Solana (SOL) has experienced an upward trend for over three months, but recent selling activity momentarily interrupted this momentum. The altcoin saw a dip before recovering quickly as investor support helped stabilize the market.

Despite evident strength, mixed feelings among holders are causing uncertainty about Solana’s short-term direction.

Solana Holders Show Mixed Sentiments

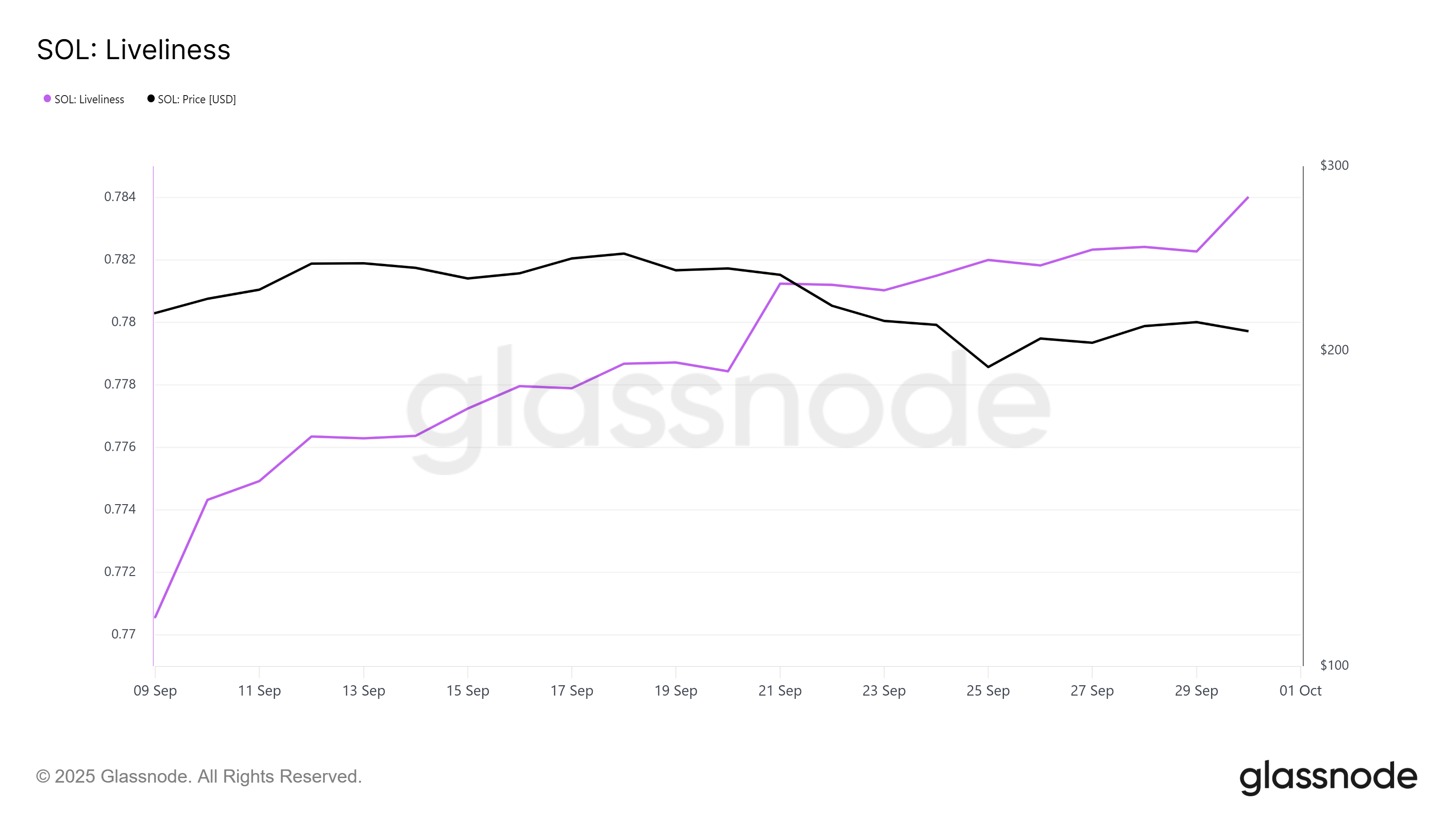

On-chain data reveals increasing bearish sentiment among long-term holders (LTHs). The Liveliness metric for Solana has surged in recent weeks, indicating a rise in coins being transferred from dormant wallets. This trend suggests that LTHs are unloading assets, diminishing their conviction and exerting downward pressure on the altcoin’s price.

Sponsored

Sponsored

This trend has continued over the past month. While the pace of LTH selling has decreased, it hasn’t ceased completely. The ongoing exits reflect caution among seasoned investors and likely contributed to Solana’s recent downturn.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

In contrast, short-term holders (STHs) are demonstrating increasing maturity. HODL Waves data indicates that supply controlled by holders of one to three months has risen to 14.4%, its highest level in five months. This signifies growing confidence from newer market participants who are choosing to hold rather than sell during volatility.

The maturation of STHs has played a crucial role in sustaining Solana’s upward trend. By opting to hold amidst recent fluctuations, these investors are counterbalancing the selling activity from LTHs.

SOL Price Is Holding On

Solana is currently trading at $209, remaining above the $206 support level and testing its uptrend line. The consistent recovery demonstrates investor commitment to sustaining bullish momentum following brief interruptions from increased selling pressure by LTHs.

The mildly optimistic outlook may extend Solana’s rally. If momentum persists, SOL could surpass the $214 and $221 resistance levels. A breakthrough of these limits would pave the way to $232, enhancing optimism for further gains in the forthcoming weeks.

However, if selling pressure from long-term holders escalates, Solana risks falling below $206. A decline to $200 would invalidate the bullish outlook, signaling weakness and potentially igniting renewed bearish sentiment within the altcoin’s market structure.