Ondo Finance has garnered significant attention following its acquisition of Oasis Pro, a company with multiple SEC-registered licenses.

This acquisition represents a strategic milestone for Ondo in the rapidly evolving Real World Assets (RWA) sector, yet the pivotal question remains: Does ONDO possess the momentum to break free?

Sponsored

Sponsored

From DeFi to TradFi: The Strategic Transition with Oasis Pro

Ondo Finance (ONDO) has officially finalized its acquisition of Oasis Pro, which includes its broker-dealer, Alternative Trading System (ATS), and Transfer Agent (TA) licenses, sanctioned by the US Securities and Exchange Commission (SEC).

“This acquisition enables Ondo to broaden accessibility as the tokenized securities market quickly accelerates, expected to surpass $18 trillion by 2033,” the announcement indicated.

The acquisition serves as a crucial step that allows Ondo to strengthen its foothold in the regulated digital asset landscape, effectively merging traditional finance (TradFi) with blockchain. Once a DeFi protocol issuing RWA tokens, it is now transforming into an infrastructure player capable of legally operating within US financial regulations, a necessity for attracting institutional investors to on-chain assets.

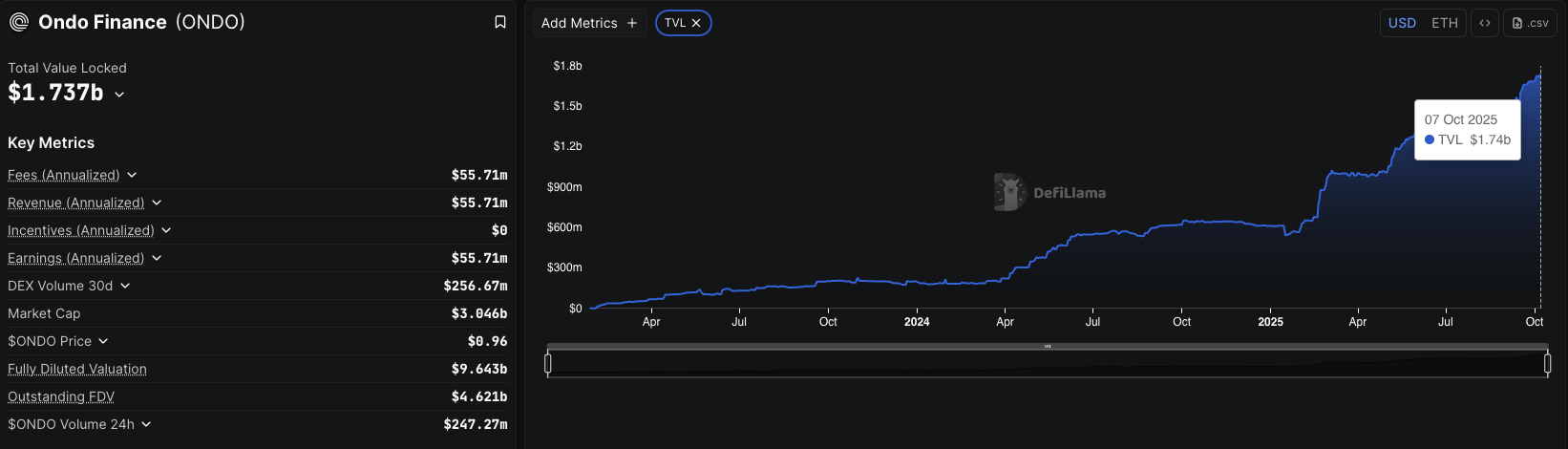

Within the DeFi ecosystem, Ondo’s Total Value Locked (TVL) has recently hit an all-time high of $1.74 billion, with revenue and fees for Q3 amounting to roughly $13.7 million.

Concurrently, BeInCrypto reported that Ondo Global Markets exceeded $300 million in tokenized assets, illustrating robust inflows into tokenized treasuries, stocks, and stablecoins.

This trend reflects a growing demand for real-world on-chain products as investors look for yield-bearing, comparatively secure alternatives amid persistently high real interest rates.

