Uniswap achieved a milestone with over 915 million transactions in 2025 and a trading volume exceeding $1 trillion. This development reinforces its status as the leading figure in DeFi.

Nevertheless, amidst this unprecedented growth, the UNI token’s value remains stagnant. This prompts many investors to ask: why does a protocol that generates billions in annual revenue fail to provide worth to its token holders?

Network Strength and Record-Breaking Trading Volume

Sponsored

Uniswap (UNI) is undergoing an extraordinary year, with the number of transactions (swaps) on its platform reaching 915 million in 2025 alone.

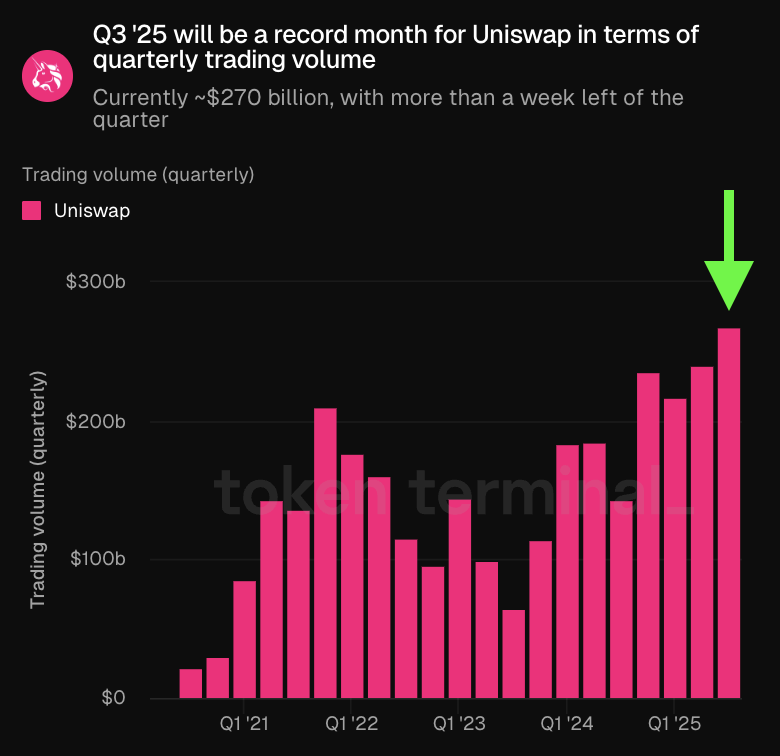

The third quarter of this year is on track to achieve the highest trading volume ever, with an estimated $270 billion in transactions, with more than a week left in the quarter.

The exchange’s total trading volume has surpassed the $1 trillion mark for the year, an impressive achievement for any DEX.

This growth highlights the evolution of the DeFi ecosystem and an increasingly defined regulatory landscape.

These elements allow protocols like Uniswap to operate securely and attract a greater user base.

