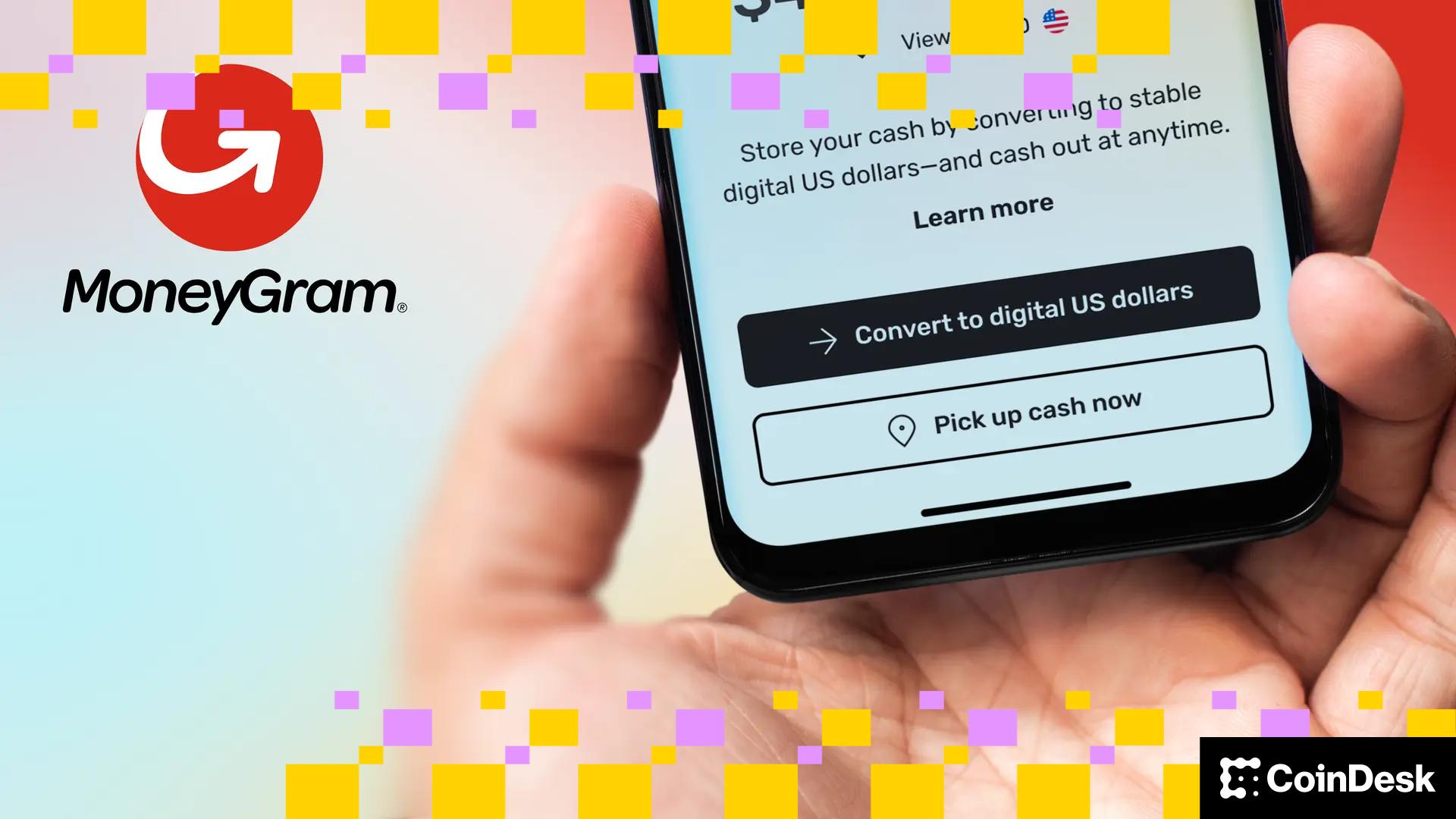

MoneyGram has partnered with Fireblocks to implement stablecoin-enabled payments and real-time treasury solutions within its vast network, as announced on Thursday.

This payment service, processing transfers in over 200 countries, will leverage Fireblocks’ digital asset infrastructure to enhance its internal operations and settlement processes. This encompasses facilitating stablecoin transactions across various blockchains, improving how MoneyGram manages liquidity, and minimizing the need to pre-fund accounts globally.

The adoption of stablecoins is rapidly increasing in the traditional remittance sector, driven by a demand for faster, lower-cost transfers and an uptick in the use of digital wallets for everyday financial management. Recently introduced regulations for the $300 billion crypto industry in the U.S. through the GENIUS Act have bolstered financial institutions and businesses wanting to integrate stablecoins into their operations.

For example, a MoneyGram customer sending funds to a relative in another country could see those funds arrive almost instantly into a digital wallet, supported by stablecoins like USDC. On the backend, MoneyGram will enhance payment reconciliation speed and alleviate challenges linked to local banking systems and capital demands.

Fireblocks secures over $5 trillion in digital asset transfers each year. Its technology will serve as the programmable foundation for MoneyGram’s stablecoin initiatives, granting the company greater control over how it directs value across various chains and regions.

This initiative builds on MoneyGram’s previous efforts to incorporate digital currency solutions and mirrors the broader transition of remittance companies from traditional cash pickup points to fully operational digital platforms.

Read more: MoneyGram Makes Stablecoins the Backbone of Its Next-Generation App