The Qubic community overwhelmingly chose the meme coin over Kaspa and Zcash. The Monero incident shed some light on the vulnerability of proof-of-work networks to concentrated hashrate attacks, and started debate about decentralization after Kraken temporarily halted deposits. Targeting Dogecoin, with its $33 billion market cap and mainstream visibility, could have far-reaching consequences for the perception of blockchain resilience. Meanwhile, the US Justice Department seized $2.8 million in crypto and other assets tied to ransomware operator Ianis Aleksandrovich Antropenko, which added to the government’s growing crypto stockpile.

Dogecoin in the Crosshairs

The Qubic community, the AI-focused blockchain project that shocked the crypto industry with its recent 51% attack on Monero, now voted to target Dogecoin (DOGE) as its next network. Sergey Ivancheglo, the project’s founder known online as Come-from-Beyond, asked the community to choose which proof-of-work blockchain to target, and listed Dogecoin, Kaspa, and Zcash as options. According to Ivancheglo’s announcement on X, Dogecoin was the clear choice after securing more than 300 votes—more than the other two networks combined.

Qubic’s move into majority control of Monero last week sent ripples across the digital asset space, as it proved the real-world vulnerability of proof-of-work blockchains to concentrated hashrate attacks. By amassing majority computing power, Qubic’s mining pool reorganized six blocks on Monero’s network after a month-long struggle with existing miners. The attack did not alter Monero’s fundamental privacy or usability, but it raised immediate concerns about the security of one of crypto’s most resilient privacy-focused blockchains.

Announcement from Qubic

The Qubic team explained that its end goal is to have Monero’s network security fully backed by its own miners. This leaves some serious open questions about decentralization and control in the long term.

At the time of the Monero takeover, Qubic’s mining pool commanded around 2.32 gigahashes per second in computing power, according to MiningPoolStats. This level of dominance allowed the successful 51% attack, which was something long feared in the industry but rarely executed against a major network.

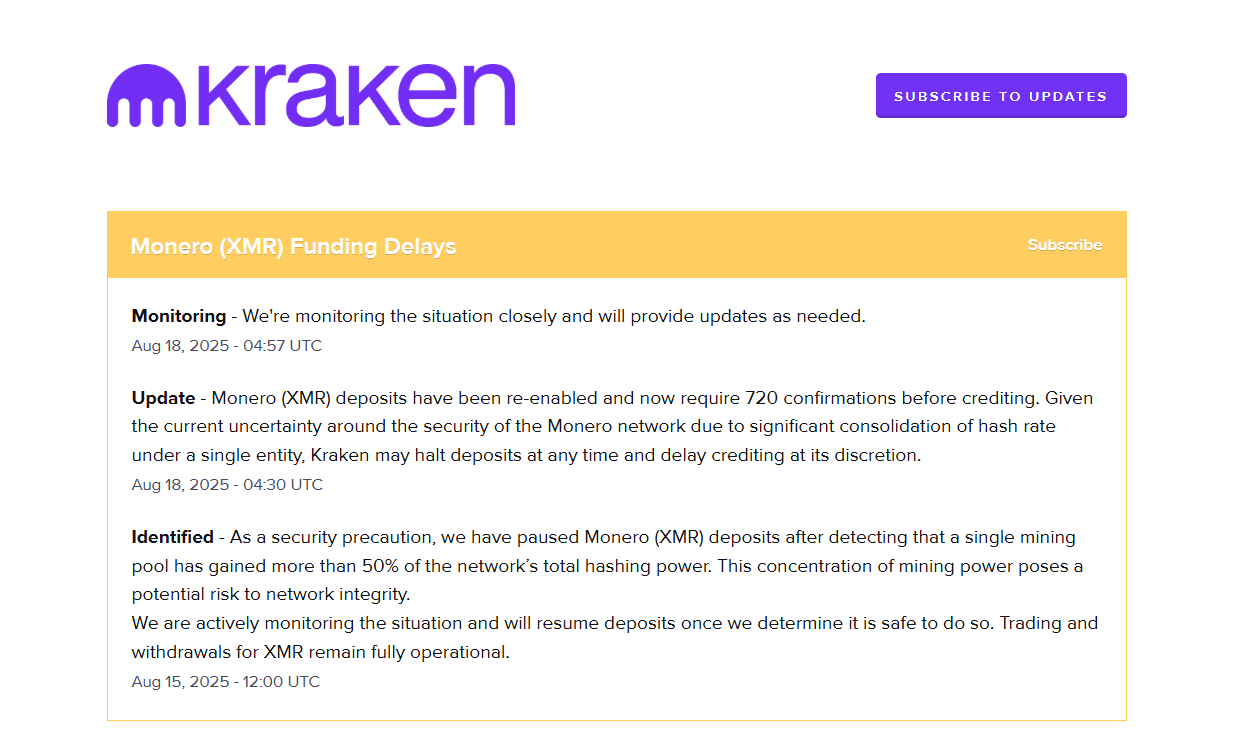

The fallout was very quick. Crypto exchange Kraken temporarily halted Monero deposits due to risks to the network’s integrity. Withdrawals and trading, however, remained active, and the exchange promised to resume deposits once it deemed the network safe again.

Announcement from Kraken

Dogecoin has a $33 billion market cap with deep cultural roots and widespread adoption. With it being marked as the next target, the implications are even bigger. Unlike Monero, Dogecoin became a household name, backed by celebrity endorsements and mainstream awareness.

If Qubic follows through, it could set a precedent that puts the security of other large proof-of-work blockchains into question.

US Seizes $2.8M Crypto

The US is also fighting for crypto control, but in this case from a ransomware operator. The US Justice Department seized more than $2.8 million in cryptocurrency, alongside cash and luxury assets, in a criminal case tied to an alleged ransomware operator.

Press release from the US DOJ

In a Thursday announcement, the department said that six warrants were unsealed authorizing the seizure of funds from a wallet controlled by Ianis Aleksandrovich Antropenko. Authorities also seized $70,000 in cash and a high-end vehicle. Antropenko faces charges of conspiring to commit computer fraud, computer fraud and abuse, and conspiracy to commit money laundering.

According to the Justice Department, the seized funds were tied to ransomware operations and laundered through services like ChipMixer, a mixing platform that was shut down in 2023 during a multinational enforcement action. Investigators said Antropenko also funneled illicit crypto into cash through structured deposits that were designed to avoid detection.

This is the latest US crackdown on ransomware-linked assets and aligns with government efforts to improve its crypto reserves after President Donald Trump’s March executive order establishing a national crypto stockpile. Earlier this week, officials revealed they confiscated about $1 million from the ransomware group BlackSuit and were looking to claim $2.4 million in Bitcoin seized by the Dallas FBI in April.

The seizures have added momentum to discussions about how much Bitcoin the US government currently controls. Treasury Secretary Scott Bessent recently clarified that while the government is not planning to buy Bitcoin outright, it is exploring “budget-neutral pathways” to increase its holdings.

Scott Bassent interview (Source: Fox Business)

Assets that are seized in criminal cases, once victims are compensated, have become the main source of the federal Bitcoin stockpile. As of Thursday, this trove was estimated at about 198,012 BTC, which is worth more than $23 billion at current prices. Despite the volatile market, these holdings position the United States as one of the largest single Bitcoin holders globally. This proves just how enforcement actions are becoming a strategic channel for crypto accumulation in many countries.