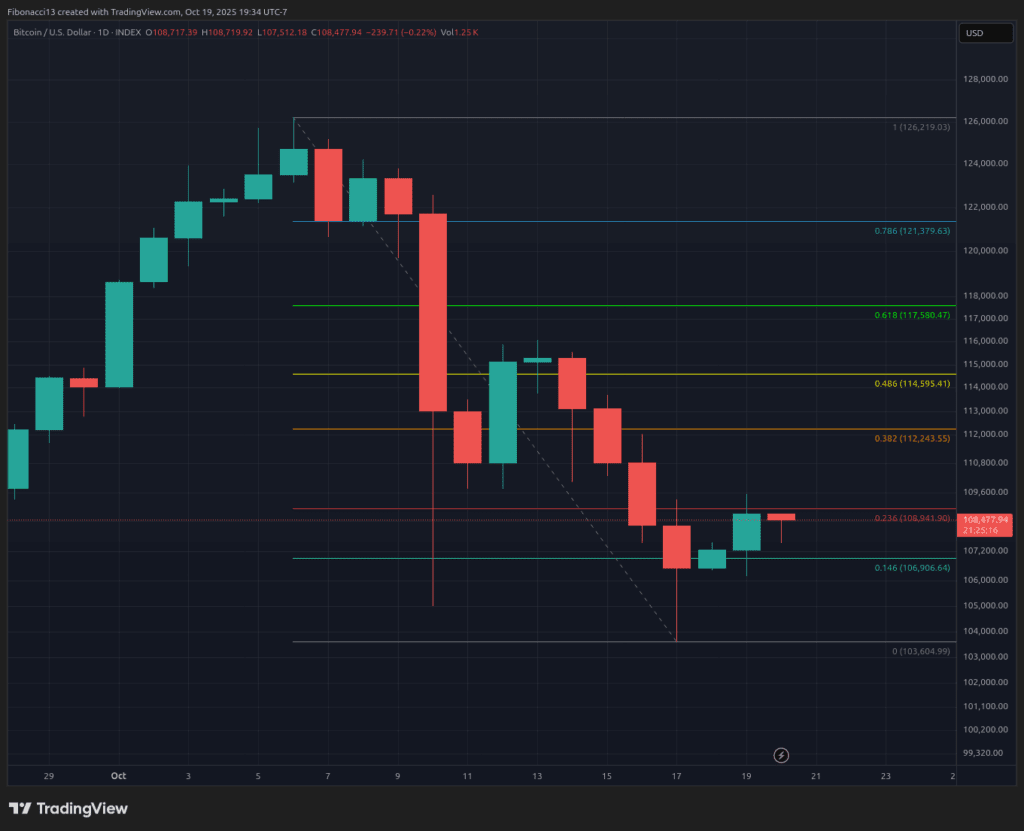

Resistance appears significantly robust at present, with critical levels identified at $112,200, $115,500, and $117,600, aligning with the 0.618 Fibonacci Retracement. Even if the price breaches these levels, a strong close above $122,000 is necessary to shift the bias back to a bullish trend and target higher valuations.

On the lower end, the $105,000 to $102,000 support zone has shown all the durability we could desire, so a return to these lows might lead to a breakdown. An even stronger support level rests around $96,000, with the 55 EMA positioned at $98,000. At this juncture, further downward movement is likely as we test these lower supports. Should we close below $96,000, it could signal a series of lower targets and effectively end the bull market.

Forecast for Coming Week

A familiar bounce is anticipated from Friday’s low into Sunday evening. Achieving a daily close above the immediate resistance level of $112,200 will be challenging, as the price may need to test it multiple times to have a chance at overcoming it. There exists minor support at the $106,900 level; should the price decline early this week, we will look for this level to provide some support for the bulls. However, sustained trading below this level could pave the way for prices under $100,000, heading down towards the $96,000 support.

Market Sentiment: Bearish – We have witnessed two significant red weekly candles consecutively, both with substantial selling volume. The bears are firmly in control and could be commencing a downward trend.

