XRP is currently in a slightly undervalued zone based on the 30-day MVRV Ratio. Here’s how it stands in comparison to other cryptocurrencies like Bitcoin and Ethereum.

XRP’s 30-Day MVRV Ratio Indicates Negative Returns

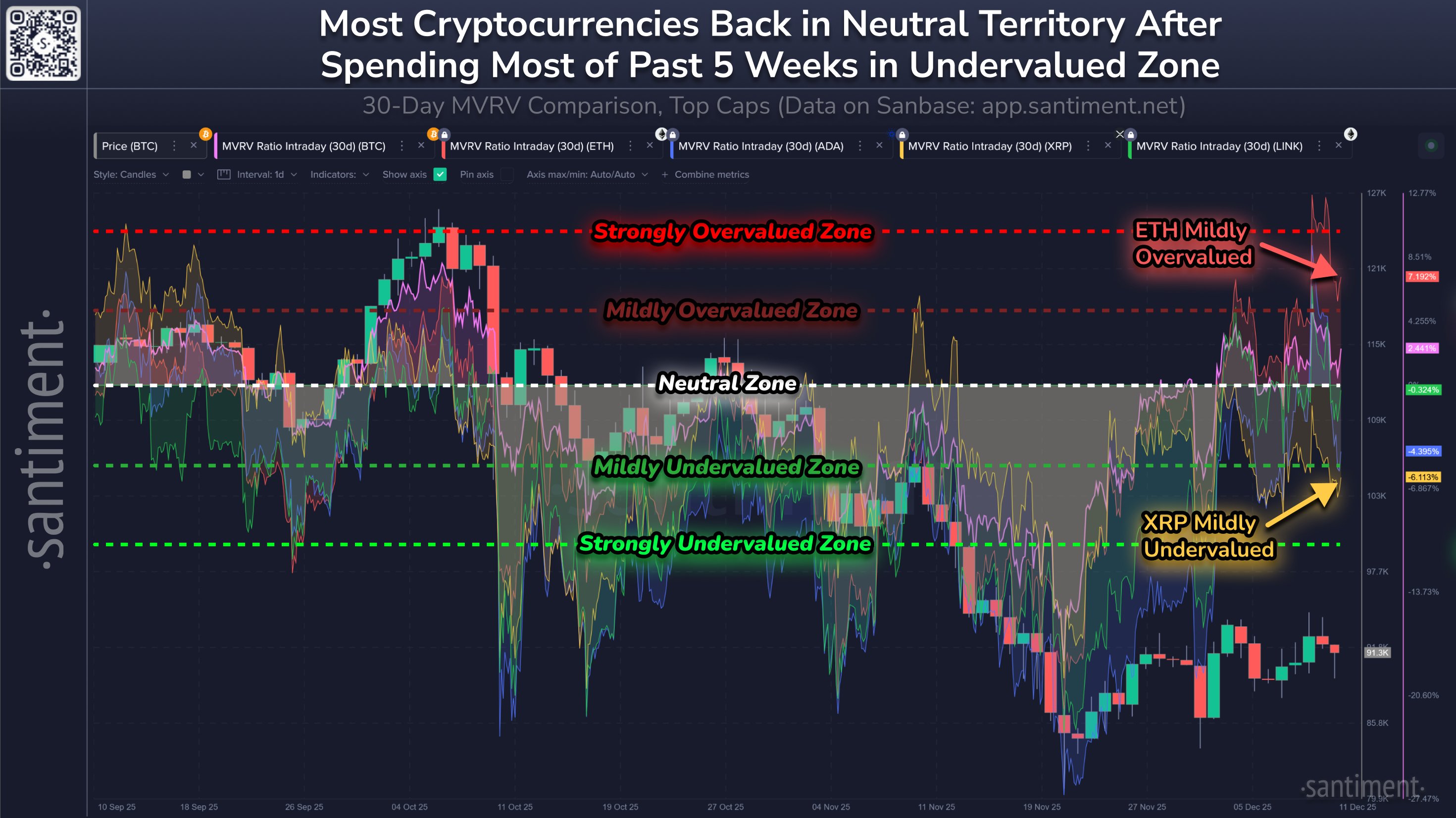

In a recent update on X, the on-chain analytics company Santiment discussed the current state of the 30-day Market Value to Realized Value (MVRV) Ratio for leading cryptocurrencies like Bitcoin and XRP.

Related Reading

The “MVRV Ratio” is a widely used indicator that measures the relationship between an asset’s market capitalization and its Realized Cap. The Realized Cap estimates the total value of a cryptocurrency by assuming that the value of each individual token is equivalent to the most recent spot price it was traded at on the blockchain.

The Realized Cap can be understood as an approximation of the capital that investors have collectively invested in their tokens. In contrast, market cap represents the current value of those holdings. By comparing these two metrics, the MVRV Ratio provides insight into the profit-loss dynamics of investors.

In this context, a specific variant of the MVRV Ratio is noteworthy: the 30-day version. This metric tracks the profit-loss balance exclusively for traders who entered the market in the last month.

Below is the chart shared by Santiment illustrating the trend in the 30-day MVRV Ratio for six cryptocurrencies: Bitcoin, Ethereum, Cardano, XRP, and Chainlink.

The graph above reveals that the 30-day MVRV Ratio has not exhibited consistent trends across leading cryptocurrencies, highlighting differing situations for recent buyers of these assets.

Currently, Ethereum’s 30-day MVRV Ratio is at a positive value of 7.2%, indicating that recent market entrants are enjoying gains of 7.2% on the network. Bitcoin also holds a positive value, but at a modest 2.4%, suggesting that 30-day traders are close to breaking even.

Chainlink mirrors a neutral trend with a 30-day MVRV Ratio of -0.3%. Meanwhile, Cardano’s recent traders are at a loss, with a more significant decrease of -4.4%.

Lastly, new investors in XRP are down 6.1%, indicating that this network currently experiences the least favorable profitability for traders. However, this situation may not necessarily be detrimental for the cryptocurrency.

Typically, as investor profits increase, the likelihood of selloffs for profit realization also rises. This can make a price peak more probable when the asset’s MVRV Ratio is elevated. Conversely, a strongly negative value might be bullish, as it suggests that profit-takers have likely diminished.

Related Reading

The analytics firm has categorized overvalued and undervalued zones in the chart based on the 30-day MVRV Ratio. Currently, XRP is the sole asset situated in an undervalued zone, while Ethereum is positioned within a mild overbought area.

XRP Pricing

As of now, XRP is trading around $2.04, reflecting a 1.5% increase in the last 24 hours.

Image credit: Dall-E, Santiment.net, chart sourced from TradingView.com