This week, Ethereum experienced renewed buying interest following news that a prominent Bitcoin whale significantly boosted its Ether holdings, a development that analysts believe may alter short-term market dynamics.

Related Reading

Significant Whale Activity in Ether

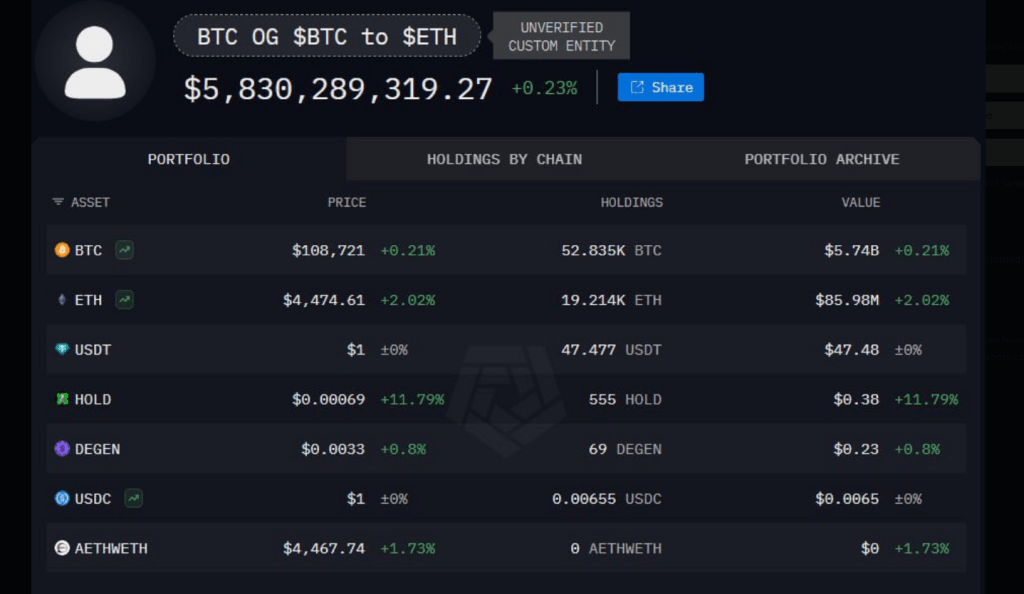

Reports indicate that one of the earliest and most influential Bitcoin whales acquired approximately 820,220 ETH within a two-week period, valued at around $3.6 billion at current rates.

The transactions were recorded across several wallets and have attracted attention due to the considerable transfer of capital into Ether over Bitcoin.

Market participants suggest that such concentrated buying activity can bolster market sentiment and attract other significant investors.

Ethereum’s recent trading activity reflects this shift. As of the latest update, ETH was trading at about $4,390, with a 24-hour trading volume reaching $39 billion and a market capitalization around $538 billion.

🐳 THIS OG BITCOIN WHALE HAS BOUGHT 820,224 ETH WORTH $3.6 BILLION IN JUST 2 WEEKS.

HE DEFINITELY KNOWS SOMETHING 👀 pic.twitter.com/iG9Su2BGZE

— Ash Crypto (@Ashcryptoreal) August 31, 2025

The token saw a 2% increase over the previous day. These figures highlight the sustained demand for Ether, even amid pullbacks in certain market sectors.

However, the derivatives market presents a more varied picture. Data shows derivatives volume dipped 14% to $61 billion, while open interest rose by 2.90% to $60 billion.

The OI Weighted metric experienced a slight drop of -0.0007%, reminding traders of a negligible decrease in positioning strength. Analysts observe that the market may be consolidating: fewer new trades are occurring, yet more positions remain intact.

Ether Price Outlook and Market Sentiment

Combining technical analysis with on-chain metrics, current projections suggest moderate upside potential. The latest forecast indicates that Ether is anticipated to rise by 11% and hit $4,870 by October 1, 2025.

Market sentiment is currently labeled as Bullish, while the Fear & Greed Index sits at 46 (Fear). Over the last month, ETH recorded 47% days in the green and a volatility measure of 9%. These indicators suggest a marketplace with room for upward movement, though uncertainty still exists.

Analysts caution that ETH’s recent outperformance against Bitcoin may face a brief pause for a retest around $4,000 as liquidity clusters are resolved and traders reassess their positions.

He points to trends in order-book activity that often signal a pullback prior to new upward trends — a pattern observed in previous rallies.

$ETH has been performing resiliently compared to BTC.

Nonetheless, a retest of $4K is still on the table.

A glance at sizable liquidity clusters explains why.

Just keep in mind: I’m only bearish in the short term. pic.twitter.com/D9XIrxr5zq

— Ted (@TedPillows) August 31, 2025

Related Reading

What to Watch for Among Traders

Investors and trading desks are focusing on three key factors: the flow of significant on-chain purchases, whether derivatives open interest continues to rise, and if prices remain above critical support near $4,000.

Whale accumulation reports have fueled discussions about increased institutional interest, but the decline in spot derivatives volume indicates some short-term traders are opting to step back.

Featured image from Meta, chart from TradingView