Sure! Here’s the rewritten content, keeping the HTML tags intact:

XRP faces intensified selling pressure as recent data reveals that large holders are transferring significant amounts out of the market.

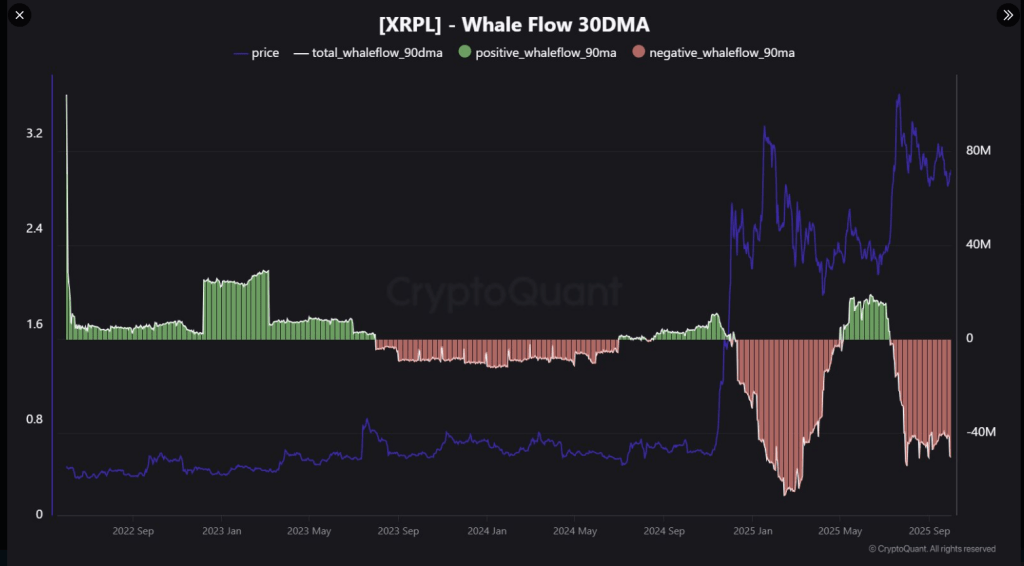

As per CryptoQuant analyst Maartunn, whales have been, on average, moving approximately $50 million away from their XRP holdings each day. This trend has aligned with a resurgence in price volatility and more pronounced fluctuations than observed in the recent past.

Price Decline Following Early October Surge

After surpassing $3.00 on October 3, XRP experienced a sharp decline. Reports indicate that the token dropped below $2.50 about a week later.

Since that downturn, the peak has been $2.83, while XRP is currently trading near $2.40 as of this report. The price movements have been varied across different periods—XRP is down roughly 20% over the past week yet remains positive on the 14-day chart.

JUST IN: $XRP whales are offloading

Whale Flow (30DMA): -$50M/day.

Sell pressure persists. pic.twitter.com/Hcnys9vCCV

— Maartunn (@JA_Maartun) October 10, 2025

Negative Whale Flows After Period of Accumulation

As indicated by on-chain data shared by Maartunn, the whale flow measured on a 30-day moving average shifted from positive to negative in the past year.

Throughout 2022 and early 2023, large transfers indicated accumulation, coinciding with relative price stability. From mid-2023 to the end of the third quarter of 2024, a distinct negative trend in whale flow emerged, which intensified after a subsequent influx.

Reports have shown that the most extreme negative reading occurred during a price surge in mid-January, when XRP peaked at $3.4 on January 16, 2025, prompting major holders to take profits.

Accumulation During Dips, Profit-Taking on Rallies

The on-chain landscape is not consistent. There was a short period of accumulation in April when XRP approached the $2 support level. This buying momentum continued into late June as the token climbed back above $2.

After that recovery, selling pressure re-emerged as holders sought to realize profits. The current 30DMA figure stands at a negative $50 million per day, indicating a persistent net outflow that signifies distribution among some major accounts.

If we close over $3.1150 by Sunday, it’ll be the most bullish $XRP weekly candle in history.

— Patrick L Riley (@Acquired_Savant) October 10, 2025

Market Reaction and Potential Outcomes

The implications for the price are uncertain. Ongoing heavy selling into thin order books could drive XRP further down toward nearby support levels around $2.20 to $2.50. Conversely, if buyers step in to absorb the outflows, XRP could trade sideways with notable intraday fluctuations.

According to reports, seasoned investor Patrick L. Riley noted a conditional bullish sentiment: a weekly close above $3.11 would result in a strong weekly candle and may draw in new demand. This scenario would necessitate significant buying to counterbalance the current selling pressure from large holders.

Featured image from Meta, chart from TradingView