Sponsored

Sponsored

Technical Indicators to Monitor

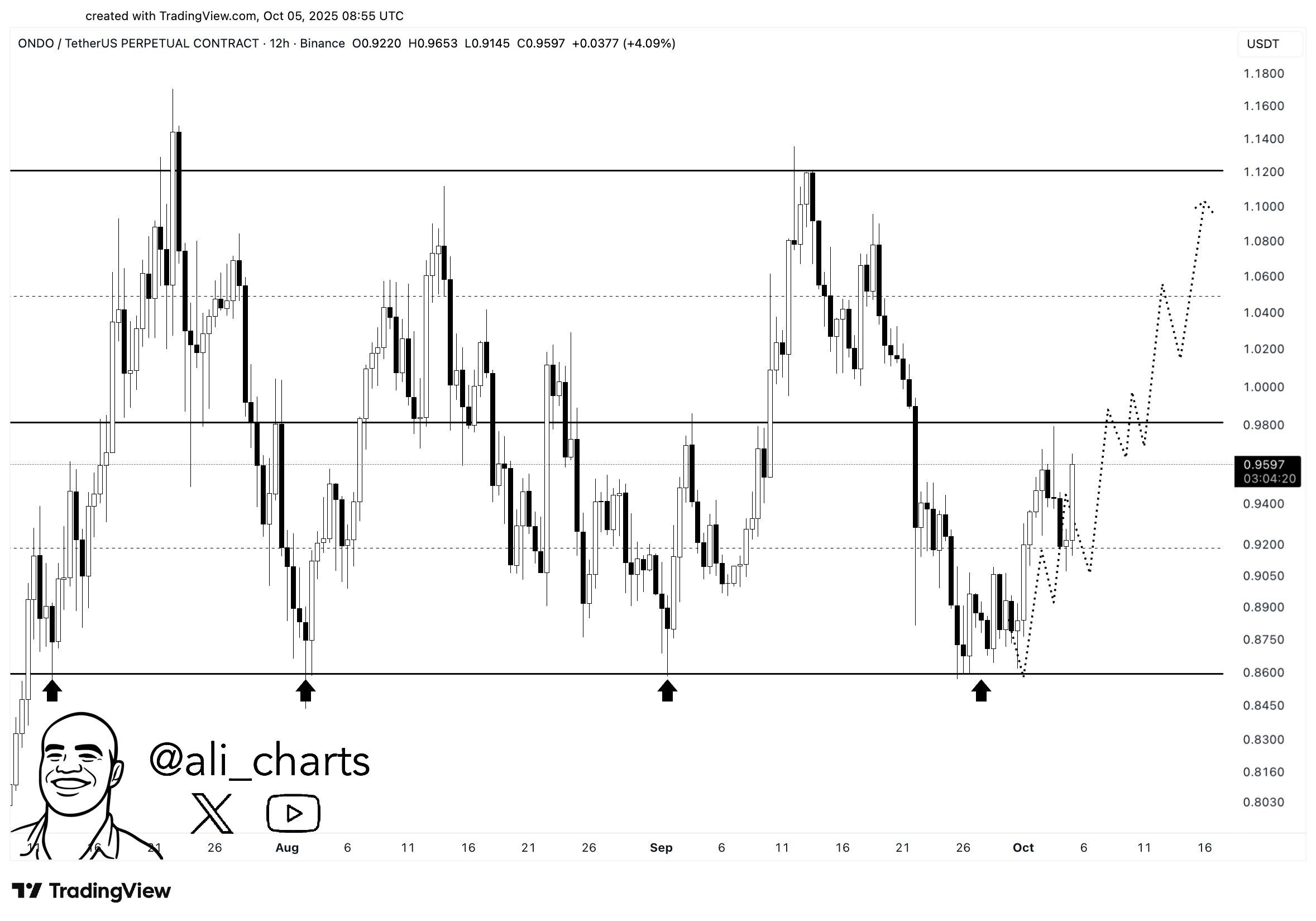

At the time of writing, BeInCrypto data indicates that ONDO is trading at $0.94, an increase of 2.84% over the past 24 hours. From a technical standpoint, crypto analyst Ali points out a strong support zone around $0.86, with the next target for upside movement at $1.12 if bullish momentum persists.

