Following a week of significant wallet activity, Elon Musk’s SpaceX has once again relocated a segment of its Bitcoin assets.

Summary

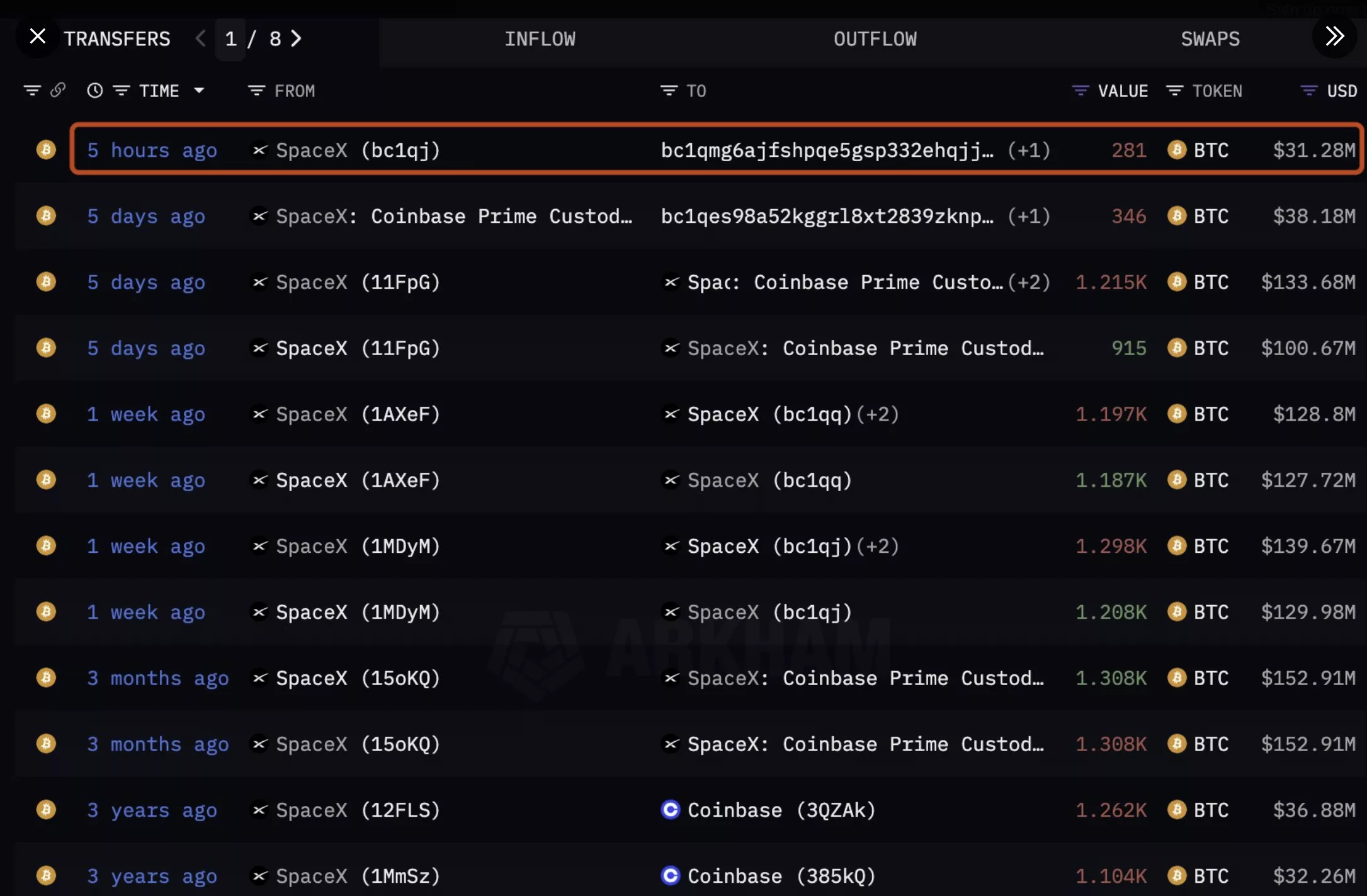

- On October 30, SpaceX moved 281 BTC, valued at $31.28 million, to a new wallet, marking its third major Bitcoin transaction in ten days.

- This transfer followed earlier transactions of 2,395 BTC and 1,215 BTC, bringing the total Bitcoin movements for October to over $432 million.

- All transfers were processed through Coinbase Prime Custody, indicating a potential internal restructuring rather than selling efforts.

On October 30, on-chain data revealed that SpaceX had transferred an additional 281 BTC, approximately worth $31.28 million. This allocation, routed through Coinbase Prime Custody, represents the company’s third significant Bitcoin transfer in the past ten days, ending a period of inactivity.

Data from Arkham Intelligence indicates that the BTC transfer originated from a SpaceX-related wallet and was sent to a newly established address containing only the received funds. The originating wallet had previously participated in earlier Bitcoin transfers this month, and this latest transaction follows two other rounds of activity in recent weeks.

Around 2,395 BTC, estimated at $268 million, was transferred on October 19, followed by an additional 1,215 BTC on October 24, valued at $134 million at the time of the transaction, making the total for this month exceed $432 million.

SpaceX’s Bitcoin activity: Internal adjustment or impending sale?

The trend of creating fresh wallets, consistently funneling through Coinbase Prime Custody, and the lack of deposits to known exchange addresses imply that SpaceX is restructuring its custody rather than liquidating its Bitcoin holdings. Similar patterns in recent quarters have been traced back to internal reorganizations related to security or accounting practices.

Nonetheless, the timing has attracted market scrutiny. Bitcoin is currently priced near $110,000, reflecting a drop of approximately 2.12% on the day, following a decrease from a weekly peak exceeding $115,000, with substantial institutional transfers often stirring speculation about potential sell-offs.

However, no outgoing transactions have been noted from the wallets associated with SpaceX since the recent reshuffle commenced, indicating that the assets may still be stored securely rather than being transferred to exchanges for sale.

SpaceX is believed to possess between 6,900 and 7,000 BTC, making it one of the largest corporate holders of Bitcoin. Additionally, Tesla, another of Musk’s enterprises with Bitcoin holdings, holds approximately 11,509 BTC valued at about $1.27 billion at current Bitcoin rates.