By the third week of August, numerous altcoins faced a significant decline in exchange reserves. This trend indicates an increasing appetite for accumulation and off-exchange holding. The shift is particularly striking as the so-called altcoin season has become progressively selective.

Which tokens are benefiting from this surge in accumulation, and what factors are fueling investor confidence?

1. Ethena (ENA)

Data from Santiment reveals that Ethena (ENA) exchange reserves dropped from 1.3 billion to 1.15 billion during the third week of August. In other words, 150 million ENA exited centralized exchanges.

This coincided with ENA’s price soaring by 30% in August, rising from $0.51 to $0.65.

The decrease in reserves aligned with the Ethena Foundation’s announcement of a $260 million buyback initiative. This program allocates approximately $5 million per day to repurchase ENA from the market.

Tokenomist estimates that the buyback might absorb 3.48% of the circulating supply. This integration of sell pressure reinforces long-term investor confidence.

Furthermore, Ethena achieved significant milestones in August, with revenue exceeding $500 million and USDe supply reaching an all-time high of $11.7 billion.

Collectively, these factors drove ENA accumulation and declines in exchange reserves.

2. BIO Protocol (BIO)

BIO Protocol, a prominent project in the DeSci sector, posted remarkable performance in August with gains exceeding 265%.

Alongside the price surge, exchange reserves saw a steep decline. From early August to the present, reserves fell from 380 million to 294 million BIO — representing a decline of more than 22%.

Notably, the third week of August experienced the largest withdrawals, with investors taking out 42 million BIO in just one week, bringing exchange reserves to their lowest level this year.

Several factors elucidate this accumulation wave. BIO launched a staking program early in August that attracted over 25 million tokens. Additionally, Arthur Hayes invested $1 million into BIO this week, reigniting market interest.

Bio Protocol also introduced a new method to engage new investors. Users can promote the project on social media to earn BioXP, which grants access to the first BioAgent sales.

These elements combined increased visibility, drew in new investors, and accelerated accumulation.

3. API3

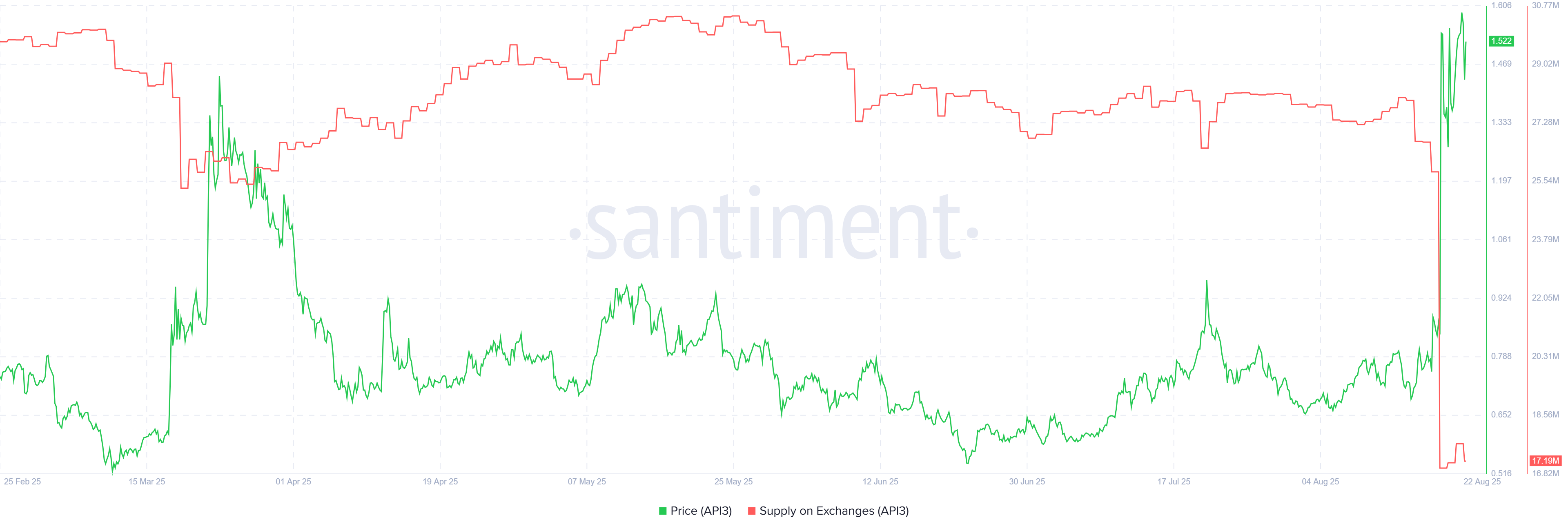

API3, an oracle-centered project, regained investor interest in August, which lifted its price by more than 130%. Concurrently, exchange reserves dropped to their lowest level this year.

The third week of August marked a pivotal moment as over 9 million API3 were withdrawn from exchanges, lowering exchange supply to just 17.19 million.

The catalyst behind this trend was Upbit’s listing of API3. According to the BeInCrypto report, the token’s price surged over 120% immediately after the listing.

Investor attention towards the Oracle sector increased, further boosted by Chainlink’s (LINK) rally. LINK’s strong performance over the past month positively influenced related projects. Data from Artemis showed that the Oracle sector was the market’s top performer in August.

The surge in API3 accumulation has stabilized its price above $1.50.

These three altcoins exemplify distinct drivers behind the selective altcoin rally in August. While a widespread altcoin season remains absent, projects with unique catalysts—be it buyback schemes, staking incentives, or exchange listings—are garnering heightened investor interest and capital.

The post Top 3 Altcoins Accumulated Off Exchanges in Mid-August appeared first on BeInCrypto.