After the recent price drop, mentions of “buy the dip” for Bitcoin have surged on social media; however, Santiment cautions that this might signal a contrarian trend.

Social Media Users Are Advocating for Bitcoin Dip Purchases

In a recent Insight post, analytics company Santiment discussed the market’s reaction to the latest Bitcoin price decline. “One key factor we monitor is the enthusiasm of retail investors in buying the dip,” states Santiment.

The firm points to the “Social Volume” indicator, which tracks the overall number of posts/messages/threads across major social media platforms that include unique references to specific terms or topics.

Santiment has filtered the Social Volume to focus on Bitcoin-related phrases and terms associated with “buy the dip.” Below is a chart illustrating the trend in this metric over the last month.

The graph shows a significant spike in Bitcoin Social Volume for these terms, suggesting that interest in buying the dip has grown among social media users. Currently, calls for dip purchases are at their highest level in 25 days.

Although this may appear to indicate a potential rebound for the cryptocurrency, historical patterns suggest otherwise. “Typically, prices trend opposite to the crowd’s expectations,” explains the analytics firm. Hence, the hype around buying the dip may actually indicate that more declines are ahead for BTC before a true bottom is reached.

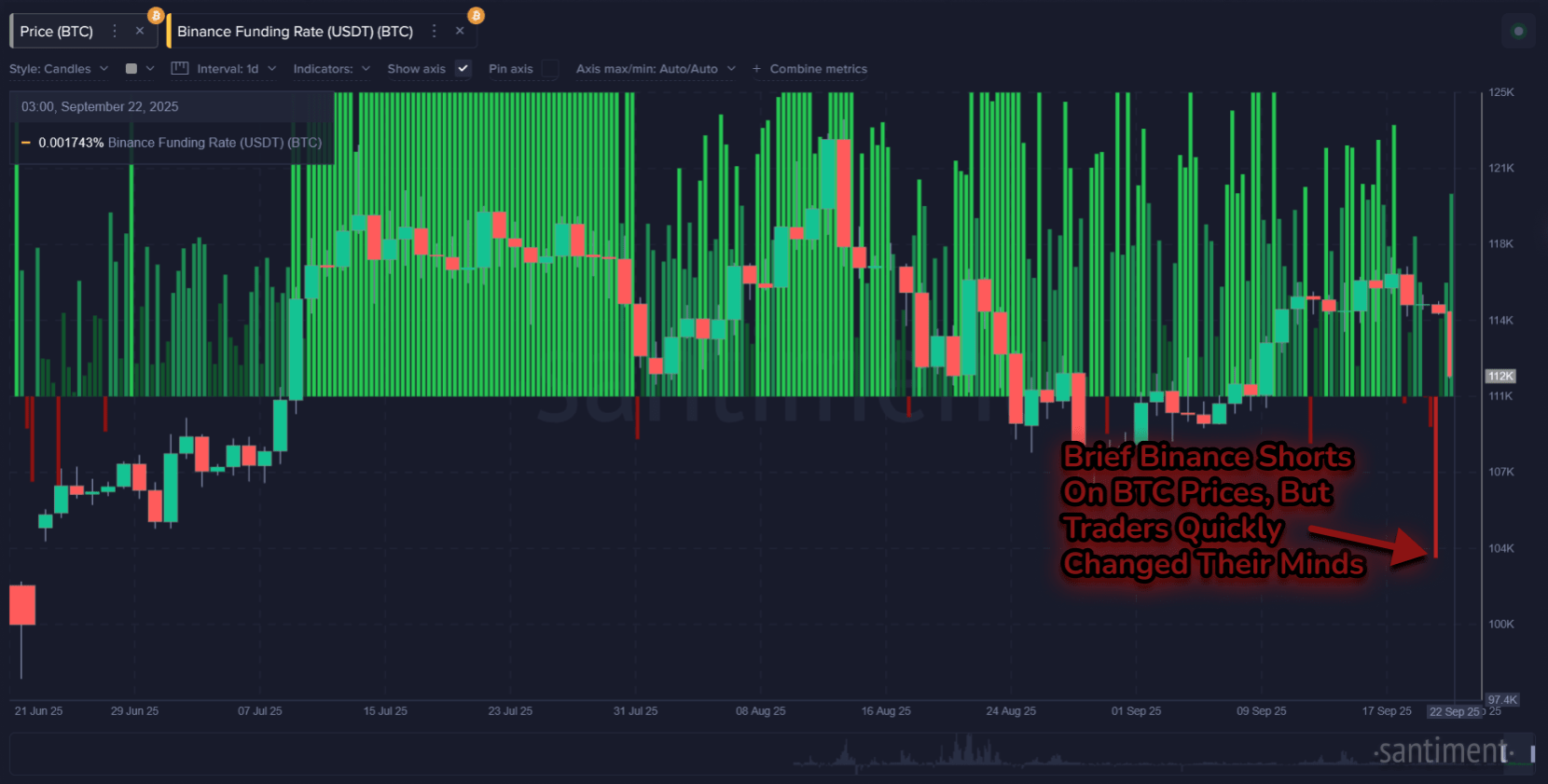

“When the crowd loses optimism and starts selling at a loss, that’s usually the best time for dip purchases,” remarks Santiment. Another barometer for market sentiment is the Binance Funding Rate, which measures the fees exchanged periodically between derivatives traders on the largest cryptocurrency exchange by trading volume.

Prior to the recent Bitcoin crash, this indicator turned sharply red, suggesting that short positions were prevailing on Binance. However, after the downturn, traders’ outlook shifted, and the metric reverted back to green.

This pattern suggests that investors are optimistic about a possible Bitcoin rebound. “For a meaningful price rebound, we need to see a sustained period of short positions exceeding longs,” notes the analytics firm. Thus, monitoring this could provide additional insights, as an extended negative phase might signal a bottom.

BTC Price

So far, Bitcoin has struggled to recover from its drop, with its price hovering around $112,700.