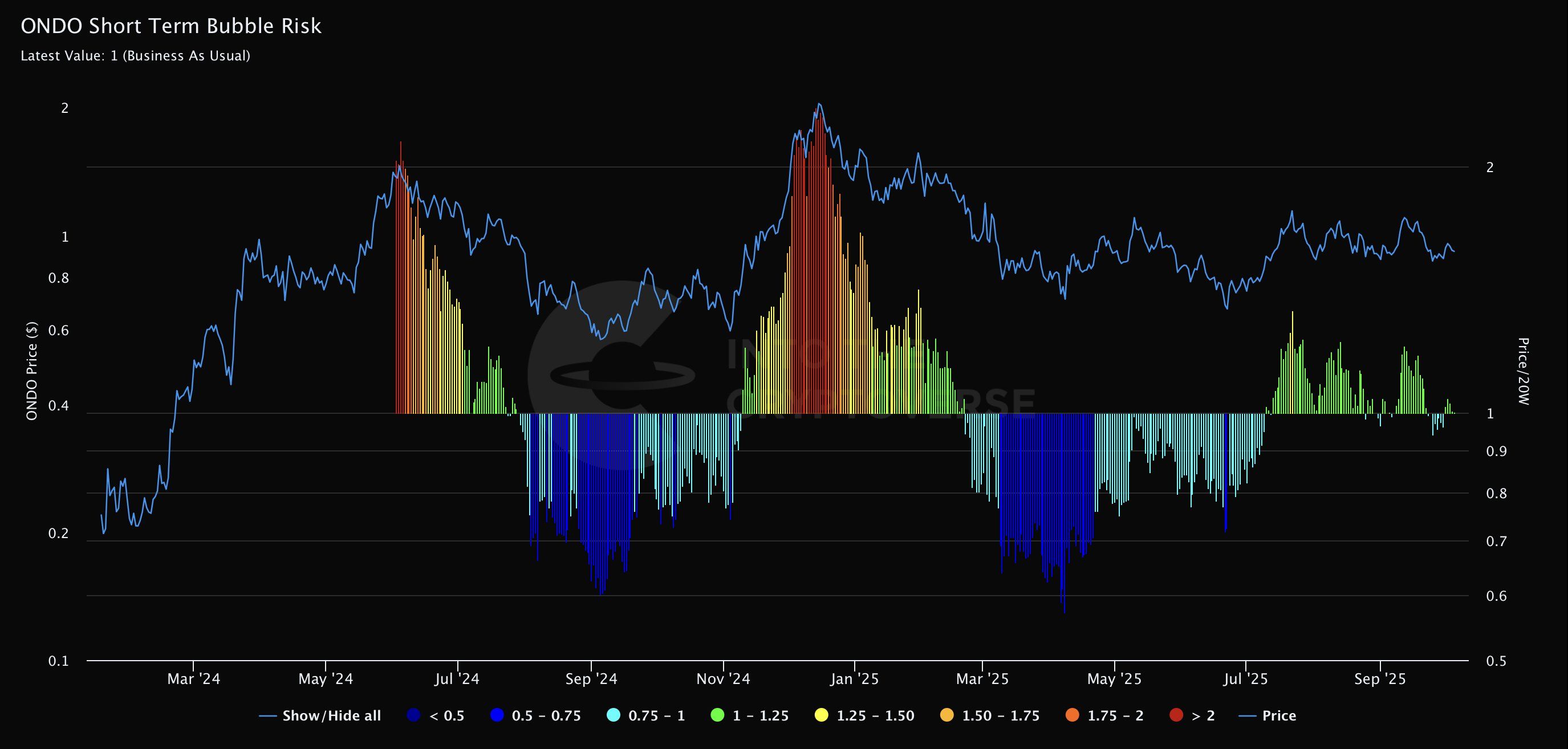

On-chain metrics provide additional context. The ONDO Short Term Bubble Risk (STBR) indicator, which represents the ratio between the price and the 20-week simple moving average (20W SMA), assists in identifying levels of overextension.

A STBR value below 1 indicates a bearish period, while values between 1.25 and 1.5 signify escalating momentum, and values above 1.75 highlight a heightened bubble risk. When the ratio exceeds 2.0, it suggests that the asset is trading at double its 20W SMA — a level that historically precedes corrections.

Data reveals that ONDO has successfully navigated a complete market cycle, transitioning from a bubble top to a capitulation phase and stabilizing. As of late September 2025, the market appears to be balanced, but analysts caution about potential overheating if volume increases further.

From a fundamental perspective, the SEC licensing represents the true catalyst — validating Ondo’s tokenization model within the U.S. regulatory landscape. This mitigates compliance risks and paves the way for institutional investments, which have historically shied away from unregulated DeFi protocols.

Nevertheless, for ONDO to achieve a sustainable breakout, three essential conditions must align: effective integration of Oasis Pro’s infrastructure, ongoing capital flow into tokenized products, and stability among large holders (whales) to deter selling pressure.

If these elements falter, the rally may be short-lived, reverting to a phase of consolidation.