Here’s the rewritten content with the HTML tags retained:

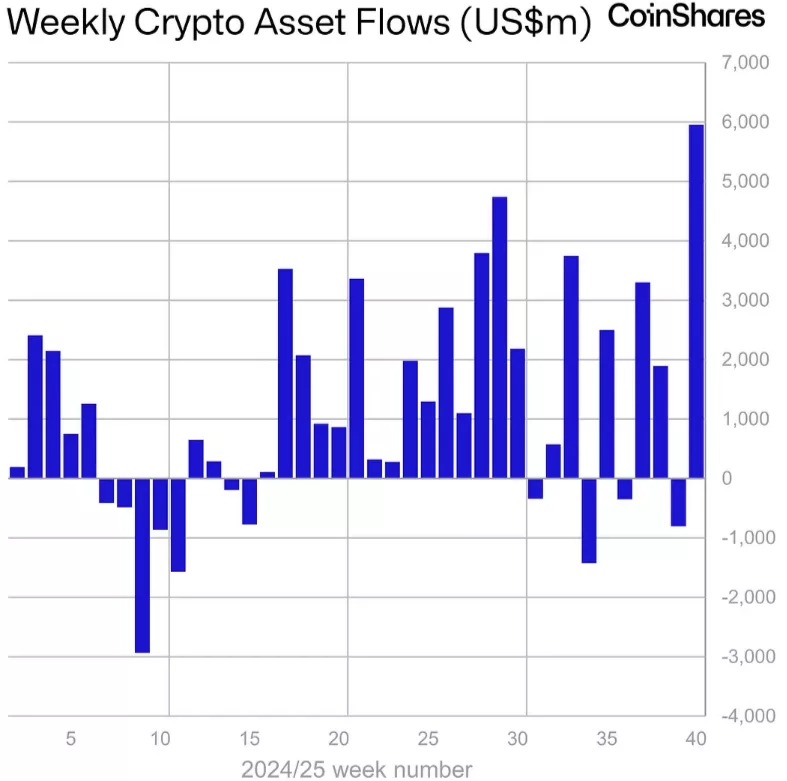

CoinShares recorded an impressive net inflow of $5.95 billion in digital asset investment products, representing the highest net weekly inflow in history. Bitcoin and Solana also set new records with their respective inflows.

Summary

- Digital asset products experienced record inflows of $5.95 billion, reversing the outflows from the previous week and elevating assets under management to a new peak.

- The U.S. spearheaded the movement with $5 billion, driving total crypto assets under management to an unprecedented high of $254 billion.

- In terms of asset class, Bitcoin led with inflows of $3.55 billion, while Ethereum and Solana achieved year-to-date inflow records of $13.7 billion and $2.5 billion, respectively.

According to CoinShares’ latest report on Digital Asset Fund Flows, the net inflows into digital asset investment products surged last week, hitting $5.95 billion. This figure marks the largest weekly inflow ever recorded.

This shift represents a significant turnaround for digital asset products, which experienced nearly $1 billion in outflows the prior week. However, investors managed to reverse this trend in just one week.

James Butterfill, Head of CoinShares Research, attributes the recent investment surge in digital asset products to weak employment data and trader apprehensions about the recent U.S. government shutdown.

“We believe this was a delayed reaction to the FOMC interest rate cut, compounded by soft employment data from Wednesday’s ADP Payroll report, alongside concerns over U.S. government stability following the shutdown,” Butterfill noted in the report.

This analysis is reinforced by the fact that net inflows from the U.S. significantly outpaced other regions, with the U.S. contributing $5 billion to last week’s inflows, setting a new weekly record. Additionally, Switzerland achieved a new weekly record with inflows of $563 million.

Germany recorded its second largest weekly inflow at $311.5 million. All other countries on the list saw positive inflows last week, except for Sweden, which experienced outflows of $8.6 million.

Overall, positive trends in the crypto market have propelled total assets under management to a landmark high of $254 billion.

CoinShares: Bitcoin inflows reach new weekly high

Bitcoin (BTC) broke its own record for the largest weekly inflows just last week, coinciding with its meteoric rise to a new all-time high. According to CoinShares’ latest data, Bitcoin’s inflows reached a staggering $3.55 billion, contributing to year-to-date flows of $27.5 billion. These record-high weekly inflows propelled BTC to its recent all-time high of $125,506.

Even with BTC reaching its historic peak, the analytics firm noted that investors did not initiate purchases of short investment products backed by the asset.

Similarly, Solana (SOL) hit a new weekly inflow record, reaching $706.5 million last week, bringing its year-to-date inflows to $2.5 billion.

In contrast, Ethereum (ETH) saw inflows of up to $1.48 billion, which, while not a weekly record, still brought its total year-to-date inflows to an impressive $13.7 billion. Compared to last year, CoinShares reported that ETH net inflows this year have tripled.

While XRP (XRP) saw considerable net inflows of $219 million, other altcoins experienced modest inflows that lagged behind the leading assets last week.