On Boxing Day, the MSTR stock price increased by more than 1% as Bitcoin and other cryptocurrencies made a cautious recovery.

Summary

- MicroStrategy’s stock rose to $160, surpassing this month’s low of $157. However, there may still be potential for further declines.

- A key factor contributing to the loss of its premium is the ongoing crash in Bitcoin (BTC), which has dropped from a year-to-date high of $126,200 to the current $88,800.

- It is anticipated that the stock price of Strategy will continue to decline as sellers aim for the psychological benchmark of $100.

MicroStrategy’s stock climbed to $160, which is above this month’s low of $157. Nonetheless, the stock faces potential downside risks as the company’s enterprise value net asset value (mNAV) has turned negative for the first time.

Data from Bitcoin Treasuries indicates that the mNAV fell to 0.988. This decline occurred as its enterprise value dropped to $59 billion, while the value of its Bitcoin holdings is at $59.7 billion.

The basic market capitalization-based net asset value has reduced to 0.763. This signifies that the premium the company enjoyed a few months ago has now vanished.

The decline in its premium can be attributed to the ongoing Bitcoin (BTC) crash, which has seen it drop from the year-to-date high of $126,200 to the current $88,800. This downturn has significantly impacted the value of its Bitcoin assets.

Another concern is the company’s continued dilution of shareholders through its at-the-market offerings. In a regulatory filing, it was disclosed that there remains over $11.8 billion in its ATM offerings, suggesting additional dilution is on the horizon.

The dilution has increased its outstanding shares to over 267 million, compared to 93.2 million in 2022.

The company may continue to face pressure as Bitcoin has displayed bearish chart patterns, as noted in our previous analysis. A death cross and a bearish pennant have been observed on the daily chart. This indicates that Bitcoin may drop to last month’s low of $80,000.

MSTR stock price technical analysis

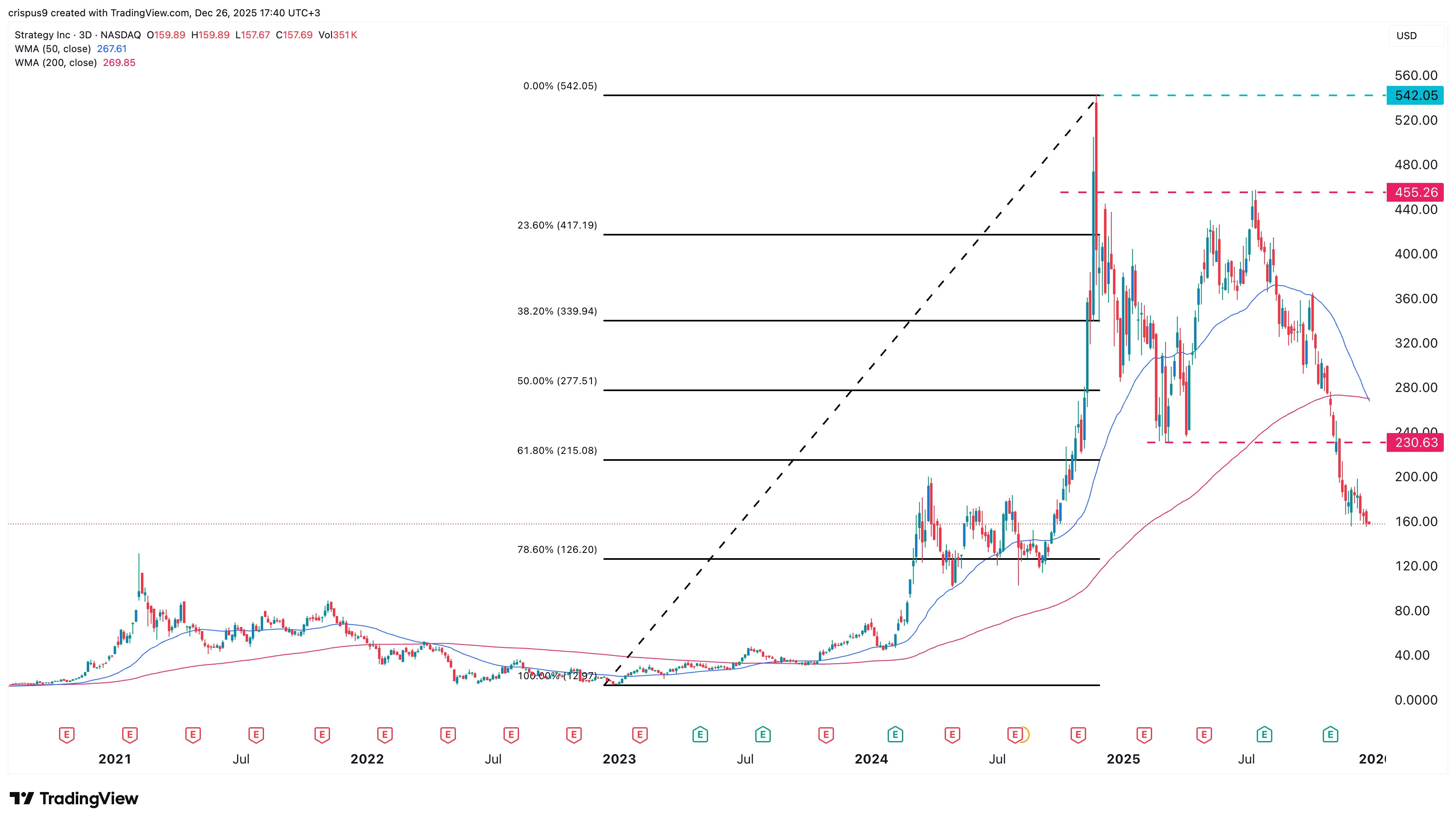

The three-day chart reveals that the MSTR share price has been in a significant decline over the past few months. It has now established a death cross pattern, where the 50-day and 200-day Weighted Moving Averages have crossed.

The stock has fallen below the crucial support level of $230, reaching its lowest point in March. It has also dipped below the 61.8% Fibonacci Retracement level.

Consequently, the Strategy stock price is expected to continue declining as sellers fixate on the psychological point of $100. This downward movement will be confirmed if it dips below the 78.6% Fibonacci Retracement level at $126.