XRP has struggled to sustain its bullish momentum after reaching a peak of $3.13 earlier this week. As of now, XRP is trading around $3.00 and is testing its strength above this level after experiencing a dip along with Bitcoin. Technical analysis indicates that this price action is crucial for XRP’s short-term trend, with crypto analyst CasiTrades highlighting a key support level that may influence the bullish structure’s stability.

Related Reading

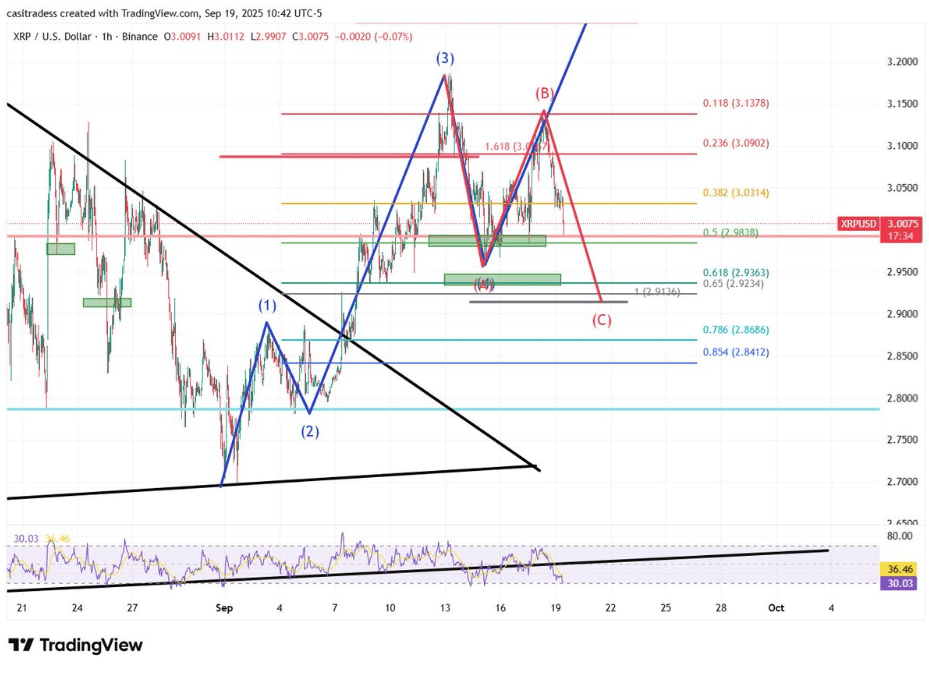

XRP Tests $2.98 Support Zone

On the social media platform X, analyst CasiTrades pointed out a critical support level that XRP needs to hold to maintain its bullish trajectory. According to CasiTrades, XRP’s immediate hurdle lies at the $2.98 support line.

The analyst’s technical insights reveal an unfolding Elliott Wave pattern transitioning into an ABC corrective structure. The analysis categorizes XRP’s price movement since early September into Elliott Waves, indicating that XRP is currently in Wave 4, which is a corrective wave structured as an ABC pattern.

While XRP is staying above $2.98, momentum indicators like the RSI on one-hour and four-hour charts reveal no bullish divergence, usually a sign for a potential reversal. This emphasizes the importance of the $2.98 level, as a drop below it may heighten the chance of further downward movement.

The analysis suggests the potential for corrective Wave C to extend beneath $2.98, targeting Fibonacci retracement levels in the low $2.90s. The projected C wave extension aims for the 0.618 Fib retracement, around $2.92 and $2.94.

Interestingly, the 15-minute chart indicates a short-term bullish divergence, providing a brief opportunity for relief bounces. However, without confirmation on higher timeframes, such movements are likely to be short-lived. The overall outlook, as presented by the analyst, still suggests a higher likelihood of another downward wave unless buyers decisively step in at $2.98 to restore confidence and uphold the broader bullish pattern.

Chart Image From X: CasiTrades

Implications If XRP Holds Above $2.98

If buyers can maintain levels above $2.98, XRP could enter a consolidation phase that establishes a base for a future upward rally. This consolidation period would provide XRP with the necessary space for a potential upward movement, marking the onset of an impulse Wave 5 in the Elliott Wave count. In this scenario, a clear advance past the $3.10 level becomes the initial hurdle, and overcoming it would signify the return of bullish momentum.

Should XRP successfully breach $3.10 with sufficient volume and follow-up, the next target indicated by the analyst is another resistance level at $3.25. Sustained bullish momentum beyond this point could propel the price toward the subsequent resistance at $3.44.

Related Reading

Currently, XRP is trading at $3.01, reflecting a 2.8% decline over a week. Maintaining the bullish wave structure and staying above $2.98 is crucial to prevent the corrective pattern from evolving into a more significant downtrend.

Featured image from Unsplash, chart from TradingView