The market for tokenized assets has quietly reached a new milestone, with assets under management (AUM) soaring to an all-time high.

This surge highlights how Ethereum’s infrastructure increasingly becomes the settlement layer of choice for stablecoins and institutional-grade tokenization.

Tokenization Reaches Historic Scale

Token Terminal reports that the AUM of tokenized assets is at an all-time high of approximately $270 billion.

The on-chain data platform highlights tokenized assets spanning a wide spectrum, ranging from currencies and commodities to treasuries, private credit, private equity, and venture capital.

Much of this growth is driven by institutions adopting blockchain rails for efficiency and accessibility, with Ethereum emerging as the dominant platform.

Ethereum hosts approximately 55% of all tokenized asset AUM, ascribed to its smart contract ecosystem and widely adopted token standards.

Tokens like USDT (Ethereum), USDC (Ethereum), and BlackRock’s BUIDL fund represent some of the largest pools of value, built on the ERC-20 framework.

Meanwhile, specialized standards such as ERC-3643 enable tokenization of real-world assets (RWA) like real estate and fine art.

With $270 billion already tokenized, continued momentum could see tokenized asset markets swell into the trillions as Ethereum cements its role as the backbone of tokenized finance.

Financial Giants Quietly Back Ethereum

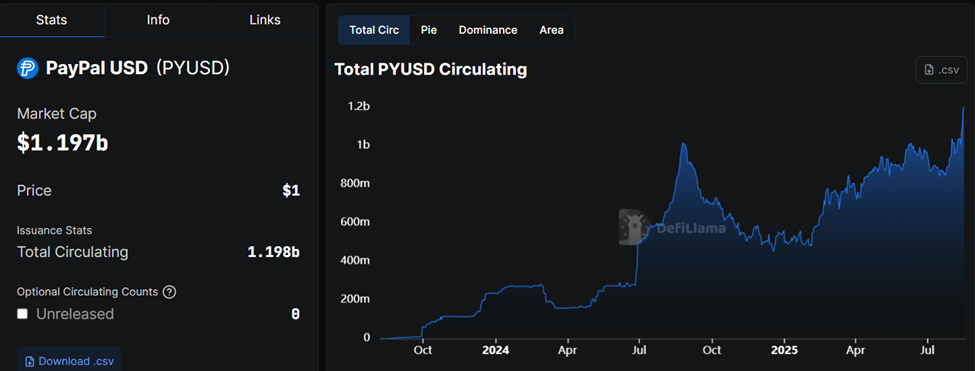

One of the most telling signs of this shift is the rise of PayPal’s PYUSD stablecoin, which has exceeded the $1 billion market in supply while entirely issued on Ethereum.

For institutions, PYUSD’s fast growth proves that Ethereum’s rails are liquid, secure, and trusted enough for a global fintech leader to scale on.

“PayPal’s PYUSD exceeding $1 billion supply cements Ethereum as the settlement layer for major finance. Stablecoin scale like this deepens liquidity and utility. Institutions are quietly standardizing on ETH,” one user observed in a post.

Beyond PayPal, traditional asset managers are also leaning into Ethereum. BlackRock’s tokenized money market fund, BUIDL, has been cited as a landmark case of institutional adoption. This demonstrates how traditional financial (TradFi) instruments can be issued and managed seamlessly on-chain.

Meanwhile, Ethereum’s dominance in tokenization comes down to its network effects and developer ecosystem. The ERC-20 standard has become the lingua franca for digital assets, ensuring compatibility across wallets, exchanges, and DeFi protocols.

Meanwhile, Ethereum’s security, liquidity, and scalability improvements through upgrades like Proof-of-Stake (PoS) and rollups enhance institutions’ confidence.

Ethereum’s flexibility allows it to serve retail and institutional needs. Stablecoins like USDT and USDC fuel global payments and DeFi liquidity. Meanwhile, tokenized treasuries and credit instruments appeal directly to institutional portfolios seeking yield and efficiency.

However, analysts urge caution for Ethereum traders, with the largest altcoin on market cap metrics facing the second-highest sell wave. Similarly, warning signs are flashing despite 98% of the Ethereum supply sitting in a profitable state.

The post Tokenized Assets Hit $270 Billion Record as Institutions Standardize on Ethereum appeared first on BeInCrypto.