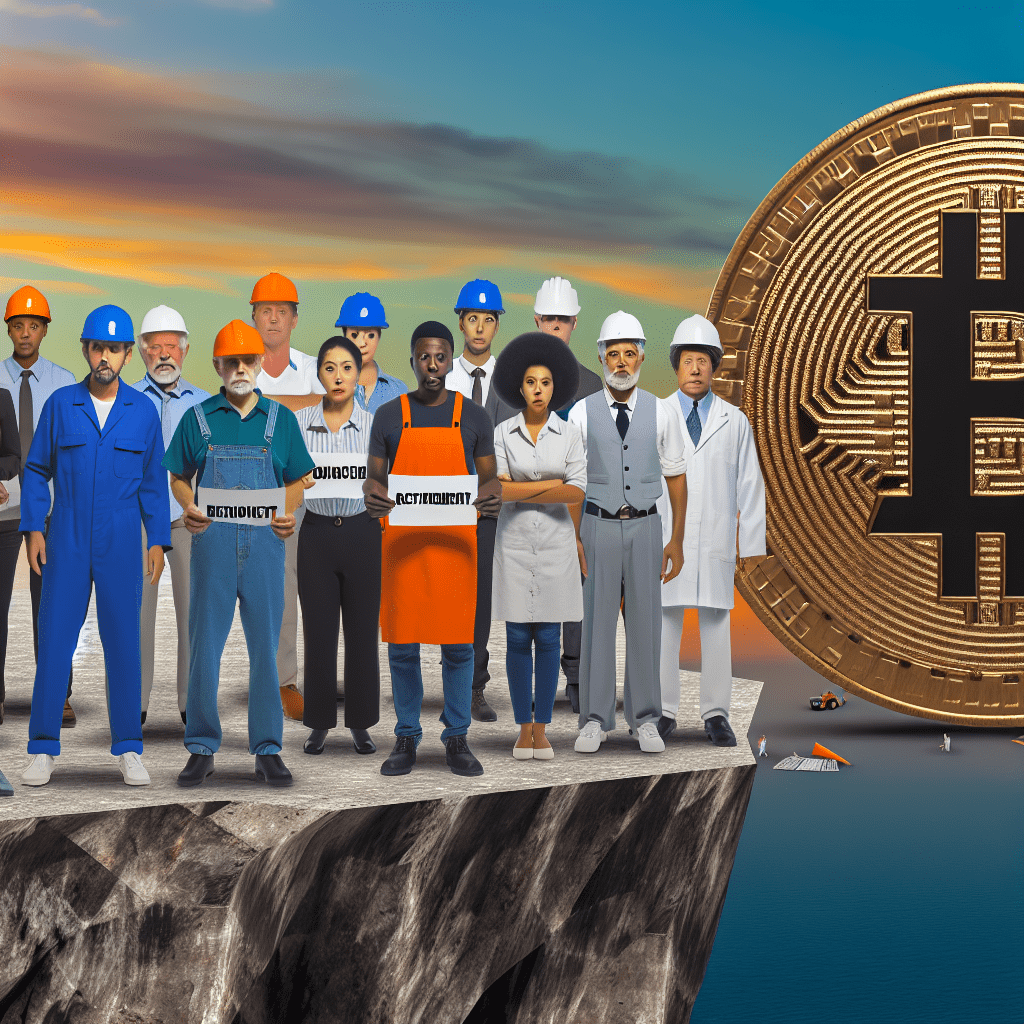

A widening divide has developed in Washington, D.C., between the cryptocurrency sector and labor unions as lawmakers discuss modifications to regulations permitting cryptocurrencies in 401(k) retirement accounts.

The contention revolves around proposed legislation concerning market structure that would permit retirement accounts to invest in crypto, a change that labor organizations argue could expose employees to high-risk speculation. In a letter sent to the US Senate Banking Committee on Wednesday, the American Federation of Teachers contended that cryptocurrencies are too unstable for pension and retirement savings, cautioning that employees could incur considerable losses.

The letter faced immediate backlash from crypto investors and industry advocates. “The American Federation of Teachers has somehow formulated the most logically inconsistent, least informed perspective possible on the issue of crypto market structure regulation,” a crypto investor stated on X.

In reaction to the letter, Castle Island Ventures partner Sean Judge remarked that the legislation would enhance oversight and mitigate systemic risk, while permitting pension funds to tap into an asset class that has demonstrated strong long-term performance.

Consensys attorney Bill Hughes asserted that the AFT’s opposition to the crypto market structure bill was politically driven, accusing the group of serving as a proxy for Democratic legislators.

Related: Atkins asserts SEC has ‘sufficient authority’ to advance crypto regulations in 2026

Opposition to crypto in retirement and pension funds increases

Supporters of incorporating crypto into retirement portfolios contend that it democratizes finance, whereas trade unions have staunchly opposed relaxing existing regulations, arguing that crypto poses excessive risks for conventional retirement plans.

“Unregulated, risky currencies and investments should not be where we place pensions and retirement savings. The wild, wild west is not what we need, whether it’s crypto, AI, or social media,” AFT president Randi Weingarten remarked on Thursday.

The AFT represents 1.8 million educators and professionals in the US and is among the largest teachers’ unions nationwide.

According to Better Markets, a nonpartisan advocacy group, cryptocurrencies are excessively volatile for traditional retirement portfolios, and their high variability can lead to time-horizon mismatches for pension investors aiming for a predictable, low-volatility retirement plan.

In October, the American Federation of Labor and Congress of Industrial Organizations (AFL-CIO) also reached out to Congress opposing elements within the crypto market structure regulatory bill.

The AFL-CIO, the largest trade union federation in the US, stated that cryptocurrencies are volatile and represent a systemic risk to pension funds and the wider financial ecosystem.

Magazine: 13 Christmas gifts that Bitcoin and crypto enthusiasts will love