CRO price has increased for the third consecutive day, soaring over 50% in the last 24 hours, bolstered by a recent CRO-centric treasury initiative, whale accumulation, and additional supportive factors.

Summary

- CRO price has risen more than 50% in the last 24 hours.

- Whale interest and derivatives market activity are fueling the ongoing rally.

- The total value locked in the Cronos ecosystem has increased significantly this week.

As reported by crypto.news, Cronos (CRO) surged 76% to a peak of $0.37 before stabilizing at $0.33 at the time of writing. The token has experienced a nearly parabolic rally over the past three days, accumulating almost 106% during that time, now trading about 350% higher than its year-to-date low.

Its market position also rose, momentarily becoming the 16th largest cryptocurrency by market capitalization earlier today before settling at the 21st position with a valuation of $11.2 billion.

The day’s gains for CRO were further supported by a notable rise in daily trading volume, which more than doubled to reach $2.29 billion from the previous day. Upbit was the leading exchange in volume, followed by Crypto.com and Coinbase.

The ascent of Cronos price in recent days can be attributed to several key developments, particularly the announcement of a $6.4 billion collaboration between Trump Media, Crypto.com, and Yorkville Acquisition Corp to establish a crypto treasury company focused on acquiring CRO.

This partnership entails over $1 billion in direct purchases of CRO and aims to integrate CRO into Trump Media’s platforms as both a payment method and a rewards system.

Another significant factor contributing to today’s price surge is the recent unveiling of the Cronos team’s roadmap for 2025–2026, which outlines strategies to scale its on-chain ecosystem and enhance user adoption.

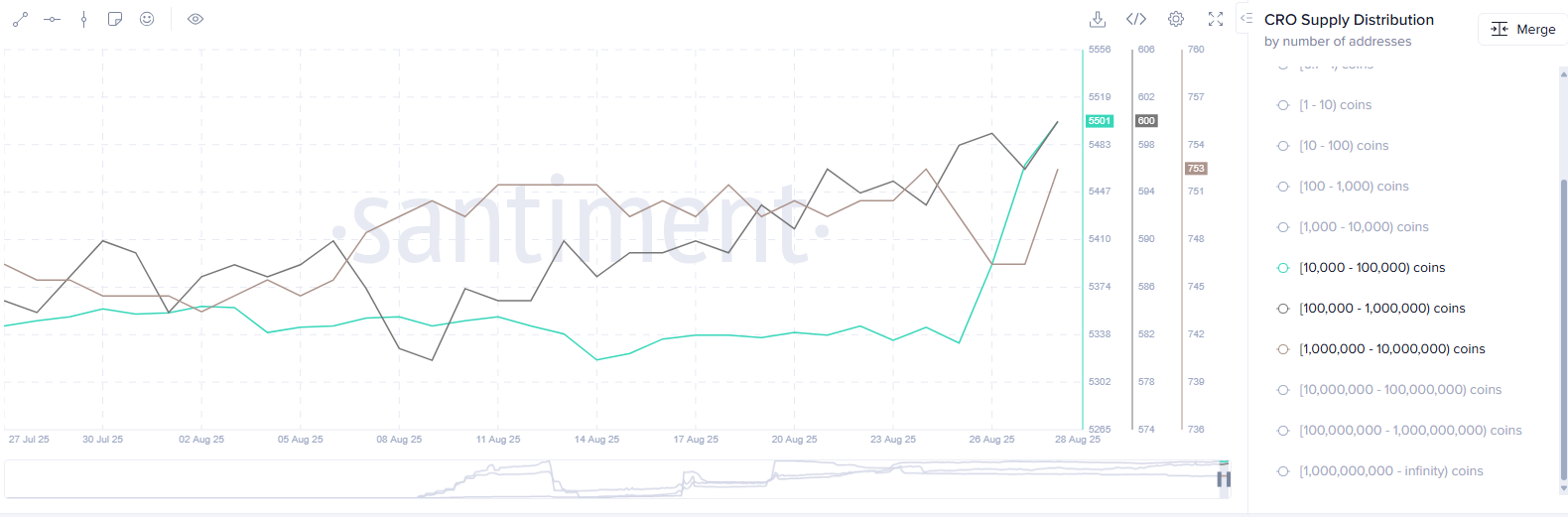

Additionally, whales have demonstrated considerable interest in CRO recently. According to Santiment data, the number of addresses holding between 10,000 to 10 million CRO tokens has increased over the last three days. Such whale accumulation typically triggers retail FOMO, leading investors to anticipate further price increases.

Derivatives data indicates that the rally is also being spurred by futures trading, with open interest reaching a record high of $181 million. The weighted funding rate has returned to positive territory, and the long/short ratio remains above 1, both of which suggest that bullish sentiment is dominant in the market.

On-chain metrics for Cronos also appear strong. Data from DeFiLlama shows that the total value locked in Cronos’s DeFi ecosystem has surged 27% over the past day, reaching $1.24 billion, while the total market cap of stablecoins on the network has risen by 9% over the past week to $183 million.

Furthermore, revenue generated by its DeFi applications skyrocketed from $63,800 last week to $225,000 this week, with over $100,000 recorded in the past 24 hours alone.

These cumulative metrics suggest an uptick in user activity and capital influx within the Cronos ecosystem, supporting today’s gains for CRO and indicating that the rally might continue in the upcoming days.

CRO price analysis

On the daily chart, CRO has displayed three successive large-bodied bullish candlesticks, indicating robust upward momentum.

At the time of writing, technical indicators continue to suggest a short-term continuation of this bullish trajectory. The Supertrend indicator has turned bullish, showing a green signal line below the current price, which is generally interpreted as a buy signal.

Moreover, the MACD line has crossed above the signal line, with expanding green histogram bars, reinforcing the bullish momentum.

Considering this setup, CRO bulls are likely to target the psychological resistance level at $0.40. An emphatic breakout above this level could pave the way for additional gains.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.