Metaplanet is broadening its bitcoin operations on two fronts, launching new subsidiaries in the United States and Japan to enhance both revenue streams and market visibility.

Summary

- Metaplanet has introduced a U.S. branch to expand its bitcoin income generation and operations.

- The firm has acquired the Bitcoin.jp domain and established Bitcoin Japan Inc. to provide bitcoin-related services.

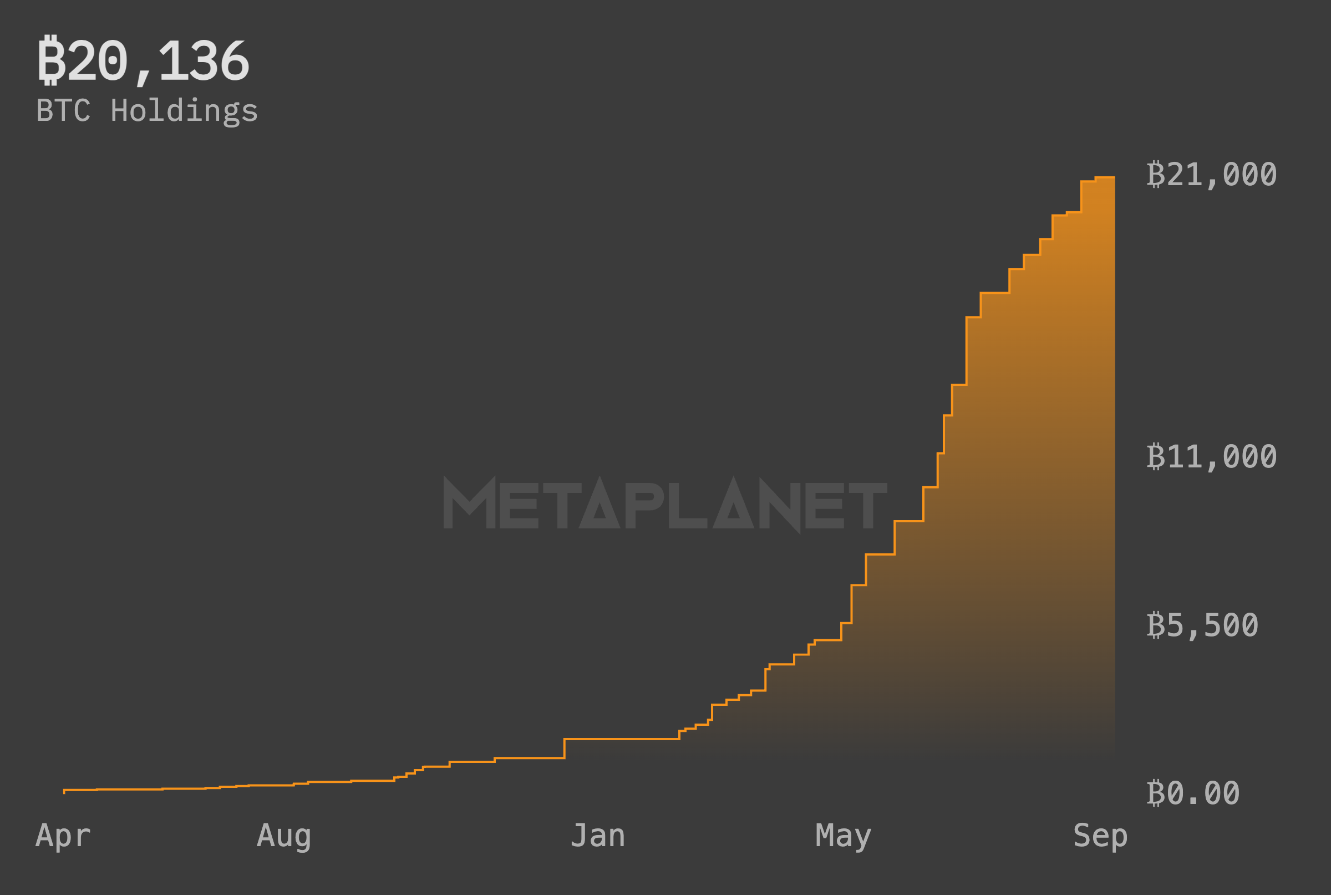

- Metaplanet’s bitcoin holdings rose to 20,136 BTC after adding another 136 BTC on September 8, with ambitions to reach 30,000 BTC by the end of 2025.

In a corporate announcement today, Metaplanet revealed the establishment of Metaplanet Income Corp., a fully owned subsidiary based in Miami, Florida.

As per the filing, the new entity was set up to enhance its Bitcoin (BTC) treasury strategy and income generation endeavors. This division will concentrate on derivatives trading and other actions aimed at fostering consistent revenue and cash flow while providing a dedicated framework separate from the core treasury operations to improve governance, transparency, and risk management.

The U.S. division will commence operations with an initial capital of $15 million, led by CEO Simon Gerovich, with Dylan LeClair and Darren Winia serving as directors. The organization indicated that this structure is intended to manage and develop its income-generation initiatives without affecting the strategic oversight of its substantial bitcoin holdings.

Alongside its U.S. expansion, Metaplanet is also solidifying its domestic presence with the formation of Bitcoin Japan Inc., a subsidiary focused on media, events, and services that promote bitcoin adoption.

As part of this strategy, the company also secured the prestigious domain Bitcoin.jp, which will act as a center for various projects, including the operation of Bitcoin Magazine Japan, hosting the Bitcoin Japan Conference in 2027, and other future bitcoin-related offerings.

CEO Gerovich stated earlier in July that the firm would prioritize business expansion in its long-term vision. He noted that they plan to utilize the growing BTC reserves to fund the acquisition of cash-flowing ventures, and these recent actions indicate that they are beginning to realize this vision.

Metaplanet’s expanding Bitcoin treasury

Metaplanet’s recent acquisition of 136 BTC on September 8, 2025, raised its total to 20,136 BTC, as per the company’s own disclosure. This positions the Tokyo-listed company sixth among public firms globally for corporate bitcoin treasuries, surpassing many established competitors.

The Japanese bitcoin treasury firm commenced its BTC accumulation only in 2024 and has now scaled its holdings to a market value of approximately $2.3 billion, experiencing a more than 3,000% increase in net asset value since it implemented a bitcoin-first strategy. Company data reflects that the value of its treasury now exceeds 160 times its initial market capitalization.

Metaplanet aims to elevate its holdings to 30,000 BTC by the end of 2025, reflecting about a 33% increase from its current status. The organization anticipates an even more significant growth for 2026, with a target of 100,000 BTC, which is more than three times the 2025 target, aspiring for a long-term goal of ultimately reaching 210,000 BTC.