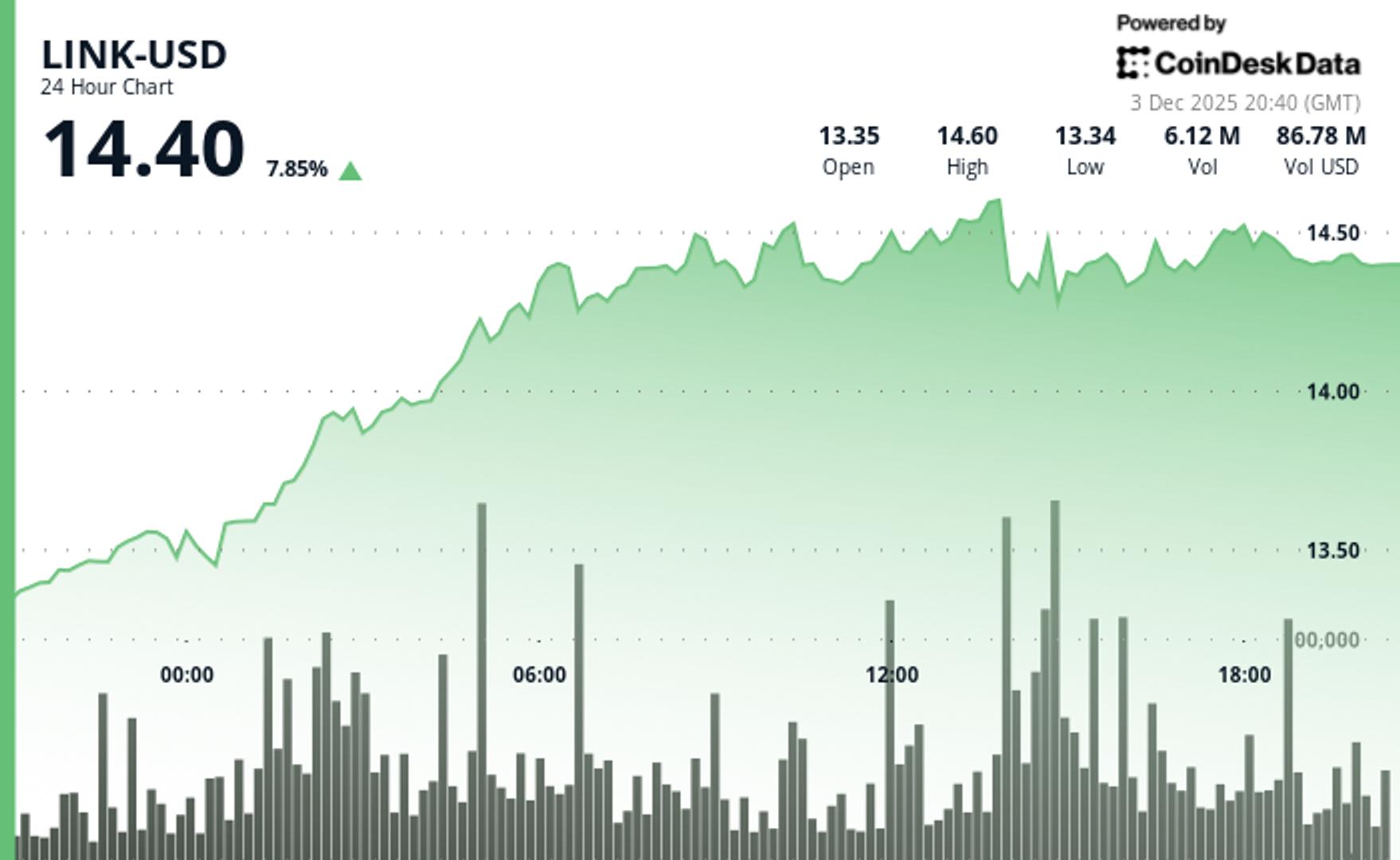

Chainlink’s native token LINK surged 7% on Wednesday within a 24-hour span, outperforming the wider cryptocurrency market as traders reacted to the launch of the first U.S.-listed spot Chainlink ETF.

The Grayscale Chainlink Trust ETF (GLNK), which was transitioned from a closed-end fund and is now trading on NYSE Arca, garnered $37 million in net inflows on its inaugural day on Tuesday, as reported by SoSoValue data. This launch signifies a pivotal moment for institutional acceptance of Chainlink, allowing traditional investors direct access to LINK through brokerage accounts.

The trading activity regarding LINK saw a significant spike, with trading volume soaring 183% above the average for the past 24 hours, hitting a peak of 6.71 million tokens traded at 14:00 UTC as LINK briefly reached $14.63 before experiencing a pullback, according to insights from CoinDesk Research’s market analysis tool.

Despite facing rejection at session highs, the token sustained an upward trendline from its $13.35 foundation, marking successive higher lows throughout the day and maintaining a bullish structure, suggested the tool.

LINK outshined most top-20 cryptocurrencies, bolstered by both the ETF catalyst and a general shift towards tokens with clear utility narratives. The CoinDesk 5 Index also saw a 3.3% increase for the day, although LINK’s gains surpassed the benchmark by over 4 percentage points.

Key technical levels to monitor:

- Support/Resistance: Support stands at $14.28, with psychological backing at $14.40; resistance at $14.63.

- Volume Analysis: A 183% surge in volume at session peak indicates institutional engagement and resistance testing.

- Chart Patterns: Consolidation between $14.395 and $14.445 could serve as a launchpad for a renewed breakout.

- Targets & Risk/Reward: The near-term target is set at $14.63, with broader upside potential if buyers hold above $14.28.

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team to ensure accuracy and compliance with our standards. For further details, please refer to CoinDesk’s complete AI Policy.