Speculation surrounding World Liberty Financial’s WLFI token has surged ahead of its launch on September 1.

Futures contracts linked to WLFI now exhibit over $800 million in open interest, underscoring the extent of trader engagement before the token initiates spot trading.

WLFI Whale With 3x Leverage Records $1 Million Gain

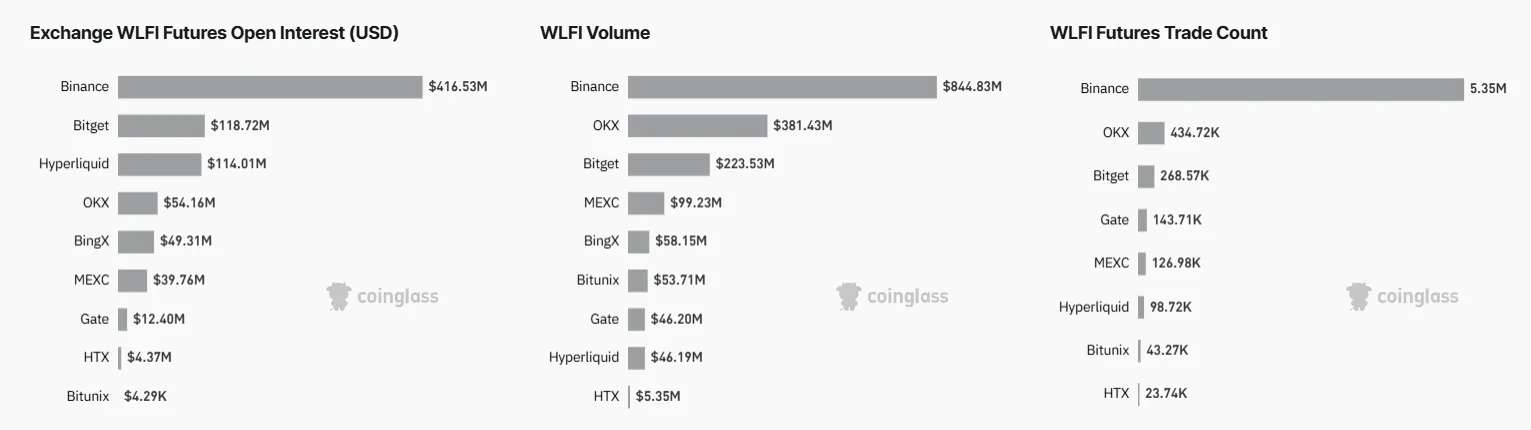

Data from CoinGlass reveals that WLFI open interest surged by 68% in the last 24 hours to reach $809.3 million, while trading volume soared 141% to $1.76 billion.

The data indicates that Binance represented more than half of both metrics, with additional trading activity observed on platforms like Hyperliquid and Bitget.

The rise in derivatives activity indicates that traders are positioning themselves for volatility around the launch. Open interest, a measure of active contracts yet to be settled, is closely monitored as a gauge of investor confidence in potential price movements.

Interestingly, blockchain analytics firm Onchain Lens reported that WLFI contracts available on the decentralized exchange Hyperliquid exhibited strong bullish momentum.

The firm noted that a leveraged whale account held over 8.6 million WLFI, valued at approximately $3.2 million.

Initially, this position displayed $644,000 in paper gains, but revised estimates from Hyperdash later adjusted this figure to nearly $1 million.

The trader operates with 3x leverage, significantly increasing potential returns while subjecting themselves to higher risk.

This strategy indicates a strong belief that WLFI’s value will rise once the token becomes available to the broader market.

Additionally, these sizable speculative positions help clarify why WLFI’s open interest has escalated to unprecedented levels in recent days.

Last week, the Donald Trump-associated DeFi venture confirmed that its WLFI token will be open for trading on September 1.

Following this announcement, major crypto trading platforms have been gearing up for the launch.

Earlier today, OKX revealed that it would convert its WLFI pre-market contracts into perpetual futures and has already begun accepting deposits for the token on its platform.

Disclaimer

In line with the Trust Project guidelines, BeInCrypto strives for unbiased, transparent reporting. This news article aims to provide accurate, timely information. Readers are encouraged to independently verify facts and consult a professional before making any decisions based on this content. Please be aware that our Terms and Conditions, Privacy Policy, and Disclaimers have been revised.