Sponsored

Massive Revenue, Yet UNI Price Remains Sluggish

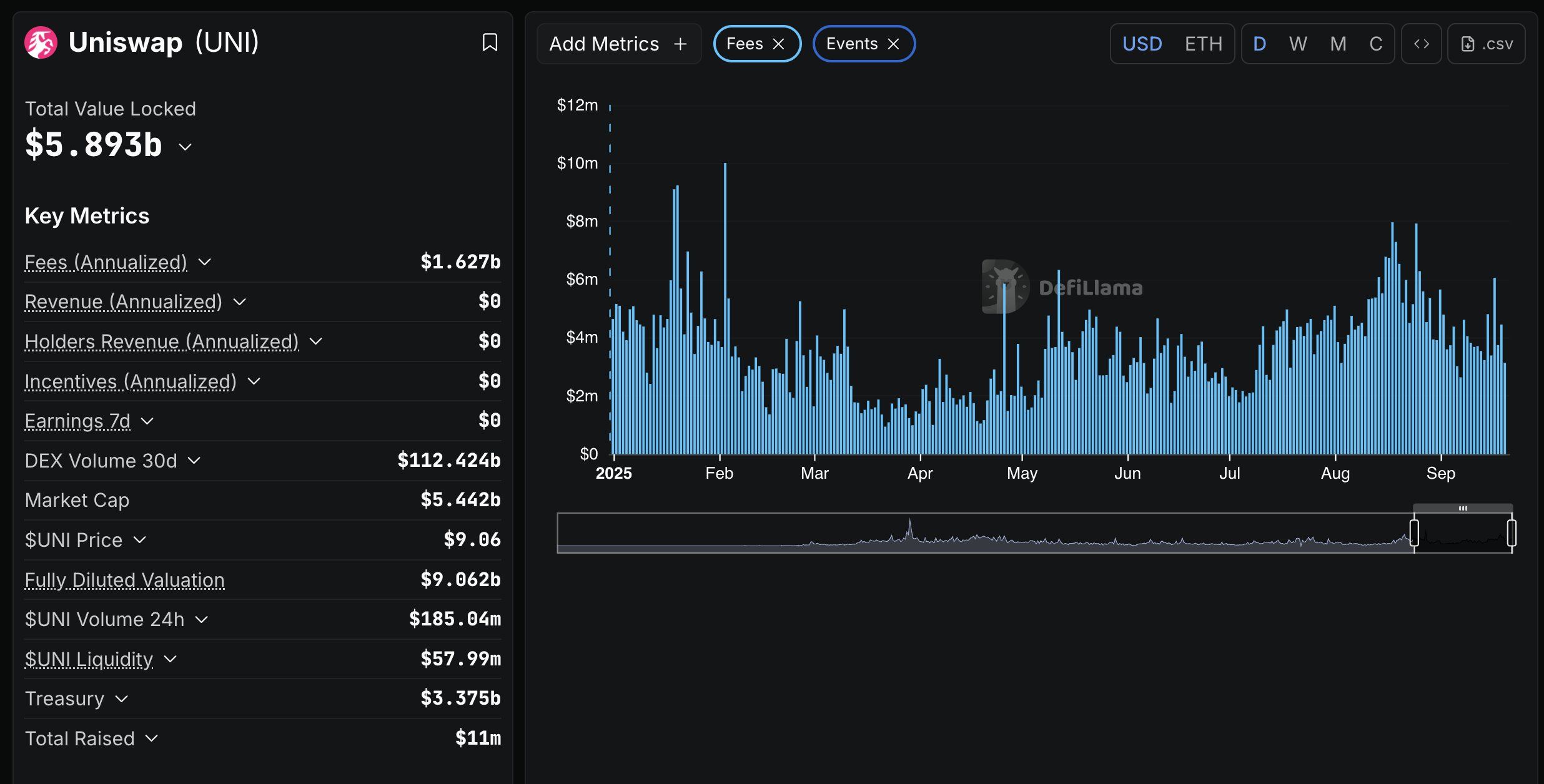

Uniswap Labs generates a robust $50 million annually, while total transaction fees for the protocol reach $1.65 billion yearly. In spite of this, this revenue has not translated into value for the UNI token.

The main issue is that Uniswap lacks mechanisms for buybacks or direct profit distribution to holders.

Currently valued at approximately $5.7 billion, many investors are questioning UNI’s purpose and true worth in today’s market.

Sponsored

Experts and community members observe that UNI is increasingly perceived as a “meaningless” token.

It fails to represent the platform’s substantial revenue and is hindered by unclear token distribution mechanisms and conflicts of interest between the core development team and investors.

“We’re not bear posting Uniswap. We’re bear posting $UNI. Just a complete nonsense token in today’s market & changing regulatory environment. Everything you and your VCs stand for is irrelevant. Turn on revenues & buybacks, or don’t bother having a token.” A user on X commented.

Echoing this, another X user noted that the token-holding mechanism does not incentivize value.

The altcoin lacks a link to the exchange’s business performance and suffers from unclear token unlocks. All these factors keep UNI’s value low despite the platform’s expansion.

Sponsored

This creates a noticeable disparity between the platform’s and token’s values, complicating the ability for investors to perceive the advantages of holding UNI.

Experts suggest three strategic paths for the UNI token to align with Uniswap’s real value.

Firstly, introduce high-quality assets on-chain to enhance liquidity and draw in users. Secondly, connect the token’s value to business performance, potentially through buybacks or redistributing a share of transaction fees to holders.

Finally, amend the token supply mechanism to ensure transparency and equilibrate the interests of developers and the community.

As of this writing, BeInCrypto data indicates UNI is trading at $8.09, down 82% from its all-time high in 2021.