Looking Ahead

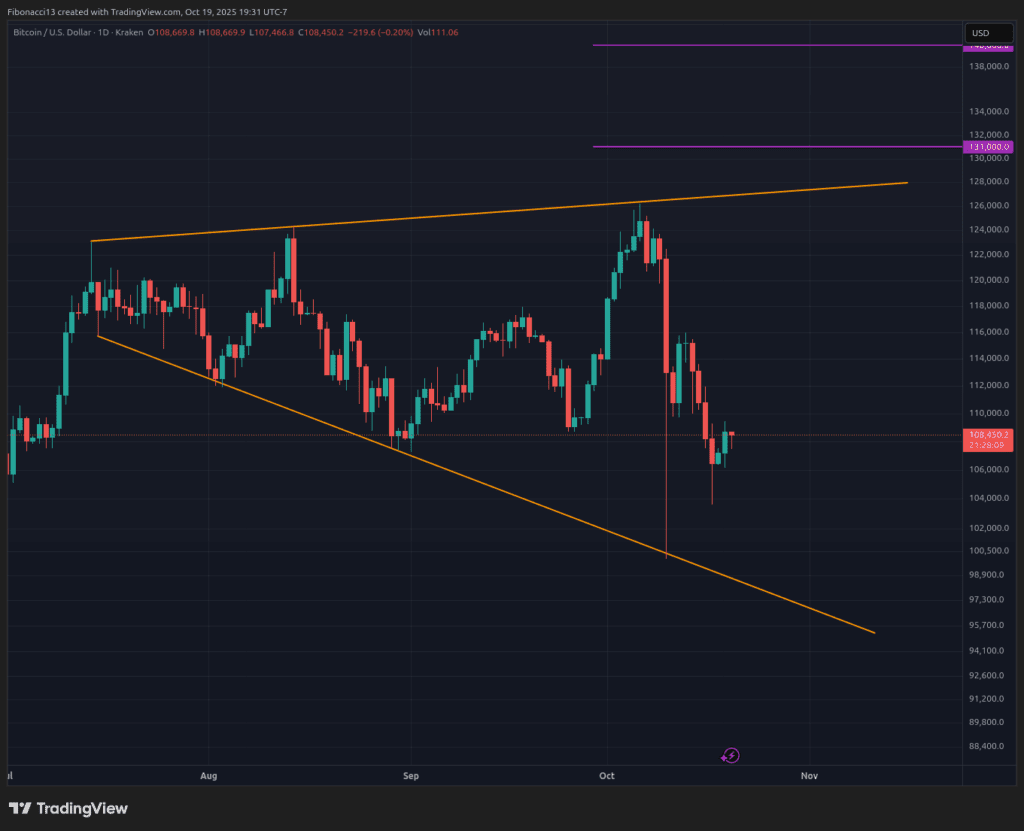

The one silver lining is that the broadening wedge pattern remains intact. There’s a possibility of a wick down to $96,000 followed by a reversal, still keeping within the range of the current pattern. We cannot definitively assert that the long-term peak has been reached until the price breaks below this broadening wedge structure. The bulls will require substantial assistance to regain momentum; anything less than a 50-basis point cut in the FOMC Meeting on October 29th is likely to lead to further declines in the weeks to come. Bitcoin bulls will be hoping for substantial rate cuts from Powell and the Federal Reserve to have a chance at reviving the long-term upward trend.

Glossary of Terms:

Bulls/Bullish: Refers to buyers or investors anticipating an increase in price.

Bears/Bearish: Indicates sellers or investors expecting a decline in price.

Support or Support Level: A price level at which the asset is expected to hold, at least temporarily. The more often support is tested, the weaker it becomes, increasing the likelihood of a breakdown.

Resistance or Resistance Level: The opposite of support. A price level likely to repel the asset’s price, at least initially. The more it is tested, the weaker it becomes, making a breakthrough more probable.

EMA: Exponential Moving Average, which gives greater weight to recent prices than to older prices, thereby reducing lag.

Fibonacci Retracements and Extensions: Ratios derived from the golden ratio, which applies to growth and decay cycles in nature, based on the constants Phi (1.618) and phi (0.618).

Broadening Wedge: A chart pattern characterized by an upper trend line serving as resistance and a lower trend line acting as support, expanding as volatility increases, leading to higher highs and lower lows.